Westjet 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 24

O

I

c

i

m

W

e

i

n

i

n

t

o

A

p

g

w

f

t

t

y

t

a

I

A

A

E

A

A

F

S

M

D

A

I

M

E

T

T

D

a

e

w

w

i

n

A

F

y

d

o

4

O

the

r

reven

ue

ncluded in ot

h

c

argo operatio

n

m

provement

w

W

estJet Vacati

e

xpansion. Du

r

n

creased volu

n

creased cap

a

hese vacation

o

n the consoli

d

A

ncillary reven

u

p

rofits through

g

uests with ad

d

w

as $137.3 mi

l

f

ees for the ye

a

o improvemen

hese booking

s

y

ear-over-year

o change thei

r

a

nd codeshare

n June of 201

A

irlines allows

A

merican Eagl

e

E

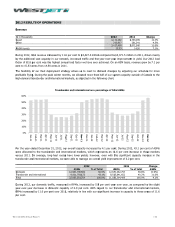

xpenses

A

ircraft fuel

A

irport operatio

n

F

light operations

S

ales and distrib

u

M

arketin

g

,

g

ene

r

D

epreciation an

d

A

ircraft leasing

I

nflight

M

aintenance

E

mployee profit

s

T

otal operating

e

T

otal, excluding

f

D

uring 2012, o

a

n ASM basis,

e

mployee profi

t

w

ith the previ

o

w

as mainly du

e

n

creases were

A

ircraft fuel

F

uel remains o

y

ear ended De

c

d

ue to a combi

o

ur overall fuel

4

.2 per cent ye

ue

h

er revenue ar

e

n

s. For 2012,

w

as driven mai

n

ons continues

r

ing 2012, we

me in vacatio

a

city in those

m

packages sol

d

d

ated stateme

n

u

e, which incl

u

the sale of

h

d

itional produ

c

l

lion, an incre

a

a

r increased b

y

ts associated

w

s

, as well cont

reduction in c

h

r

flights, and l

o

guests origina

t

2, we introdu

c

WestJet Rewa

e

and America

n

n

s

and navigation

a

u

tion

r

al and administ

r

d

amortization

s

hare

e

xpenses

f

uel and profit s

h

perating expe

n

operating exp

t

share, CASM

o

usly provided

e

to incremen

t

realized acros

s

ur most signifi

c

ember 31, 20

nation of the

y

consumption.

ar over year.

e

amounts rel

a

other revenu

e

n

ly by increase

s

to be succes

experienced

o

n packages s

o

m

arkets. Furt

h

d

. The land c

o

n

t of earnings

u

des service fe

e

h

igher-margin

c

ts and servic

e

a

se of approxi

m

y

$0.15 or 1.9

w

ith an increa

s

inued growth

h

ange and can

o

wer second b

t

ing outside of

c

ed our first f

u

rd members t

o

n

Connection.

a

l charges

r

ation

h

are

n

ses increased

enses increas

e

increased by

3

estimate of a

t

al airport ope

r

s

all expense li

n

cant cost, rep

r

12, aircraft fu

e

y

ear-over-year

Fuel costs pe

r

a

ted to WestJe

e

increased by

s in WestJet V

a

sful in gener

a

year-over-yea

old to our po

h

ermore, we a

o

mponent, wh

i

at the net am

o

e

s, onboard sa

goods and se

r

e

s to meet the

m

ately 10.8 p

e

per cent to $7

s

e in the rate

in our WestJe

t

cel fees attrib

u

ag and excess

Canada whos

e

u

lly reciprocal

f

o

earn WestJ

e

Exp

e

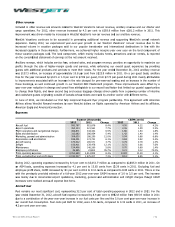

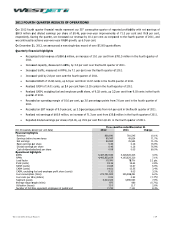

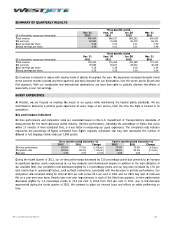

2012

992,787

454,114

366,871

313,082

208,620

185,401

173,412

156,411

154,406

46,585

3,051,689

2,012,317

by 8.4 per ce

e

d by 4.1 per

3

.1 per cent in

2

full-year 2012

r

ations, marke

t

ne items.

r

esenting 32.5

e

l expense incr

increase in ou

r

ASM for 201

2

t Vacation’s n

o

4.5 per cent

a

cation’s non-

a

a

ting additiona

r growth in

o

pular transbo

r

chieved highe

i

ch mainly incl

o

unt received.

les, and progr

a

rvices, while

e

ir needs. For t

e

r cent from $

1

.89 per guest,

charged for pr

t

RBC Master

c

u

table to our r

e

baggage char

e

tickets were

s

f

requent flyer

t dollars on fli

e

nse (thousan

d

2011

915,878

421,561

344,442

296,954

186,290

174,751

165,571

139,478

146,260

23,804

2,814,989

1,875,307

nt to $3,051.7

cent to 13.83

2012 to 9.12 c

e

year-over-yea

ting, general

a

per cent of t

o

eased by 8.4

p

r fuel costs pe

2

, were 4.50 c

e

o

n-air revenue

,

to $293.9 mil

a

ir revenue an

d

l revenue an

d

o

ur WestJet V

r

der and inte

r

r margins yea

l

udes hotels,

a

a

m revenue, p

e

nhancing our

t

he year ende

d

123.9 million i

n

from $7.74 p

e

r

e-reserved se

a

c

ard program.

e

cord load fact

r

ges driven pa

r

s

old by anothe

program part

n

i

ghts operated

d

s)

Change

8.4%

7.7%

6.5%

5.4%

12.0%

6.1%

4.7%

12.1%

5.6%

95.7%

8.4%

7.3%

7

million as co

m

cents from 1

3

ents as compa

r CASM increa

a

nd administra

o

tal operating

e

p

er cent to $9

9

e

r litre and the

ents, compare

y

, ancillary rev

e

l

lion from $28

d

our ancillary

d

supporting

W

V

acations’ non

-

r

national dest

i

r over year o

n

a

ttractions an

d

p

rovides an op

p

overall guest

d

December 3

1

n

2011. On a

e

r guest durin

g

a

ting and an i

n

These improv

e

t

or that limited

r

tly from a gr

o

r carrier with

d

n

ership. This

a

by American

C

A

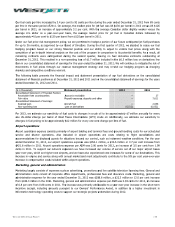

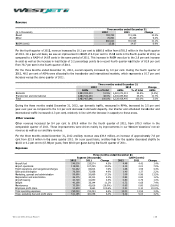

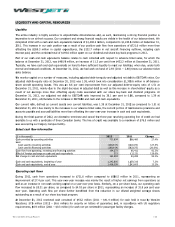

2012

4.50

2.06

1.66

1.42

0.94

0.84

0.79

0.71

0.70

0.21

13.83

9.12

m

pared to $2,

8

3

.29 cents in

2

a

red to 8.85 ce

n

se of 3.0 to 3

.

a

tion and inflig

expenses in 2

0

9

2.8 million fr

o

5.0 per cent

y

d to 4.32 cent

e

e

nue and our

c

1.2 million in

revenue.

W

estJet’s over

a

-

air revenue

d

i

nations in lin

e

n

the land co

m

d

car rentals,

i

p

ortunity to m

a

experience b

y

1

, 2012 ancilla

per guest bas

i

g

2011 mainly

a

n

crease in the

e

ments were

o

our guests’ o

p

o

wing number

d

ifferent terms

.

a

greement wit

h

Airlines and it

A

SM (cents)

2011

4.32

1.99

1.63

1.40

0.88

0.82

0.78

0.66

0.69

0.12

13.29

8.85

8

15.0 million i

n

2

011. Excludi

n

n

ts in 2011. T

h

.

5 per cent. T

h

ht charges th

o

0

12 and in 20

1

o

m $915.9 mill

i

y

ear-over-year

t

s in 2011, an

│

c

harter and

2011. This

a

ll network

d

ue to the

e

with the

m

ponent of

i

s reported

a

ximize our

y

providing

ry revenue

i

s, ancillary

a

ttributable

number of

o

ffset by a

p

portunities

of interline

.

h

American

t

s affiliates,

Change

4.2%

3.5%

1.8%

1.4%

6.8%

2.4%

1.3%

7.6%

1.4%

75.0%

4.1%

3.1%

n

2011. On

n

g fuel and

h

is is in line

h

e increase

o

ugh CASM

1

1. For the

i

on in 2011

increase in

increase of