TCF Bank 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

average yield of 6.03 percent and has

maintained very strong credit quality

metrics. TCF entered the inventory

finance business in 2008 and now

has a well-diversified portfolio with

loans in the powersports, lawn and

garden, electronics and appliance,

recreational vehicle, marine and

specialty vehicle markets.

The inventory finance business is

unique in the banking industry given

its steep barriers to entry including

industry expertise. TCF Inventory

Finance’s experienced management

team and customer service focus have

resulted in relationships with several

industry-leading manufacturers

including BRP, The Toro Company

and Arctic Cat, Inc. Celebrating its

five-year anniversary in 2013, TCF

Inventory Finance continued its

focus on customer service while

strengthening its relationships with

its manufacturers. We continue to look

at opportunities to add additional

programs and expect to continue to

grow the business going forward.

TCF’s leasing and equipment finance

businesses continue to be a key part

of the TCF lending story. Leasing and

equipment finance ended the year

with total balances of $3.4 billion,

which represents 7.2 percent

year-over-year asset growth, driven

by continued growth in originations.

Portfolio performance during 2013

was exceptional with the leasing

and equipment finance provision for

credit losses at .03 percent of average

earning assets.

The leasing and equipment finance

businesses consider investment in

information technology to be a

strategic differentiator. As such, the

businesses implemented a number of

system enhancements throughout the

year. For example, TCF Equipment

Finance received a 2013 Equipment

Leasing and Finance Association

Operations and Technology Excellence

Award for its development and

implementation of its “End of Lease

Cycle” system which provides dynamic

workflow processes for all lease end

of term activity. TCF’s leasing and

equipment finance businesses

represent the 30th largest equipment

finance/leasing company in the U.S.

and the 15th largest bank-affiliated

leasing company.

Consumer real estate loans decreased

5 percent during the year to $6.3 billion.

Given the reduction in borrowers

meeting TCF’s underwriting criteria

and the competition for those that

do, TCF’s focus in the consumer real

estate portfolio has been on high-

quality junior liens originated on a

national level. These loans are made

to high-FICO borrowers which has

resulted in pristine credit quality

within the portfolio. TCF has been

actively managing the concentration

risk in this portfolio by selling a

portion of the originations on a

quarterly basis. TCF’s home equity

line of credit portfolio totaled

$2.3 billion at December 31, 2013 with

only 10.2 percent reaching maturity

or draw period end prior to 2021.

With increased competition in our

banking footprint, commercial loan

balances declined 7.5 percent during

the year to $3.1 billion. We continued

to see strong originations in 2013 of

$1.6 billion; however, competition in

the marketplace has led to elevated

levels of prepayments. While TCF

has focused on maintaining strong

relationships with our current

customers, the growth opportunities

in our national lending businesses

have given us the luxury of selectively

choosing commercial loans based on

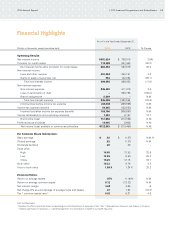

Total Deposits

Billions of Dollars

1312111009

$14.4

$11.6

$11.6

$12.2

$14.1

1312111009

1.07%

0.53%

0.38%

0.31%

0.26%

Total Deposits

Average Interest Rate on Deposits

Tangible Realized

Common Equity

Millions of Dollars

Tangible Realized Common Equity

Tangible Realized Common Equity Ratio

1312111009

$1,485

$1,020

$1,334

$1,579

$1,353

1312111009

5.75%

7.28%

8.42%

7.52%

8.18%

2013 Annual Report // TCF Financial Corporation and Subsidiaries 07