TCF Bank 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Keys to Future Success

The building and investing in 2012

and the execution in 2013 have

positioned us well for the future, but

there is more hard work that needs to

be done to achieve our goals. Our

primary goal as we head into 2014

and beyond is to achieve a return on

average assets of 1.25 percent. TCF’s

return on average assets in 2013 was

.87 percent, up 37 basis points from

2012, excluding the balance sheet

repositioning. We are where we need

to be on the revenue side of the bank,

but we still have a ways to go on the

expense side and with the provision.

Below are some keys to achieving this

goal and other future initiatives:

• Increase revenue while controlling

expenses. A focus will continue to

be placed on identifying additional

sources of revenue while managing

expenses by improving business

efficiencies.

• Consistent high quality, diversified

loan and lease originations. TCF’s

recent investments in our national

lending platforms have given us the

opportunity to generate consistent

loan and lease originations while

adhering to our conservative

underwriting philosophy. We will

continue to look for additional

asset-generation opportunities.

• Continue to improve the customer

experience. TCF expects to further

improve the branch customer

experience in 2014 through product,

service and branding enhancements

along with channel optimization

initiatives in branch, ATM, online

and mobile platforms.

• Continued improvements in credit

quality. 2013 was a good year for

TCF in terms of improving credit

quality. Now we need to ensure that

we are able to continue the trends

we have seen into 2014. We believe

that economic improvement, such

as increases in home values, as well

as growth in our strong credit quality

national lending businesses and a

conservative underwriting philosophy

will help us achieve this goal.

• Further enhance enterprise risk

management. The investments made

in our enterprise risk management

program in 2013 are already paying

off. TCF’s new Chief Risk Officer is

making great strides in further

enhancing the program. Enterprise

risk management will continue to

be a company-wide priority.

• Maintain strong capital management.

We believe that maintaining a

strong capital position will ensure

that we are prepared for all market-

place situations and are able to

take advantage of marketplace

opportunities. We continue to

operate in excess of Basel III

capital requirements.

• Ensure strong and diverse sources

of liquidity. TCF’s funding sources

are diverse and include a large core

depositor base. Sufficient levels of

liquidity are also available, consisting

of cash held at the Federal Reserve

and unencumbered marketable

securities. While maintaining these

sources, TCF will continue to explore

additional avenues to add further

diversity, which will help to ensure

that TCF is prepared for future

growth opportunities.

• Emphasize good corporate

governance. Our customers and

stockholders entrust us with their

money and confidential information,

and therefore our management

practices demand high standards.

A reputation for honesty and

integrity continues to rank at the

top of our priorities.

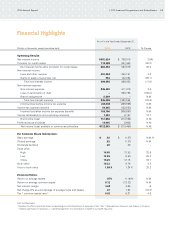

Non-accrual Loans

& Leases and Other

Real Estate Owned

Millions of Dollars

1312111009

$346

$402

$486

$433

$476

1312111009

Net Charge-offs

Percent

13

12111009

1.34%

1.47%

1.45%

1.54%

13

12111009

0.81%

2013 Annual Report // TCF Financial Corporation and Subsidiaries 11