TCF Bank 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

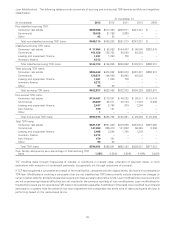

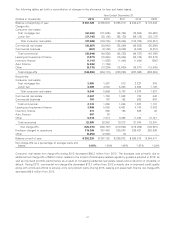

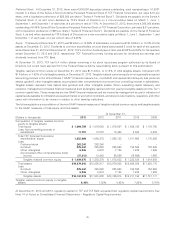

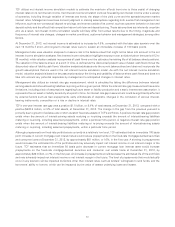

The following table is a reconciliation of the non-GAAP financial measure of Tier 1 common capital to the GAAP measure of Tier 1

risk-based capital.

At December 31,

(Dollars in thousands) 2013 2012

Computation of Tier 1 risk-based capital ratio:

Total Tier 1 capital $ 1,763,682 $ 1,633,336

Total risk-weighted assets 15,455,706 14,733,203

Total Tier 1 risk-based capital ratio 11.41% 11.09%

Computation of Tier 1 common capital ratio:

Total Tier 1 capital $ 1,763,682 $ 1,633,336

Less:

Preferred stock 263,240 263,240

Qualifying non-controlling interest in subsidiaries 11,791 13,270

Total Tier 1 common capital $ 1,488,651 $ 1,356,826

Total risk-weighted assets $15,455,706 $14,733,203

Total Tier 1 common capital ratio 9.63% 9.21%

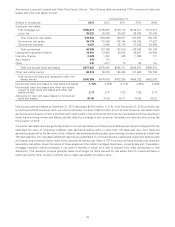

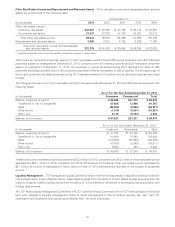

Total Tier 1 capital at December 31, 2013, was $1.8 billion, or 11.41% of risk-weighted assets, compared with $1.6 billion, or

11.09% of risk-weighted assets at December 31, 2012. Tier 1 common capital at December 31, 2013, was $1.5 billion, or 9.63%

of risk-weighted assets, compared with $1.4 billion, or 9.21% of risk-weighted assets at December 31, 2012. The increase in

Tier 1 risk-based capital ratio and Tier 1 common capital ratio from December 31, 2012 is due to retained earnings less dividends

supporting the asset growth of the organization.

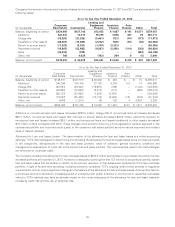

Critical Accounting Policies

Critical accounting estimates occur in certain accounting policies and procedures and are particularly susceptible to significant

change. Policies that contain critical accounting estimates include the determination of the allowance for loan and lease losses,

lease financings and income taxes. See Note 1 of Notes to Consolidated Financial Statements for further discussion of critical

accounting policies.

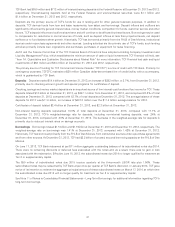

Recent Accounting Developments

On January 17, 2014, the Financial Accounting Standards Board (‘‘FASB’’) issued Accounting Standards Update (‘‘ASU’’)

No. 2014-04, Receivables – Troubled Debt Restructurings by Creditors (Subtopic 310-40): Reclassification of Residential Real

Estate Collateralized Consumer Loans upon Foreclosure, which clarifies when an in substance repossession or foreclosure

occurs and when a creditor is considered to have received physical possession of residential real estate property collateralizing a

consumer mortgage loan. The adoption of this ASU will be required, either on a modified retrospective basis or on a prospective

basis, beginning with TCF’s Quarterly Report on Form 10-Q for the quarter ending March 31, 2015. The adoption of this ASU is

not expected to have a material impact on TCF.

On January 15, 2014, the FASB issued ASU No. 2014-01, Investments – Equity Method and Joint Ventures (Topic 323):

Accounting for Investments in Qualified Affordable Housing Projects, which permits an accounting policy election to account for

investments in qualified affordable housing projects using the proportional amortization method if certain conditions are met. The

adoption of this ASU will be required on a retrospective basis beginning with TCF’s Quarterly Report on Form 10-Q for the quarter

ending March 31, 2015. The adoption of this ASU is not expected to have a material impact on TCF.

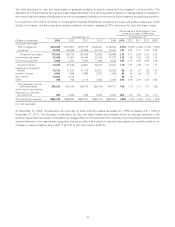

On July 18, 2013, the FASB issued ASU No. 2013-11, Presentation of an Unrecognized Tax Benefit When a Net Operating Loss

Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists, which addresses the financial statement presentation of an

unrecognized tax benefit, or a portion of an unrecognized tax benefit, as a reduction to a deferred tax asset for a net operating

loss carryforward, a similar tax loss, or a tax credit carryforward. The adoption of this ASU will be required on a prospective basis

beginning with TCF’s Quarterly Report on Form 10-Q for the quarter ending March 31, 2014. The adoption of this ASU is not

expected to have a material impact on TCF.

On July 17, 2013, the FASB issued ASU No. 2013-10, Derivatives and Hedging (Topic 815): Inclusion of the Fed Funds Effective

Swap Rate (or Overnight Index Swap Rate) as a Benchmark Interest Rate for Hedge Accounting Purposes (a consensus of the

FASB Emerging Issues Task Force), which permits an entity to designate the Fed Funds Effective Swap Rate, also referred to as

the overnight index swap rate, as a benchmark interest rate for hedge accounting purposes. In addition, this ASU removes the

46