TCF Bank 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

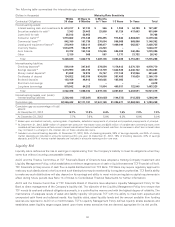

Contractual Obligations and Commitments As disclosed in Notes 10, 11 and 17 of Notes to Consolidated Financial

Statements, TCF has certain obligations and commitments to make future payments under contracts. At December 31, 2013,

the aggregate contractual obligations (excluding demand deposits) and commitments were as follows.

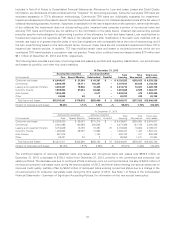

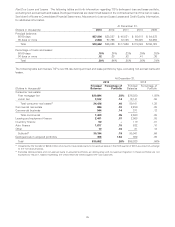

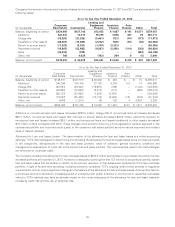

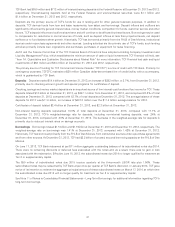

Payments Due by Period

(In thousands) Less than 1-3 3-5 More than

Contractual Obligations Total 1 year years years 5 years

Total borrowings $1,488,243 $ 431,912 $ 859,427 $ 87,715 $109,189

Time deposits 2,426,412 1,814,489 504,130 81,699 26,094

Annual rental commitments under non-cancelable

operating leases 174,566 25,788 50,945 43,822 54,011

Contractual interest payments(1) 118,620 38,277 35,961 18,881 25,501

Campus marketing agreements 40,787 4,099 5,760 5,875 25,053

Construction contracts and land purchase

commitments for future branch sites 910 910 – – –

Total $4,249,538 $2,315,475 $1,456,223 $237,992 $239,848

Amount of Commitment – Expiration by Period

(In thousands) Less than 1-3 3-5 More than

Commitments Total 1 year years years 5 years

Commitments to extend credit:

Consumer real estate and other $1,274,006 $ 43,901 $ 70,353 $142,549 $1,017,203

Commercial 482,777 143,395 111,359 157,703 70,320

Leasing and equipment finance 158,321 158,321 – – –

Total commitments to extend credit 1,915,104 345,617 181,712 300,252 1,087,523

Standby letters of credit and guarantees on industrial

revenue bonds 13,364 10,119 2,810 435 –

Total $1,928,468 $ 355,736 $184,522 $300,687 $1,087,523

(1) Includes accrued interest and future contractual interest obligations on borrowings and time deposits.

Unrecognized tax benefits, projected benefit obligations, demand deposits with indeterminate maturities and discretionary credit

facilities which do not obligate the Company to lend have been excluded from the contractual obligations table above.

Campus marketing agreements consist of fixed or minimum obligations for exclusive marketing and naming rights with seven

campuses. TCF is obligated to make various annual payments for these rights in the form of royalties and scholarships through

2029. TCF also has various renewal options, which may extend the terms of these agreements. Campus marketing agreements

are an important element of TCF’s campus banking strategy.

Commitments to extend credit are agreements to lend to a customer provided there is no violation of any condition in the

contract. These commitments generally have fixed expiration dates or other termination clauses and may require payment of a

fee. Since certain of the commitments are expected to expire without being drawn upon, the total commitment amounts do not

necessarily represent future cash requirements. Collateral to secure any funding of these commitments predominantly consists

of residential and commercial real estate.

Standby letters of credit and guarantees on industrial revenue bonds are conditional commitments issued by TCF guaranteeing

the performance of a customer to a third party. These conditional commitments expire in various years through 2017. Collateral

held consists primarily of commercial real estate mortgages. Since the conditions under which TCF is required to fund these

commitments may not materialize, the cash requirements are expected to be less than the total outstanding commitments.

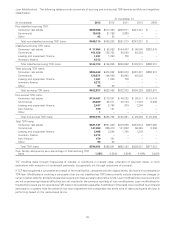

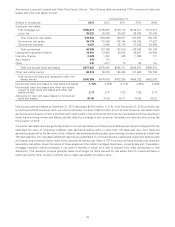

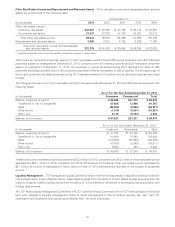

Capital Management

TCF is committed to managing capital to maintain protection for depositors and creditors. TCF employs a variety of capital

management tools to achieve its capital goals, including, but not limited to, dividends, public offerings of preferred and common

stock, common share repurchases, and the issuance or redemption of trust preferred securities, subordinated debt and other

capital instruments. TCF maintains a Capital Plan and Dividend Policy which applies to TCF Financial and incorporates TCF Bank’s

Capital Adequacy Plan and Dividend Policy. These policies ensure that capital strategy actions, including the addition of new

capital, if needed, and/or the declaration of preferred stock, common stock or bank dividends, are prudent, efficient, and provide

value to TCF’s stockholders, while ensuring that past and prospective earnings retention is consistent with TCF’s capital needs,

asset quality, and overall financial condition. TCF’s capital levels are managed in such a manner that all regulatory capital

requirements for well-capitalized banks and bank holding companies are exceeded.

44