TCF Bank 2013 Annual Report Download - page 69

Download and view the complete annual report

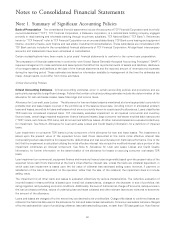

Please find page 69 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TCF’s asset liquidity may be held in the form of on-balance sheet cash invested with the Federal Reserve or through the use of

overnight Federal Funds sold to highly rated counterparties or short-term U.S. Treasury Bills or Notes. Other asset liquidity can be

provided by unpledged, highly-rated securities which could be sold or pledged to various counterparties under established TCF

lines. At December 31, 2013, TCF had asset liquidity of $1.1 billion.

Deposits are TCF’s primary source of funding. TCF also maintains secured sources of funding, which primarily include $2.2 billion

of borrowing capacity at the FHLB of Des Moines, as well as access to the Federal Reserve Discount Window. Collateral pledged

by TCF to the FHLB and the Federal Reserve consists primarily of consumer and commercial real estate loans. The FHLB relies

upon its own internal credit analysis of TCF’s financial results when determining TCF’s secured borrowing capacity. In addition to

the above, TCF maintains other sources of unsecured and uncommitted borrowing capacity, including overnight federal funds

purchased lines, access to brokered deposits, and access to the capital markets. TCF has developed and maintains a contingency

funding plan should certain liquidity needs arise.

Foreign Currency Risk

The Company is also exposed to foreign currency risk as changes in foreign exchange rates may impact the Company’s

investment in TCF Commercial Finance Canada, Inc. or results of other transactions in countries outside of the United States.

Beginning in 2011, TCF entered into forward foreign exchange contracts in order to minimize the risk of changes in foreign

exchange rates on its investment in and loans to TCF Commercial Finance Canada, Inc. and on certain other foreign lease

transactions. The values of forward foreign exchange contracts vary over their contractual lives as the related currency exchange

rates fluctuate. TCF may also experience realized and unrealized gains or losses on forward foreign exchange contracts as a

result of changes in foreign exchange rates.

53