TCF Bank 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

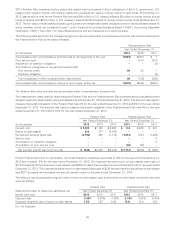

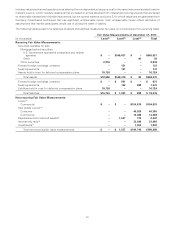

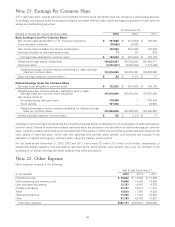

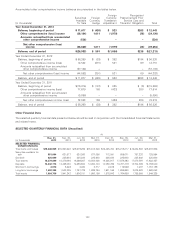

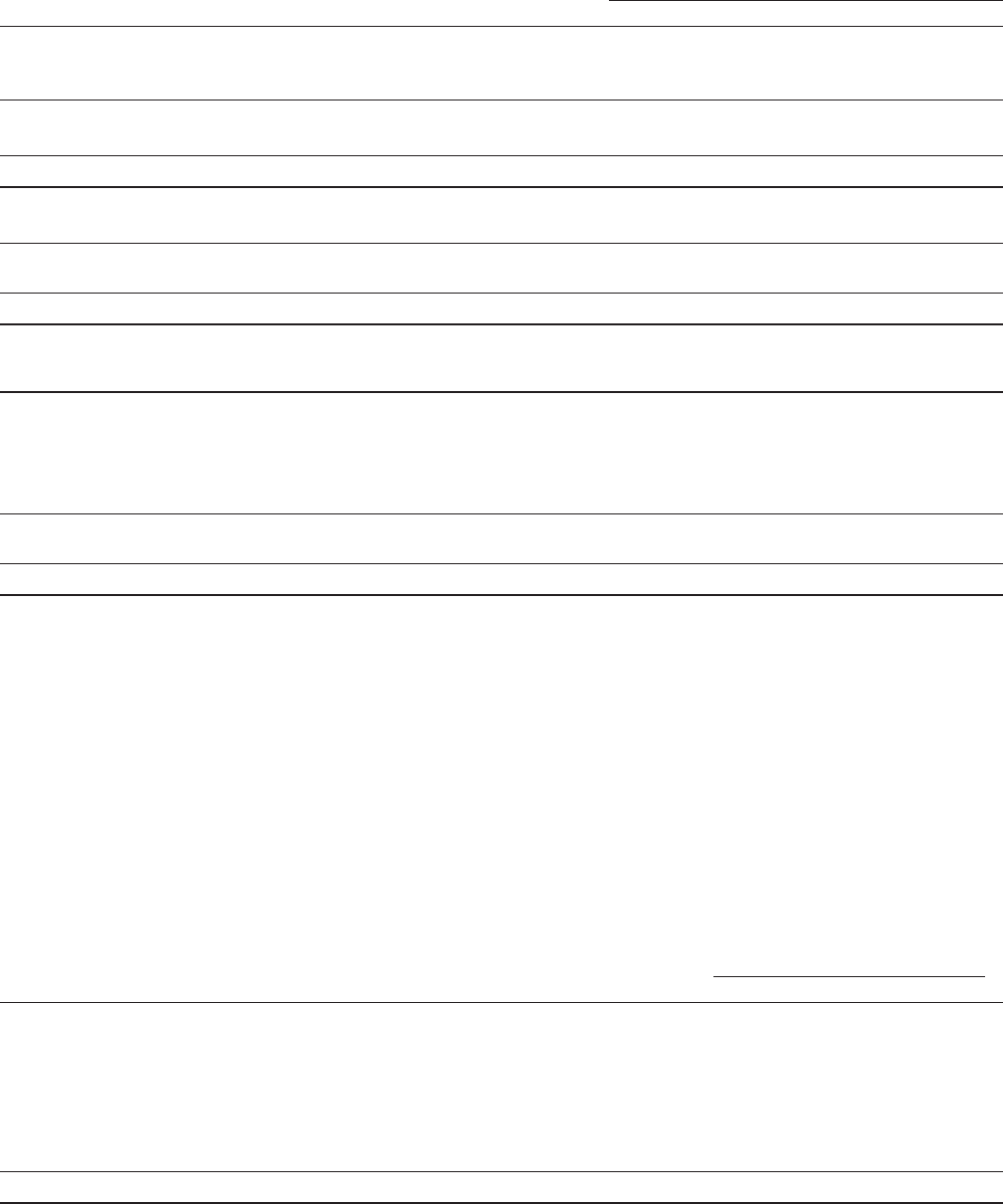

Note 21. Earnings Per Common Share

TCF’s restricted stock awards that pay non-forfeitable common stock dividends meet the criteria of a participating security.

Accordingly, earnings per share is calculated using the two-class method, under which earnings are allocated to both common

shares and participating securities.

At December 31,

(Dollars in thousands, except per-share data) 2013 2012 2011

Basic Earnings (Loss) Per Common Share

Net income (loss) attributable to TCF Financial Corporation $ 151,668 $ (212,884) $ 109,394

Preferred stock dividends (19,065) (5,606) –

Net income (loss) available to common stockholders 132,603 (218,490) 109,394

Earnings allocated to participating securities 71 50 292

Earnings (loss) allocated to common stock $ 132,532 $ (218,540) $ 109,102

Weighted-average shares outstanding 164,229,421 162,288,902 155,938,871

Restricted stock (3,213,417) (3,020,094) (1,716,565)

Weighted-average common shares outstanding for basic earnings

(loss) per common share 161,016,004 159,268,808 154,222,306

Basic earnings (loss) per common share $ .82 $ (1.37) $ .71

Diluted Earnings (Loss) Per Common Share

Earnings (loss) allocated to common stock $ 132,532 $ (218,540) $ 109,102

Weighted-average common shares outstanding used in basic

earnings (loss) per common share calculation 161,016,004 159,268,808 154,222,306

Net dilutive effect of:

Non-participating restricted stock 719,459 – 204,354

Stock options 191,092 – 82,560

Weighted-average common shares outstanding for diluted earnings

(loss) per common share 161,926,555 159,268,808 154,509,220

Diluted earnings (loss) per common share $ .82 $ (1.37) $ .71

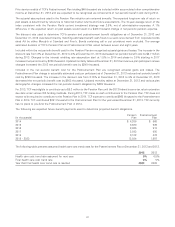

All shares of restricted stock are deducted from weighted-average shares outstanding for the computation of basic earnings per

common share. Shares of performance-based restricted stock are included in the calculation of diluted earnings per common

share, using the treasury stock method, at the beginning of the quarter in which the performance goals have been achieved. All

other shares of restricted stock, which vest over specified time periods, stock options, and warrants, are included in the

calculation of diluted earnings per common share, using the treasury stock method.

For the years ended December 31, 2013, 2012 and 2011, there were 3.8 million, 5.1 million and 5 million, respectively, of

outstanding shares related to non-participating restricted stock, stock options, and warrants that were not included in the

computation of diluted earnings per share because they were anti-dilutive.

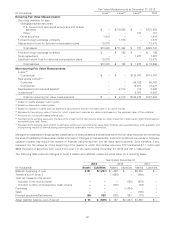

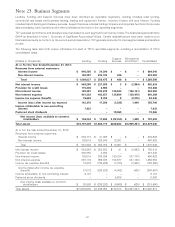

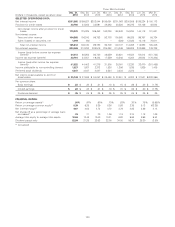

Note 22. Other Expense

Other expense consists of the following.

Year Ended December 31,

(In thousands) 2013 2012 2011

Professional fees $ 18,642 $ 13,608 $ 15,466

Card processing and issuance cost 15,868 15,586 18,593

Loan and lease processing 13,787 9,567 6,533

Outside processing 13,767 12,919 11,910

Travel 12,810 11,740 9,880

Telecommunications 11,720 11,735 12,420

Other 81,183 88,742 70,687

Total other expense $167,777 $163,897 $145,489

96