TCF Bank 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

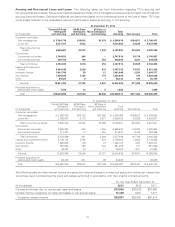

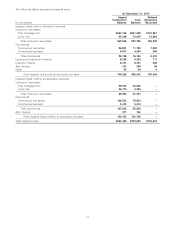

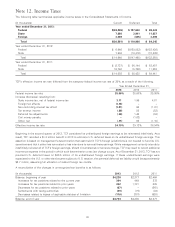

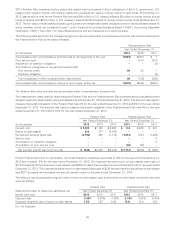

Note 12. Income Taxes

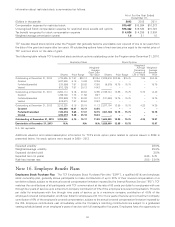

The following table summarizes applicable income taxes in the Consolidated Statements of Income.

(In thousands) Current Deferred Total

Year ended December 31, 2013:

Federal $(38,206) $ 107,630 $ 69,424

State 7,686 3,941 11,627

Foreign 3,939 (645) 3,294

Total $(26,581) $ 110,926 $ 84,345

Year ended December 31, 2012:

Federal $ 6,646 $(129,082) $(122,436)

State 7,994 (18,416) (10,422)

Total $ 14,640 $(147,498) $(132,858)

Year ended December 31, 2011:

Federal $ (2,737) $ 56,144 $ 53,407

State 16,740 (5,706) 11,034

Total $ 14,003 $ 50,438 $ 64,441

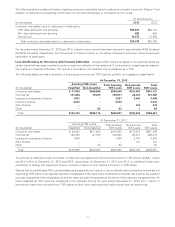

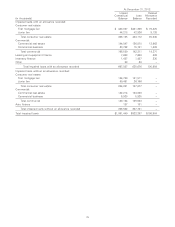

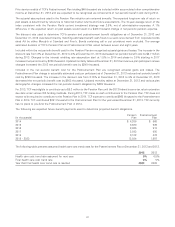

TCF’s effective income tax rate differed from the statutory federal income tax rate of 35% as a result of the following.

Year Ended December 31,

2013 2012 2011

Federal income tax rate 35.00% 35.00% 35.00%

Increase (decrease) resulting from:

State income tax, net of federal income tax 3.11 1.99 4.01

Foreign tax effects (1.13) ––

Non-controlling interest tax effect (1.01) .64 (1.01)

Tax exempt income (.86) .55 (.82)

Deferred tax adjustments (.30) 1.40 (.04)

Civil money penalty –(1.03) –

Other, net (.11) .58 (1.10)

Effective income tax rate 34.70% 39.13% 36.04%

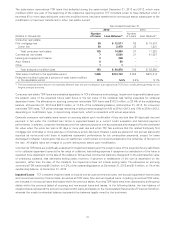

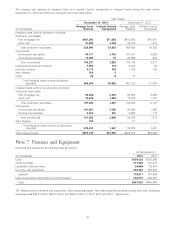

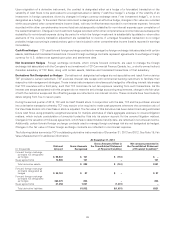

Beginning in the second quarter of 2013, TCF considered its undistributed foreign earnings to be reinvested indefinitely. As a

result, TCF recorded a $1.2 million benefit in 2013 to eliminate U.S. deferred taxes on its undistributed foreign earnings. This

assertion is based on management’s determination that cash held in TCF’s foreign jurisdictions is not needed to fund its U.S.

operations and that it either has reinvested or has intentions to reinvest these earnings. While management currently intends to

indefinitely reinvest all of TCF’s foreign earnings, should circumstances or tax laws change, TCF may need to record additional

income tax expense in the period in which such determination or tax law change occurs. As of December 31, 2013, TCF has not

provided U.S. deferred taxes on $33.5 million of its undistributed foreign earnings. If these undistributed earnings were

repatriated to the U.S. or otherwise became subject to U.S. taxation, the potential deferred tax liability would be approximately

$2.7 million, assuming full utilization of related foreign tax credits.

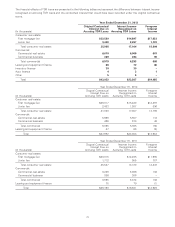

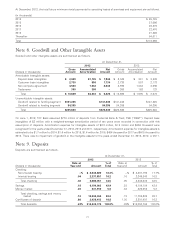

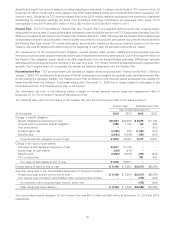

A reconciliation of the changes in unrecognized tax benefits is as follows.

(In thousands) 2013 2012 2011

Balance, beginning of year $4,230 $2,377 $2,464

Increases for tax positions related to the current year 394 449 273

Increases for tax positions related to prior years 362 1,781 605

Decreases for tax positions related to prior years (67) – (261)

Settlements with taxing authorities (39) (70) (84)

Decreases related to lapses of applicable statutes of limitation (176) (307) (620)

Balance, end of year $4,704 $4,230 $2,377

80