TCF Bank 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

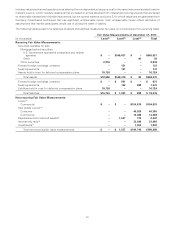

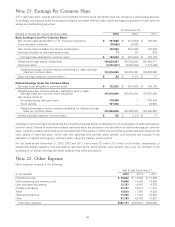

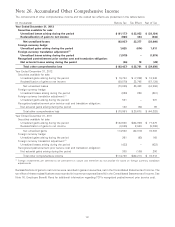

Note 26. Accumulated Other Comprehensive Income

The components of other comprehensive income and the related tax effects are presented in the tables below.

(In thousands) Before Tax Tax Effect Net of Tax

Year Ended December 31, 2013

Securities available for sale:

Unrealized losses arising during the period $ (61,177) $ 23,053 $ (38,124)

Reclassification of gains to net income (860) 324 (536)

Net unrealized losses (62,037) 23,377 (38,660)

Foreign currency hedge:

Unrealized gains arising during the period 1,625 (614) 1,011

Foreign currency translation adjustment:(1)

Unrealized losses arising during the period (1,979) – (1,979)

Recognized postretirement prior service cost and translation obligation:

Net actuarial losses arising during the period (46) 18 (28)

Total other comprehensive loss $ (62,437) $ 22,781 $ (39,656)

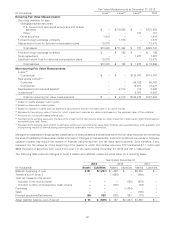

Year Ended December 31, 2012

Securities available for sale:

Unrealized gains arising during the period $ 19,794 $ (7,252) $ 12,542

Reclassification of gains to net income (89,879) 32,745 (57,134)

Net unrealized losses (70,085) 25,493 (44,592)

Foreign currency hedge:

Unrealized losses arising during the period (630) 239 (391)

Foreign currency translation adjustment:(1)

Unrealized gains arising during the period 531 – 531

Recognized postretirement prior service cost and translation obligation:

Net actuarial gains arising during the period 123 (54) 69

Total other comprehensive loss $ (70,061) $ 25,678 $ (44,383)

Year Ended December 31, 2011

Securities available for sale:

Unrealized gains arising during the period $122,638 $(44,959) $ 77,679

Reclassification of gains to net income (8,045) 2,949 (5,096)

Net unrealized gains 114,593 (42,010) 72,583

Foreign currency hedge:

Unrealized gains arising during the period 261 (93) 168

Foreign currency translation adjustment:(1)

Unrealized losses arising during the period (433) – (433)

Recognized postretirement prior service cost and translation obligation:

Net actuarial gains arising during the period 308 (108) 200

Total other comprehensive income $114,729 $(42,211) $ 72,518

(1) Foreign investments are deemed to be permanent in nature and therefore do not provide for taxes on foreign currency translation

adjustments.

Reclassifications of gains to net income were recorded in gains on securities, net in the Consolidated Statements of Income. The

tax effect of these reclassifications was recorded in income tax expense (benefit) in the Consolidated Statements of Income. See

Note 16, Employee Benefit Plans for additional information regarding TCF’s recognized postretirement prior service cost.

101