Westjet 2012 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

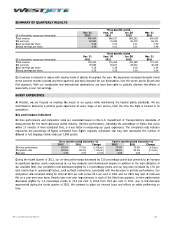

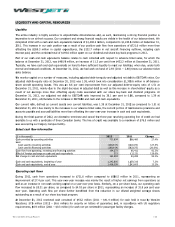

WestJet 2012 Annual Report / 25

O

p

p

a

a

U

f

h

c

r

D

i

t

m

m

T

s

e

(

C

C

F

o

c

A

A

s

a

e

$

c

y

i

n

i

n

M

M

a

a

f

o

i

n

i

n

O

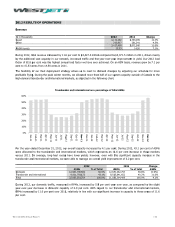

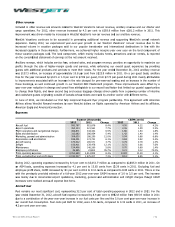

ur fuel costs

p

p

er litre in the

s

p

er barrel in 2

0

a

verage U.S.

d

a

pproximately

4

U

nder our fuel

f

or up to 36 m

h

edging progr

a

c

ompletion of

a

r

emaining con

t

D

ecember 31,

2

t

em in our con

m

ovements in

m

arkets and c

o

T

he following

t

s

tatement of fi

n

e

nded Decemb

e

(

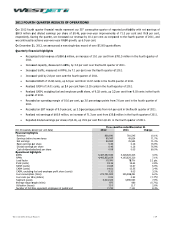

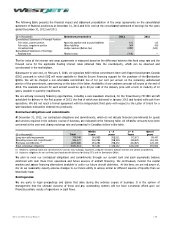

$ in thousands)

C

onsolidated Sta

Receivable fro

m

Fair value

C

onsolidated Sta

Realized gain

Non-operatin

g

F

or 2013, we

e

o

ne US-dollar

c

c

hanges in fuel

A

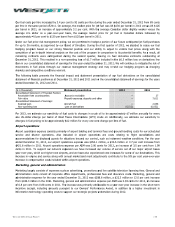

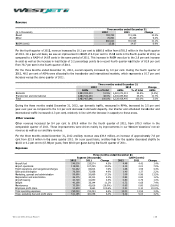

irport oper

at

A

irport operati

o

s

ervice and

c

a

ccommodatio

n

e

nded Decemb

$

421.6 million

c

ents in 2011.

y

ear-over-year

,

n

crease in vol

u

n

crease in co

m

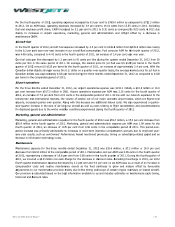

M

arketin

g

, g

e

M

arketing larg

e

a

dministration

a

dministration

e

f

rom $186.3 m

i

o

f 6.8 per cent

n

centive accr

u

n

formation tec

p

er litre increa

s

s

ame period o

f

0

11, an increa

d

ollar on a y

e

4

.0 per cent to

price risk man

onths, as app

r

a

m based on

a

n in-depth int

t

racts were e

x

2

012. This res

solidated stat

e

fuel prices th

r

o

mpetitive con

d

t

able presents

n

ancial positio

n

e

r 31, 2012 an

tement of Finan

c

m

counterpartie

s

tement of Earni

n

loss

e

stimate our s

e

c

hange per b

a

pricing to be

a

at

ion

s

o

ns expense c

o

c

harter opera

t

n

s for displace

d

er 31, 2012,

o

in 2011. Airpo

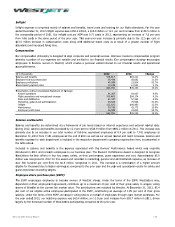

To support o

u

,

which are hig

u

me and servi

c

m

pensation cos

t

e

neral and a

d

e

ly consists of

costs consist

o

e

xpense for t

h

i

llion in the 20

1

from 0.88 cen

u

al, including

a

hnology opera

t

s

ed by 3.4 per

f

2011. On av

e

se of approxi

m

e

ar-over-year

$130 per barr

agement polic

y

r

oved by our

B

our strong fi

n

e

rnal analysis

x

tinguished d

u

ulted in a non

e

ment of earni

n

r

ough our rev

e

d

itions warrant

the financial

n

as at Decem

b

d 2011.

S

t

c

ial Position:

s

A

P

ng

s:

A

L

e

nsitivity of fu

e

a

rrel of West

T

a

pproximately

$

o

nsists primaril

y

t

ions. Also in

c

d

guests for s

i

o

ur airport ope

r

rt operations

e

u

r network ex

p

her-cost airpo

r

c

e along with a

t

s included wit

h

d

ministratio

n

expenses suc

h

o

f corporate o

f

h

e year ended

1

1. Marketing,

ts in 2011. Th

e

a

mounts purs

u

t

ing costs to s

u

cent to 92 ce

n

e

rage, the mar

k

m

ately 3.2 per

basis, the av

e

el from $125

p

y

, we are per

m

B

oard of Direc

t

n

ancial positio

n

on the cost of

u

ring the sec

o

-operating los

s

n

gs for the yea

enue manage

m

.

impact and s

t

b

er 31, 2012 a

n

tatement pres

e

A

ccounts receiva

b

P

repaid expense

s

A

ircraft fuel

L

oss on derivativ

e

e

l costs to ch

a

T

exas Interm

e

$

12 million for

y

of airport la

n

c

luded in ai

r

i

tuations beyo

n

r

ations expen

s

e

xpense per A

S

p

ansion we ha

v

r

ts, and we ha

v

nnual market

a

h

in airport ope

h

as advertisin

g

f

fice departm

e

December 31,

general and a

d

e

increase was

u

ant to our O

w

u

pport our stra

n

ts per litre du

r

k

et price for je

t

cent. With th

e

e

rage market

p

er barrel in 20

m

itted to hedg

e

t

ors. During th

n

and our abi

the program

i

o

nd quarter, l

s

of $1.7 millio

r ended Dece

m

m

ent strategy

tatement pres

e

n

d 2011 and o

n

entation

ble

s

, deposits and o

t

e

s

nges in crude

e

diate (WTI)

c

every one-cen

n

ding and term

port operatio

n

n

d our control

,

s

e was $454.1

S

M was 2.06 c

ve increased

o

v

e also experie

a

nd merit adju

rations.

g

, promotions

a

nts, professio

n

2012 was $2

0

d

ministration e

primarily attri

b

w

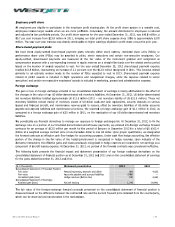

ners’ Perfor

m

tegic projects

u

r

ing the year e

n

t fuel was US

$

e

average Ca

n

price for jet

0

11.

e

a portion of

o

e first quarter

i

lity to adjust

i

n comparison

l

eaving no fu

e

o

n included in

t

m

ber 31, 2012.

and may re-

v

entation of o

u

n

the consolid

a

t

her

oil to be appr

c

rude oil. Addi

t

n

t change per l

i

inal fees and

g

n

s are costs

,

such as incl

e

million, a $32

.

c

ents for 2012

,

o

ur volume of

e

nced rate incr

e

u

stments contri

a

nd live satelli

t

n

al fees and i

n

0

8.6 million, a

e

xpense per A

S

butable to a y

e

m

ance Award,

u

ndertaken du

y

nded Decemb

e

$

130 per barr

e

n

adian dollar s

l

fuel in Canad

o

ur future anti

c

of 2012, we

d

to volatile fu

e

to its potentia

e

l derivative

c

the $6.5 millio

.

We will conti

n

v

isit our hedgi

n

u

r fuel derivat

a

ted statement

2012

(6,51

r

oximately $7

m

t

ionally, we e

s

itre of fuel.

g

round handlin

relating to

e

ment weather

.

6 million or 7

.

,

an increase

o

service out o

f

e

ases for som

e

bute to the 9.

9

t

e television li

c

n

surance costs

$22.3 million

o

S

M was 0.94 c

e

e

ar-over-year i

in addition t

o

ring 2012.

e

e

r 31, 2012 fro

e

l in 2012 vers

u

l

ightly weaker

ian dollars in

c

c

ipated jet fue

l

d

ecided to cea

el prices alon

g

l benefits. As

a

c

ontracts out

s

o

n loss on deri

v

n

ue to mitigat

e

n

g program a

s

ives on the c

o

t

of earnings f

o

20

―

―

―

2)

m

illion annuall

y

s

timate our s

e

g costs for ou

r

flight cancell

a

r

conditions. F

o

.

7 per cent inc

o

f 3.5 per cen

t

f

our major ai

r

e

of our destin

a

9

per cent yea

r

c

ensing fees.

G

s

. Marketing,

g

o

r 12.0 per ce

e

nts for 2012,

a

ncrease in the

o

a higher inv

│

m 89 cents

u

s US $126

versus the

c

reased by

l

purchases

se our fuel

g

with the

a

result, all

s

tanding at

v

atives line

e

the risk of

s changing

o

nsolidated

o

r the years

11

27

7,611

2,656

(6,052)

y for every

e

nsitivity to

r

scheduled

a

tions and

o

r the year

c

rease from

t

from 1.99

r

port bases

a

tions. This

r-over-year

G

eneral and

g

eneral and

nt increase

a

n increase

short-term

estment in