TCF Bank 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

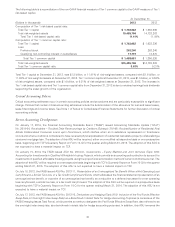

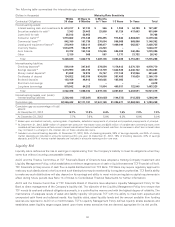

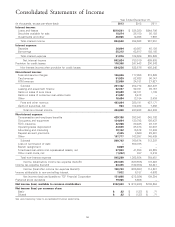

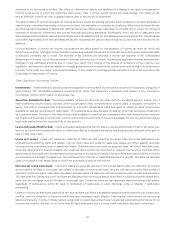

Consolidated Statements of Income

Year Ended December 31,

(In thousands, except per-share data) 2013 2012 2011

Interest income:

Loans and leases $819,501 $ 835,380 $844,796

Securities available for sale 18,074 35,150 85,188

Investments and other 26,965 14,093 7,967

Total interest income 864,540 884,623 937,951

Interest expense:

Deposits 36,604 40,987 45,108

Borrowings 25,312 63,617 193,155

Total interest expense 61,916 104,604 238,263

Net interest income 802,624 780,019 699,688

Provision for credit losses 118,368 247,443 200,843

Net interest income after provision for credit losses 684,256 532,576 498,845

Non-interest income:

Fees and service charges 166,606 177,953 219,363

Card revenue 51,920 52,638 96,147

ATM revenue 22,656 24,181 27,927

Subtotal 241,182 254,772 343,437

Leasing and equipment finance 92,037 92,721 89,167

Gains on sales of auto loans 29,699 22,101 1,133

Gains on sales of consumer real estate loans 21,692 5,413 –

Other 18,484 13,184 3,434

Fees and other revenue 403,094 388,191 437,171

Gains on securities, net 964 102,232 7,263

Total non-interest income 404,058 490,423 444,434

Non-interest expense:

Compensation and employee benefits 429,188 393,841 348,792

Occupancy and equipment 134,694 130,792 126,437

FDIC insurance 32,066 30,425 28,747

Operating lease depreciation 24,500 25,378 30,007

Advertising and marketing 19,132 16,572 10,034

Deposit account premiums 2,345 8,669 22,891

Other 167,777 163,897 145,489

Subtotal 809,702 769,574 712,397

Loss on termination of debt –550,735 –

Branch realignment 8,869 ––

Foreclosed real estate and repossessed assets, net 27,950 41,358 49,238

Other credit costs, net (1,252) 887 2,816

Total non-interest expense 845,269 1,362,554 764,451

Income (loss) before income tax expense (benefit) 243,045 (339,555) 178,828

Income tax expense (benefit) 84,345 (132,858) 64,441

Income (loss) after income tax expense (benefit) 158,700 (206,697) 114,387

Income attributable to non-controlling interest 7,032 6,187 4,993

Net income (loss) attributable to TCF Financial Corporation 151,668 (212,884) 109,394

Preferred stock dividends 19,065 5,606 –

Net income (loss) available to common stockholders $132,603 $ (218,490) $109,394

Net income (loss) per common share:

Basic $ .82 $ (1.37) $ .71

Diluted $ .82 $ (1.37) $ .71

See accompanying notes to consolidated financial statements.

56