TCF Bank 2013 Annual Report Download - page 98

Download and view the complete annual report

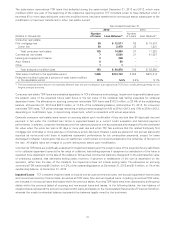

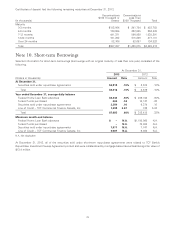

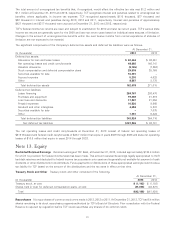

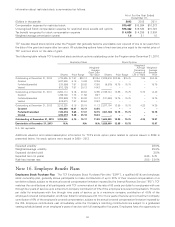

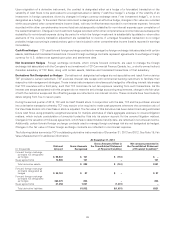

Please find page 98 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Depositary Shares Representing 7.50% Series A Non-Cumulative Perpetual Preferred Stock On June 25, 2012, TCF

completed the public offering of depositary shares, each representing a 1/1,000th interest in a share of Series A Non-Cumulative

Perpetual Preferred Stock, par value $.01 per share (the ‘‘Series A Preferred Stock’’). In connection with the offering, TCF issued

6,900,000 depositary shares at a public offering price of $25 per depositary share. Dividends are payable on the Series A

Preferred Stock if, as and when declared by TCF’s Board of Directors on a non-cumulative basis on March 1, June 1,

September 1, and December 1 of each year at a per annum rate of 7.5%. Net proceeds of the offering to TCF, after deducting

underwriting discounts and commissions and estimated offering expenses of $5.8 million, were $166.7 million. TCF paid

$12.9 million and $5.6 million in cash dividends to holders of Series A Preferred Stock during 2013 and 2012, respectively.

6.45% Series B Non-Cumulative Perpetual Preferred Stock On December 19, 2012, TCF completed the public offering of

4,000,000 shares of 6.45% Series B Non-Cumulative Perpetual Preferred Stock par value $.01 per share (the ‘‘Series B Preferred

Stock’’). Net proceeds of the offering to TCF, after deducting underwriting discounts, commissions and estimated offering costs

of $3.5 million, were $96.5 million. Dividends are payable on the Series B Preferred Stock if, as and when declared by TCF’s

Board of Directors on a non-cumulative basis on March 1, June 1, September 1, and December 1 of each year, commencing on

March 1, 2013, at a per annum rate of 6.45%. TCF paid $6.1 million in cash dividends to holders of Series B Preferred stock during

2013 and no cash dividends were paid to holders of Series B Preferred Stock in 2012.

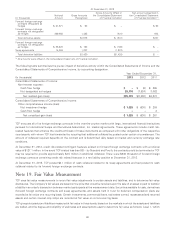

Shares Held in Trust for Deferred Compensation Plans

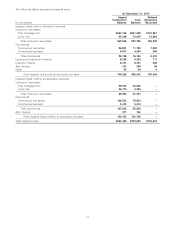

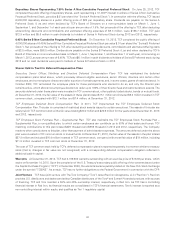

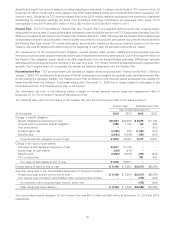

Executive, Senior Officer, Winthrop and Directors Deferred Compensation Plans TCF has maintained the deferred

compensation plans listed above, which previously allowed eligible executives, senior officers, directors and certain other

employees, and non-employee directors to defer a portion of certain payments, and, in some cases, grants of restricted stock. In

October 2008, TCF terminated the employee plans for those participants who elected to do so, and only the Director plan

remains active, which allows non-employee directors to defer up to 100% of their director fees and restricted stock awards. The

amounts deferred under these plans were invested in TCF common stock, other publicly traded stocks, bonds or mutual funds.

At December 31, 2013, the fair value of the assets in these plans totaled $15.1 million and included $9.4 million invested in TCF

common stock, compared with $12.1 million and $7.4 million, at December 31, 2012.

TCF Employees Deferred Stock Compensation Plan In 2011, TCF implemented the TCF Employees Deferred Stock

Compensation Plan. This plan is comprised of restricted stock awards issued to certain executives. The assets of this plan are

solely held in TCF common stock with a fair value totaling $30.2 million and $22.6 million for the years ended December 31, 2013

and 2012, respectively.

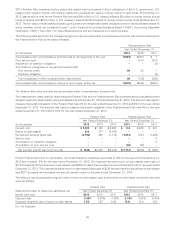

TCF Employees Stock Purchase Plan – Supplemental Plan TCF also maintains the TCF Employees Stock Purchase Plan –

Supplemental Plan, a non-qualified plan, to which certain employees can contribute up to 50% of their salary and bonus. TCF

matching contributions to this plan totaled $829 thousand and $556 thousand in 2013 and 2012, respectively. The Company

made no other contributions to this plan, other than payment of administrative expenses. The amounts deferred under the above

plan were invested in TCF common stock or mutual funds. At December 31, 2013, the fair value of the assets in the plan totaled

$27.8 million and included $16.4 million invested in TCF common stock, compared with a total fair value of $19 million, including

$11.5 million invested in TCF common stock at December 31, 2012.

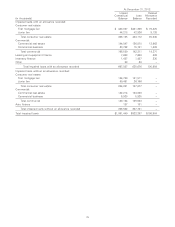

The cost of TCF common stock held by TCF’s deferred compensation plans is reported separately in a manner similar to treasury

stock (that is, changes in fair value are not recognized) with a corresponding deferred compensation obligation reflected in

additional paid-in capital.

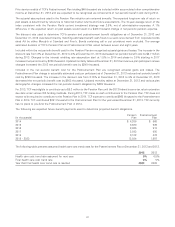

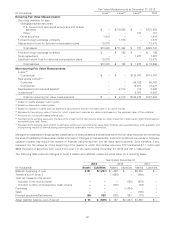

Warrants At December 31, 2013, TCF had 3,199,988 warrants outstanding with an exercise price of $16.93 per share, which

expire on November 14, 2018. Upon the completion of the U.S. Treasury’s secondary public offering of the warrants issued under

the Capital Purchase Program (‘‘CPP’’) in December 2009, the warrants became publicly traded on the New York Stock Exchange

under the symbol ‘‘TCBWS’’. As a result, TCF has no further obligations to the Federal Government in connection with the CPP.

Joint Venture TCF has a joint venture with The Toro Company (‘‘Toro’’) called Red Iron Acceptance, LLC (‘‘Red Iron’’). Red Iron

provides U.S. distributors and dealers and select Canadian distributors of the Toro and Exmark branded products with sources

of financing. TCF and Toro maintain a 55% and 45% ownership interest, respectively, in Red Iron. As TCF has a controlling

financial interest in Red Iron, its financial results are consolidated in TCF’s financial statements. Toro’s interest is reported as a

non-controlling interest within equity and qualifies as Tier 1 regulatory capital.

82