Westjet 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 28

F

a

l

e

I

O

t

r

O

a

p

p

d

c

c

F

r

r

F

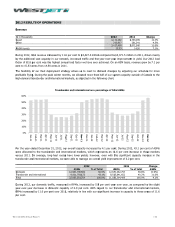

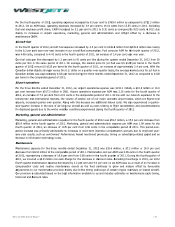

or 2013, we

e

a

pproximate i

m

e

asing and $2

I

ncome taxe

s

O

ur operations

he provision

f

r

egulation.

O

ur effective

a

pproximately

p

ermanent diff

p

ronounced, r

e

d

eferred inco

m

c

orporate inco

m

c

onsolidated ta

x

F

or 2013, we a

r

ange from 20

1

r

ate increase i

n

e

stimate that

m

pact of $15

m

million related

s

span several

C

f

or income ta

x

consolidated

i

29 per cent.

f

erences (expe

e

sulting in a c

o

m

e tax liability

m

e tax rate re

d

x rate remaine

nticipate that

o

1

2 is primarily

n

Ontario.

every one-ce

n

m

illion on our

a

to other US-d

o

C

anadian tax j

u

x

es involves j

u

i

ncome tax r

a

Typically wh

e

nses which a

r

o

rresponding d

due to the

p

d

uctions and f

e

d consistent i

n

o

ur annual eff

e

due to the re

m

t change in t

h

annual operati

o

llar denomina

t

u

risdictions, su

b

udgments ba

s

a

te for the y

e

n we experi

e

r

e non-deducti

ecrease in the

p

rovincial gov

e

reezing the co

n

comparison t

o

e

ctive tax rate

m

oval of the

o

h

e value of th

ng costs (app

r

t

ed operating

e

b

jecting our in

c

s

ed on the an

ears ended

D

e

nce higher c

o

ble from taxa

b

rate. Howeve

e

rnment of O

n

rporate incom

e

o

the prior yea

r

will fall within

o

ne-time deferr

s

e Canadian d

o

r

oximately $1

1

e

xpenses).

c

ome to vario

u

n

alysis of sev

e

D

ecember 31,

o

mparative e

a

b

le income) o

r this decreas

e

n

tario cancelli

n

e

tax rate at

1

r

.

the range of

2

r

ed tax liability

s

o

llar versus th

1

million for f

u

u

s rates of tax

a

e

ral different

p

2012 and

D

a

rnings, the i

m

n the overall

e

was offset b

y

n

g the July 1,

1

1.5 per cent.

2

7 and 29 per

c

y

revalue arisi

n

s

e US dollar

w

u

el, $2 million

a

tion. The com

p

ieces of legi

s

D

ecember 31,

m

pact of rela

t

effective tax

r

y

the increase

2012 and Ju

As a result, o

u

c

ent. The decr

e

n

g from the co

r

│

w

ill have an

for aircraft

putation of

s

lation and

2011 was

t

ively fixed

r

ate is less

to our net

ly 1, 2013

u

r effective

e

ase in our

r

porate tax