Westjet 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

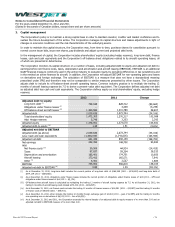

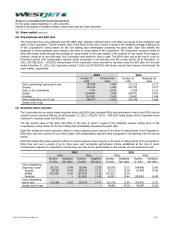

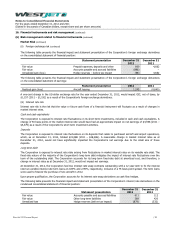

11. Income taxes

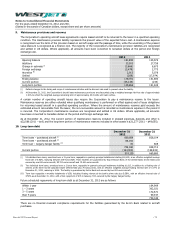

(a) Reconciliation of total tax expense

The effective rate on the Corporation’s earnings before income tax differs from the expected amount that would arise using the

combined Canadian federal and provincial statutory income tax rates. A reconciliation of the difference is as follows:

2012

2011

Earnings before income tax

340,229

208,006

Combined Canadian federal and provincial income tax rate

25.95%

27.26%

Expected income tax provision

88,289

56,702

Add (deduct):

Non-deductible expenses

3,709

3,344

Non-deductible share-based payment expense

2,978

3,430

Effect of tax rate changes

4,426

(4,539)

Other

(1,565)

367

Actual income tax provision

97,837

59,304

Effective tax rate

28.76%

28.51%

The effective tax rate for the year ended December 31, 2012 is similar to the prior year. As earnings increase, the impact of

relatively fixed permanent differences on the overall effective tax rate is less pronounced, resulting in a corresponding decrease

in the effective tax rate. However, this decrease was more than offset by an increase due to enacted tax rate changes in certain

Canadian provincial jurisdictions for current and future years.

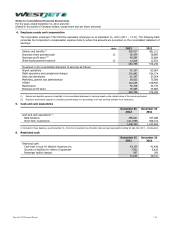

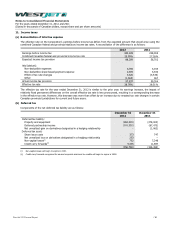

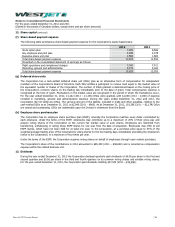

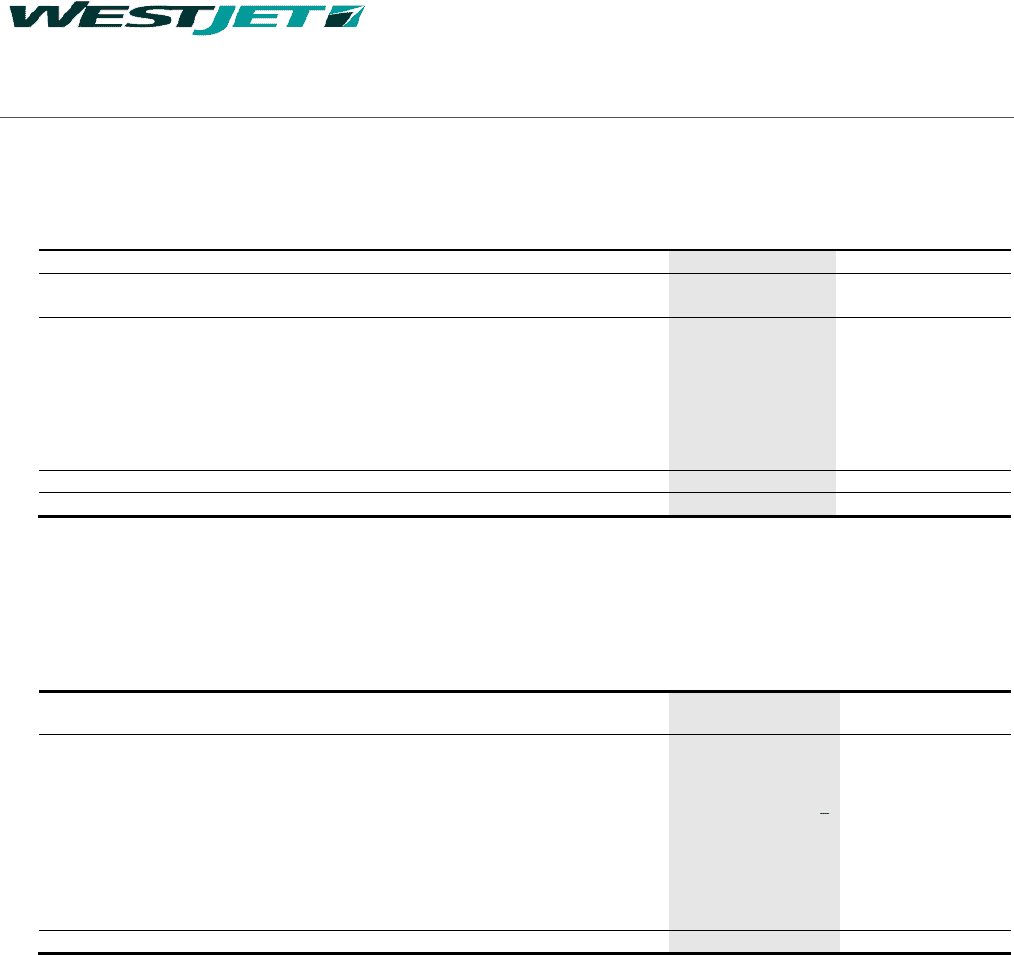

(b) Deferred tax

Components of the net deferred tax liability are as follows:

December 31

2012

December 31

2011

Deferred tax liability:

Property and equipment

(262,219)

(278,003)

Deferred partnership income

(101,352)

(67,473)

Net unrealized gain on derivatives designated in a hedging relationship

(1,062)

Deferred tax asset:

Share issue costs

373

747

Net unrealized loss on derivatives designated in a hedging relationship

253

−

Non-capital losses(i)

752

7,348

Credit carry forwards(ii)

5,445

11,987

(356,748)

(326,456)

(i) Non-capital losses will begin to expire in 2030.

(ii) Credit carry forwards recognized for unused corporate minimum tax credits will begin to expire in 2028.

WestJet 2012 Annual Report

/ 80