TCF Bank 2013 Annual Report Download - page 109

Download and view the complete annual report

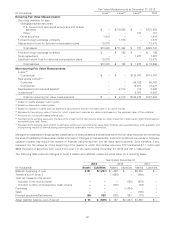

Please find page 109 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The following is a description of valuation methodologies used for assets and liabilities recorded at fair value on a recurring basis.

Securities Available for Sale Securities available for sale consist primarily of U.S. Government-sponsored enterprise and

federal agency securities. The fair value of U.S. Government-sponsored enterprise securities is recorded using prices obtained

from independent asset pricing services that are based on observable transactions, but not quoted markets, and are categorized

as Level 2 assets. Management reviews the prices obtained from independent asset pricing services for unusual fluctuations

and comparisons to current market trading activity. Other mortgage-backed securities, for which there is little or no market

activity, are categorized as Level 3 assets and the fair value of these assets is determined by using internal pricing methods.

Other securities are categorized as Level 1 assets and the fair value is determined using quoted prices from the New York Stock

Exchange.

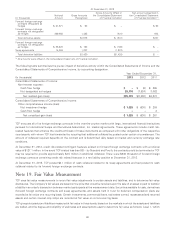

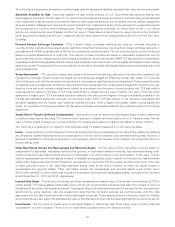

Forward Foreign Exchange Contracts TCF’s forward foreign exchange contracts are currency contracts executed in

over-the-counter markets and are valued using a cash flow model that includes key inputs such as foreign exchange rates and, in

accordance with GAAP, an assessment of the risk of counterparty non-performance. The risk of counterparty non-performance is

based on external assessments of credit risk. The majority of these contracts are based on observable transactions, but not

quoted markets, and are categorized as Level 2 assets and liabilities. As permitted under GAAP, TCF has elected to net derivative

receivables and derivative payables and the related cash collateral received and paid, when a legally enforceable master netting

agreement exists. For purposes of the previous tables, the derivative receivable and payable balances are presented gross of this

netting adjustment.

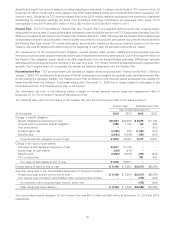

Swap Agreements TCF executes interest rate swaps with commercial banking customers to facilitate the company’s risk

management strategy. These interest rate swaps are simultaneously hedged by offsetting interest rate swaps TCF executes

with a third party, such that the company minimizes its net risk exposure resulting from such transactions. These transactions are

considered Level 2 investments, and the fair value is determined using a cash flow model which considers the forward curve, the

discount curve and credit valuation adjustments related to counterparty and borrower non-performance risk. TCF also holds a

swap agreement related to the sale of TCF’s Visa Class B stock, categorized as a Level 3 liability. The value of the Visa swap

agreement is based upon TCF’s estimated exposure related to the Visa covered litigation through a probability analysis of the

funding and estimated settlement amounts. As permitted under GAAP, TCF has elected to net derivative receivables and

derivative payables and the related cash collateral received and paid, when a legally enforceable master netting agreement

exists. For purposes of the previous tables, the derivative receivable and payable balances are presented gross of this netting

adjustment.

Assets Held in Trust for Deferred Compensation Assets held in trust for deferred compensation plans include investments

in publicly traded stocks, excluding TCF common stock reported in treasury and other equity, and U.S. Treasury notes. The fair

value of these assets is based upon prices obtained from independent asset pricing services based on active markets.

The following is a description of valuation methodologies used for assets measured on a non-recurring basis.

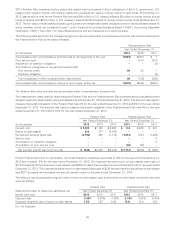

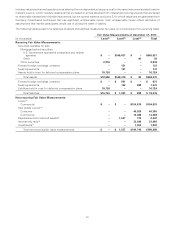

Loans Impaired loans for which repayment of the loan is expected to be provided solely by the value of the underlying collateral

are considered collateral dependent and are valued based on the fair value of collateral, less estimated selling costs; however, if

payment or satisfaction of the loan is dependent on the operation, rather than the sale, of the collateral, the impairment does not

include selling costs.

Other Real Estate Owned and Repossessed and Returned Assets The fair value of other real estate owned is based on

independent full appraisals, real estate broker’s price opinions, or automated valuation methods, less estimated selling costs.

Certain properties require assumptions that are not observable in an active market in the determination of fair value. The fair

value of repossessed and returned assets is based on available pricing guides, auction results or price opinions, less estimated

selling costs. Assets acquired through foreclosure, repossession or returned to TCF are initially recorded at the lower of the loan

or lease carrying amount or fair value less estimated selling costs at the time of transfer to other real estate owned or

repossessed and returned assets. Other real estate owned and repossessed and returned assets were written down

$15.6 million and $25.2 million, which was included in foreclosed real estate and repossessed assets, net expense for the years

ended December 31, 2013 and 2012, respectively.

Interest-Only Strips The fair value of interest-only strips represents the present value of future cash flows retained by TCF on

certain assets. TCF uses available market data, along with its own empirical data and discounted cash flow models, to arrive at

the estimated fair value of its interest-only strips. The present value of the estimated expected future cash flows to be received is

determined by using discount, loss and prepayment rates that the Company believes are commensurate with the risks

associated with the cash flows and what a market participant would use. These assumptions are inherently subject to volatility

and uncertainty and, as a result, the estimated fair value of the interest-only strip may fluctuate significantly from period to period.

Investments The fair value of investments is estimated based on discounted cash flows using current market rates and

consideration of credit exposure. There is not an observable secondary market for these securities.

93