Westjet 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

12. Share capital (continued)

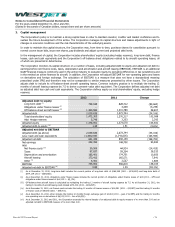

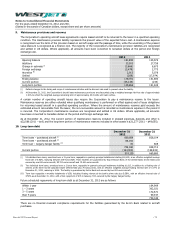

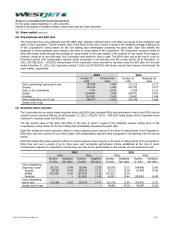

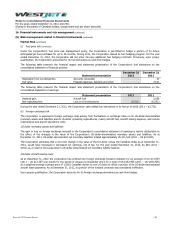

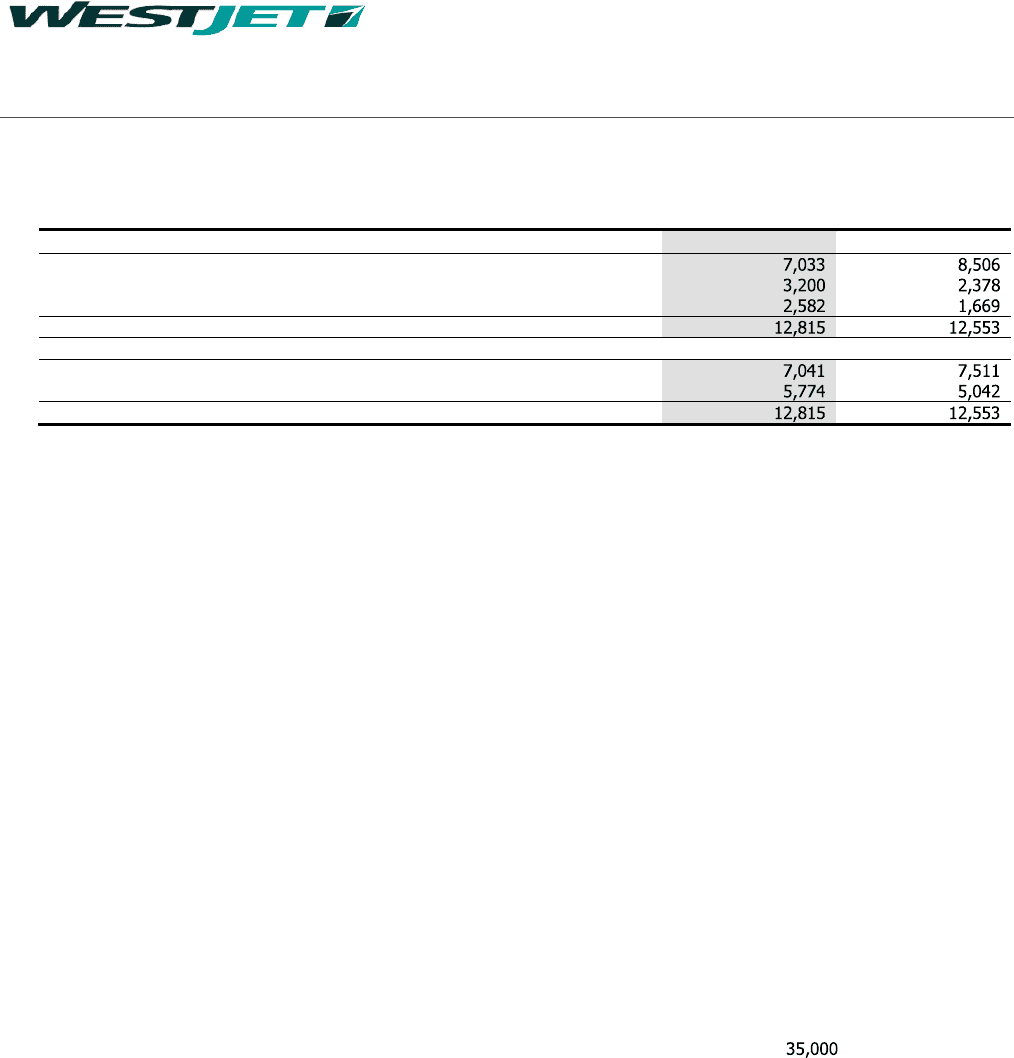

(f) Share-based payment expense

The following table summarizes share-based payment expense for the Corporation’s equity-based plans:

2012

2011

Stock option plan

Key employee and pilot plan

Executive share unit plan

Total share-based payment expense

Presented on the consolidated statement of earnings as follows:

Flight operations and navigational charges

Marketing, general and administration

Total share-based payment expense

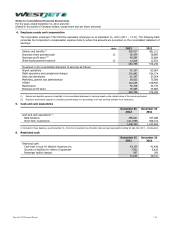

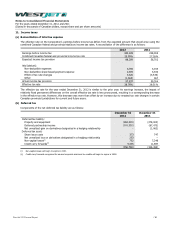

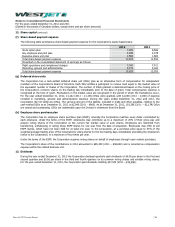

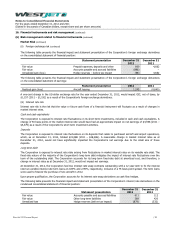

(g) Deferred share units

The Corporation has a cash-settled deferred share unit (DSU) plan as an alternative form of compensation for independent

members of the Corporation’s Board of Directors. Each DSU entitles a participant to receive cash equal to the market value of

the equivalent number of shares of the Corporation. The number of DSUs granted is determined based on the closing price of

the Corporation’s common shares on the trading day immediately prior to the date of grant. Total compensation expense is

recognized at the time of grant. Fluctuations in the market value are recognized in the period in which the fluctuations occu r.

For the year ended December 31, 2012, 21,162 (2011 – 21,146) DSUs were granted, with $1,080 (2011 – $108) of expense

included in marketing, general and administration expense. During the years ended December 31, 2012 and 2011, the

Corporation did not settle any DSUs. The carrying amount of the liability, included in trade and other payables, relating to the

cash-settled DSUs as at December 31, 2012 is $2,046 (2011 - $966). As at December 31, 2012, 103,296 (2011 – 82,134) DSUs

are vested and outstanding. DSUs are redeemable upon the Director’s retirement from the Board.

(h) Employee share purchase plan

The Corporation has an employee share purchase plan (ESPP), whereby the Corporation matches every dollar contributed by

each employee. Under the terms of the ESPP, employees may contribute up to a maximum of 20% of their gross pay and

acquire voting shares of the Corporation at the current fair market value of such shares. Employees are restricted from

transferring, withdrawing or selling these ESPP shares for one year from the date of acquisition. Employees may offer to sell

ESPP shares, which have not been held for at least one year, to the Corporation, at a purchase price equal to 50% of the

weighted average trading price of the Corporation’s voting shares for the five trading days immediately preceding the employee’s

notice to the Corporation, to a maximum of four times per year.

Under the terms of the ESPP, the Corporation acquires voting shares on behalf of employees through open market purchases.

The Corporation’s share of the contributions in 2012 amounted to $65,439 (2011 – $58,682) and is recorded as compensation

expense within the related business unit.

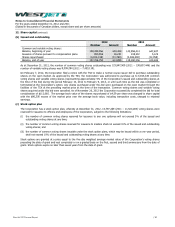

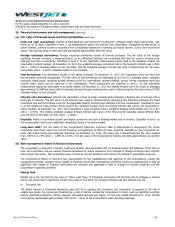

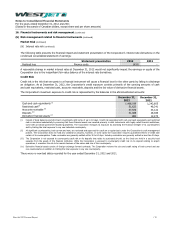

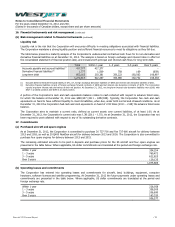

13. Dividends

During the year ended December 31, 2012 the Corporation declared quarterly cash dividends of $0.06 per share in the first and

second quarters and $0.08 per share in the third and fourth quarters on its common voting shares and variable voting shares.

For the year ended December 31, 2012, the Corporation paid dividends totalling $37,549 (2011 – $ ).

WestJet 2012 Annual Report

/ 85