Westjet 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

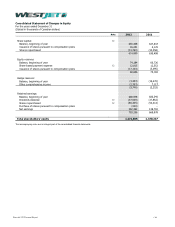

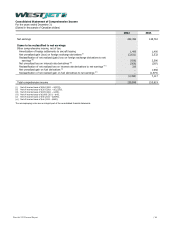

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

1. Statement of significant accounting policies

The annual consolidated financial statements of WestJet Airlines Ltd. (the Corporation) for the years ended December 31, 2012

and 2011, were authorized for issue by the Board of Directors on February 5, 2013. The Corporation is a public company

incorporated and domiciled in Canada. The Corporation provides airline service and travel packages. The Corporation’s shares

are publicly traded on the Toronto Stock Exchange. The principal business address is 22 Aerial Place N.E., Calgary, Alberta, T2E

3J1 and the registered office is Suite 2400, 525 - 8 Avenue SW, Calgary, Alberta, T2P 1G1.

(a) Basis of presentation

These annual consolidated financial statements and the notes hereto have been prepared in accordance with International

Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

These annual consolidated financial statements have been prepared on an historical cost basis except for certain financial assets

and liabilities, including derivative financial instruments that are measured at fair value. Where applicable, these differences have

been described in the notes hereto.

Amounts presented in these annual consolidated financial statements and the notes hereto are in Canadian dollars, the

Corporation’s reporting currency, unless otherwise stated. The Corporation’s functional currency is the Canadian dollar.

(b) Principles of consolidation

The accompanying consolidated financial statements include the accounts of the Corporation and its wholly owned subsidiaries,

as well as the accounts of six special-purpose entities (SPEs), which are utilized to facilitate the financing of aircraft. The

Corporation has no equity ownership in the SPEs; however, the substance of the relationship between the Corporation and the

SPEs indicates that they are controlled by the Corporation. Accordingly, the accounts of the SPEs have been consolidated in the

Corporation’s financial statements and all intercompany balances and transactions have been eliminated.

(c) Seasonality

The airline industry is sensitive to general economic conditions and the seasonal nature of air travel. The Corporation

experiences increased domestic travel in the summer months and more demand for transborder and international travel over the

winter months, thus reducing the effects of seasonality on net earnings.

(d) Revenue recognition

(i) Guest

Guest revenue, including the air component of vacation packages, are recognized when air transportation is provided. Tickets

sold but not yet used are reported in the consolidated statement of financial position as advance ticket sales.

(ii) Other

Other revenue include charter revenue, cargo revenue, net revenue from the sale of the land component of vacation packages,

ancillary revenue and other.

Revenue for the land component of vacation packages is generated from providing agency services equal to the amount paid by

the guest for products and services, less payment to the travel supplier, and is reported at the net amount received. Revenue

from the land component is deferred as advance ticket sales and recognized in earnings on completion of the vacation.

Ancillary revenue are recognized when the services and products are provided to the guests. Included in ancillary revenue are

fees associated with guest itinerary changes or cancellations, baggage fees, buy-on-board sales, pre-reserved seating fees, and

ancillary revenue from the WestJet Rewards Program.

WestJet 2012 Annual Report

/ 66