Westjet 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 40

F

O

d

W

u

je

O

i

n

r

a

F

T

p

t

h

D

a

c

n

P

a

w

t

a

w

F

i

n

p

F

F

r

r

m

o

U

F

p

a

2

I

I

m

e

e

e

F

INANCIAL I

N

O

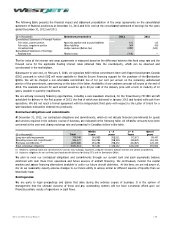

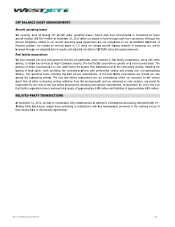

ur financial

a

d

erivative instr

u

W

e are expose

d

u

se various fin

a

e

t fuel prices.

W

O

verall, our B

o

n

cluding thos

e

r

elated to fina

n

a

ctivities.

F

uel risk

T

he airline ind

u

p

rices. Fuel pr

ensions, refin

e

h

edge a portio

D

uring the first

a

bility to adjus

t

c

omparison to

n

o fuel derivati

v

P

reviously, up

o

a

ccounting, th

e

w

hile the ineff

e

he effective g

a

ircraft fuel ex

w

ere recognize

F

or a discussio

n

cluding the fi

n

p

lease refer to

F

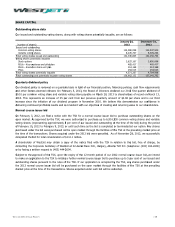

oreign exch

a

F

oreign exchan

r

esult of chang

r

ates on our

U

m

ainly aircraft

o

ur exposure,

U

pon proper q

u

F

or a discussi

o

p

urposes they

a

nd loss associ

a

2

0

1

2 Results o

f

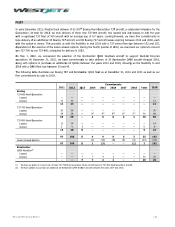

I

nterest rate

nterest rate ri

s

m

arket interes

t

e

quivalents bal

e

arnings of $5

e

quivalents. W

e

N

STRUMENT

S

a

ssets and lia

b

u

ments, identi

f

d

to market, c

a

ncial derivati

v

W

e do not hol

d

o

ard of Direc

t

e

related to fi

n

n

cial instrume

n

u

stry is inhere

n

ices are affec

t

e

ry capacity, a

n

n of our futur

quarter of 20

1

t

to volatile fu

e

its potential b

e

v

e contracts o

u

o

n proper qu

a

e

effective port

e

ctive portion

w

ains and loss

e

pense. We ex

c

d in non-oper

a

n of the natur

n

ancial statem

e

2012 Results

o

a

nge risk

ge risk is the r

es in foreign

e

S-dollar-deno

m

fuel, aircraft l

e

we periodicall

y

u

alification, we

o

n of the nat

u

serve; risk ma

a

ted with the i

f

operations –

F

risk

s

k is the risk t

h

t

rates. We ar

e

ance. A chang

.0 million for

e

are also ex

p

S

AND RISK

M

b

ilities consist

f

ied interest-b

e

r

edit and liqui

d

v

es to reduce

m

d

or use any d

e

t

ors has resp

o

n

ancial instru

m

n

ts are revie

w

n

tly dependent

t

ed by a host

n

d global dem

a

e anticipated

j

1

2, we decide

d

e

l prices along

e

nefits. As a r

e

u

tstanding at

D

a

lification, we

t

ion of the cha

n

w

as recognize

d

e

s previously r

c

luded time v

a

a

ting income (

e

r

e and extent

o

e

nt classificati

o

o

f operations

–

isk that the fai

e

xchange rate

s

m

inated mone

t

e

asing expens

e

y

use financial

designate our

u

re and exten

nagement acti

v

nstruments; a

n

F

oreign excha

n

h

at the value o

e

exposed to i

n

e of 50 basis

the year end

e

p

osed to inter

e

M

ANAGEMEN

primarily of

e

aring deposits

,

d

ity risks asso

c

m

arket risk ex

p

e

rivative instru

m

o

nsibility for t

h

m

ents. Manage

m

w

ed and addr

e

upon jet fuel

t

of factors ou

a

nd and suppl

y

j

et fuel purch

a

d

to cease our

f

with the com

p

e

sult, all remai

n

D

ecember 31,

2

accounted fo

n

ge in the fair

d

in non-opera

ecognized in

h

a

lue from the

e

xpense) durin

g

o

f our use of

f

o

n and amoun

t

–

Aircraft fuel

o

n

r value of reco

s

. We are exp

o

t

ary assets an

d

e

, certain mai

n

derivative in

s

foreign excha

n

t of our use

vities; the fina

n

d the signific

a

n

g

e

on page 2

7

r future cash f

n

terest rate fl

u

points in the

m

e

d December

3

e

st rate fluctu

a

T

cash and cas

,

accounts pay

a

c

iated with our

p

osures from

c

ments for trad

i

h

e establishm

e

m

ent perform

s

e

ssed in light

t

o operate and

tside our con

t

y

. Under our f

u

a

ses for up to

fuel hedging p

r

p

letion of an in

n

ing contracts

2

012.

r fuel derivati

value of the h

ting income (

e

h

edge reserve

s

measurement

g

the period th

f

uel derivative

s

t

of income, ex

n

page 24 of t

h

gnized assets

a

o

sed to foreign

d

liabilities an

d

n

tenance costs

s

truments, incl

n

ge forward c

o

of US-dollar

f

ncial stateme

n

a

nt assumptio

n

7

of this MD&A

f

lows of a fina

n

u

ctuations on

s

m

arket interes

t

3

1, 2012 (20

1

a

tions on our

d

s

h equivalents

,

able and accr

u

r

financial asse

t

c

hanges in for

e

i

ng or speculat

e

nt and appr

o

s

continuous a

of changes t

o

d

, therefore, w

e

t

rol, such as

s

u

el price risk

m

36 months,

a

rogram based

-depth interna

were extingui

s

i

ves as cash

h

edging instru

m

e

xpense). Upo

n

s

were record

e

of effectivene

e change occu

s

for the year

s

x

pense, gain a

n

h

is MD&A.

a

nd liabilities

o

exchange ris

k

d

our US-dolla

and a portion

uding US-doll

a

o

ntracts as cas

h

f

oreign excha

n

n

t classificatio

n

n

s made in det

e

A

.

n

cial instrumen

s

hort-term inv

e

t

rate would h

a

1

1 – $4.4 mill

i

d

eposits that

r

s

,

restricted c

a

u

ed liabilities a

n

ts and liabiliti

e

e

ign exchange

t

ive purposes.

o

val of our ri

s

a

ssessments s

o

o

market cond

e

are exposed

s

ignificant we

a

m

anagement p

o

a

s approved b

y

on our strong

l analysis on t

h

s

hed during th

e

flow hedges.

m

ent was reco

g

n

maturity of t

e

d in net ear

n

e

ss; accordingl

y

u

rred.

s

ended Dece

m

n

d loss associa

o

r future cash f

k

s arising from

r-denominate

d

n

of airport op

e

a

r foreign exc

h

h

flow hedges

n

ge derivative

s

n

and amount

o

e

rmining their

t will fluctuate

e

stments inclu

d

a

ve had an a

p

i

on) as a res

u

r

elate to purc

h

s

a

sh, accounts

n

d long-term d

e

s. From time

t

rates, interes

t

s

k manageme

n

o

that all signi

itions and ou

r

to the risk of

v

a

ther events,

g

o

licy, we are p

e

y

our Board o

f

financial positi

h

e cost of the

e

second quar

t

Under cash f

g

nized in hedg

t

he derivative i

n

ings as a co

m

y

, changes in

m

ber 31, 2012

ted with the i

n

f

lows would flu

fluctuations i

n

d

operating ex

p

e

ration costs.

T

h

ange forward

for accounting

s

, including th

of income, ex

p

fair value, ple

a

as a result of

d

ed in our cas

h

p

proximate im

p

u

lt of our cas

h

h

ased aircraft

a

│

receivable,

ebt.

t

o time, we

t

rates and

n

t policies,

ficant risks

r

operating

v

olatile fuel

g

eopolitical

e

rmitted to

f

Directors.

on and our

program in

t

er, leaving

f

low hedge

e reserves,

nstrument,

m

ponent of

time value

and 2011,

n

struments,

ctuate as a

n

exchange

p

enditures,

T

o manage

d

contracts.

purposes.

e business

p

ense, gain

a

se refer to

changes in

h

and cash

p

act on net

h

and cash

a

nd airport