Westjet 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 39

O

O

1

c

c

q

e

c

W

a

t

s

S

W

y

W

f

o

t

F

r

p

m

s

p

W

i

n

m

2

p

o

s

s

G

O

UTLOOK

O

ur positive m

o

1

7.4 million gu

c

ent for the s

e

c

apacity by 4.

1

q

uarters of 20

1

e

xpansion in t

h

c

apacity.

W

e will add fiv

e

a

re scheduled

t

he end of 20

1

s

cheduled for

d

S

ystem-wide c

a

W

e are project

i

y

ear-over-year

W

e expect fue

f

orecasted jet f

o

ne US dollar.

W

o three per ce

n

F

or the full-ye

a

r

elated primari

p

urchases. For

m

illion. The ful

l

s

cheduled for

d

p

urchase com

m

W

e estimate t

h

n

come tax in

e

m

oving forwar

d

2

013 promises

p

artnerships, a

n

o

ptions for mo

r

s

ustainable R

O

s

hareholders.

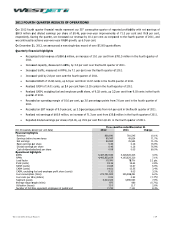

G

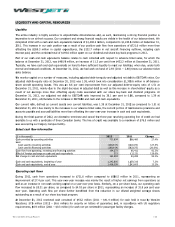

uidance su

m

RASM

Fuel cost per lit

r

CASM, excludin

g

System capacit

y

Domestic capa

c

Effective tax ra

t

Capital expendi

t

o

mentum is cl

e

ests in 2012,

a

e

cond consecu

t

1

per cent an

d

1

2 with year-

o

h

e first quart

e

e

Boeing 737

N

t

o deliver in

M

1

3. WestJet E

n

d

elivery in Ju

n

a

pacity increas

e

i

ng domestic c

a

for the first q

u

l costs to ran

g

f

uel prices of

U

W

e anticipate

o

n

t compared t

o

a

r 2013, we ar

ly to direct o

w

the first quart

l

-year and first

d

elivery during

m

itments.

h

at our 2013 a

n

e

arly 2013 for

d

.

s

to be anoth

e

n

d enhance va

r

e comfort, co

n

O

IC target of

1

m

mary

r

e

g

fuel and profit

y

ity

t

e

t

ures

e

arly reflected

a

year-over-y

e

t

ive quarter, a

c

d

saw our traf

f

o

ver-year incre

a

e

r of 2013, n

o

N

ext-Generatio

M

arch (2), Oct

o

n

core will take

n

e. We anticip

a

e

s are expect

e

a

pacity growth

u

arter of 2013.

g

e between 9

4

U

S$136 per ba

r

o

ur first quart

e

o

2012. This in

c

r

e forecasting

c

w

ned aircraft

d

er of 2013, w

e

-quarter 2013

the first quar

t

n

nual effective

current taxes

er exciting y

e

lue to more b

u

n

venience and

1

2 per cent a

n

share

in the record

e

e

ar increase of

c

hieving 13.7

f

ic increase by

ases in both

y

o

twithstanding

n aircraft in 2

0

o

ber (1) and D

e

delivery of s

e

a

te system-wi

d

e

d to be betwe

e

of between fi

v

4

and 96 cen

t

r

rel and an av

e

e

r and full-year

c

orporates cos

t

c

apital expend

d

eliveries, de

p

e

expect our c

a

estimates incl

u

t

er of 2013.

Th

income tax ra

accrued in 2

0

e

ar for WestJ

e

u

siness and lei

s

flexibility will

g

n

d believe thi

s

earnings per s

8.6 per cent

a

per cent for t

h

8.1 per cent.

y

ield and RAS

M

the difficult p

0

13, the first o

e

cember (1).

T

e

ven Bombardi

e

d

e capacity gr

o

e

n five and si

x

v

e and six per

t

s per litre for

e

rage foreign e

x

2013 CASM, e

ts associated

w

itures of appr

o

p

osits on futur

a

pital expendit

u

de the purcha

h

e previously

p

te will range

b

0

12 and expec

e

t as we lau

n

s

ure guests. T

h

g

ive our guest

s

s

will allow us

Thr

e

M

M

D

$1

4

s

s

hare and load

a

nd surpassed

h

e year. Durin

g

We realized

r

M

. We expect

rior year com

p

o

f which delive

r

T

his will bring

o

e

r Q400 Next

G

o

wth for 201

3

x

per cent yea

r

cent for the f

u

r

the first qua

r

xchange rate

o

e

xcluding fuel

a

w

ith the launch

o

ximately $43

0

r

e aircraft, ov

e

t

ures to range

se commitme

n

p

rovided capit

a

b

etween 27.0

a

c

t that ongoin

g

n

ch WestJet E

h

e introduction

s

more choices

s

to continue

g

e

e months end

M

arch 31, 2013

M

oderate Growth

94 to 96 cents

Up 2% to 3%

Up 5% to 6%

D

own 2% to 3%

4

0 to $150 millio

s

factors acco

m

our sustaina

b

g 2012, we in

r

ecord quarter

l

moderate gro

w

p

arisons and

i

r

ed in January

o

ur Boeing 73

7

G

en aircraft in

3

to be betwe

e

r

over year for

u

ll-year, and d

o

r

ter of 2013.

T

o

f approximat

e

a

nd employee

p

h

of WestJet E

n

0

million to $4

5

e

rhauls on ow

between appr

o

n

ts for the thre

a

l expenditure

a

nd 29.0 per c

e

g

cash tax inst

E

ncore, add t

o

of fare bundl

e

s

than ever. W

e

g

enerating an

d

d

ed

D

o

n

s

m

plished in 201

b

le ROIC targe

t

creased our s

y

l

y load factors

w

th in RASM

a

i

nc

r

eases in s

y

2013 and re

m

7

aircraft coun

t

2013, with t

h

e

n 7.5 and 8.

5

the first quart

e

o

wn two to thr

e

T

his is based

e

ly one Canadi

a

p

rofit share, t

o

n

core.

5

0 million, wit

h

ned engines

a

o

ximately $14

0

e Boeing 737-

8

guidance excl

u

e

nt. We will b

e

t

allments will

b

o

and evolve

e

s, WestJet Plu

e

remain focu

s

d

returning v

a

Year ende

d

D

ecember 31,

Up 2% to 3

%

Up 7.5% to 8.

Up 5% to 6

%

27% to 29

%

$430 to $450

m

│

2. We flew

t

of 12 per

y

stem-wide

in all four

a

nd margin

y

stem-wide

m

aining fou

r

t

to 105 by

h

e first two

5

per cent.

e

r of 2013.

e

e per cent

on current

a

n dollar to

o

be up two

h spending

a

nd rotable

0

and $150

8

00 aircraft

u

ded these

e

gin paying

b

e required

our airline

s, and new

s

sed on our

a

lue to our

d

2013

%

5%

%

%

m

illion