TCF Bank 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

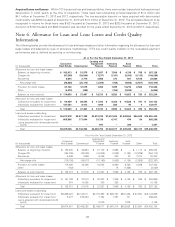

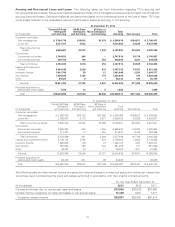

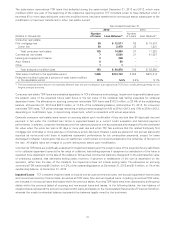

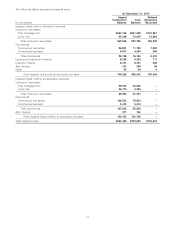

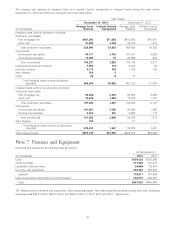

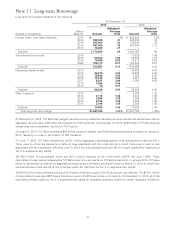

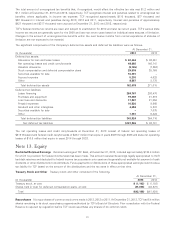

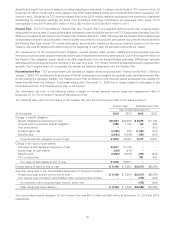

Note 11. Long-term Borrowings

Long-term borrowings consisted of the following.

At December 31,

2013 2012

Weighted- Weighted-

Stated Average Average

(Dollars in thousands) Maturity Amount Rate Amount Rate

Federal Home Loan Bank advances 2013 $– –%$ 680,000 .73%

2014 398,000 .37 448,000 .42

2015 200,000 .33 125,000 .44

2016 497,000 .76 297,000 1.12

2017 75,000 .21 ––

Subtotal 1,170,000 .52 1,550,000 .69

Subordinated bank notes 2014 ––71,020 1.96

2015 50,000 1.83 50,000 1.89

2016 74,868 5.59 74,810 5.59

2022 109,113 6.37 109,036 6.37

Subtotal 233,981 5.15 304,866 4.42

Discounted lease rentals 2013 ––30,985 4.97

2014 26,275 4.06 16,325 4.82

2015 18,866 3.96 8,240 4.79

2016 13,319 3.92 5,451 4.80

2017 8,281 3.69 2,885 4.62

2018 1,689 3.45 ––

2019 76 3.31 ––

Subtotal 68,506 3.94 63,886 4.88

Other long-term 2013 ––2,340 1.36

2014 2,718 1.36 2,474 1.36

2015 2,669 1.36 2,508 1.36

2016 2,705 1.36 2,542 1.36

2017 2,746 1.36 2,580 1.36

Subtotal 10,838 1.36 12,444 1.36

Total long-term borrowings $1,483,325 1.41% $1,931,196 1.42%

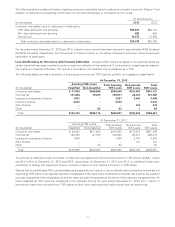

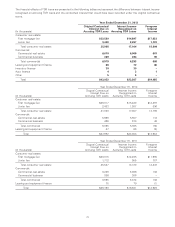

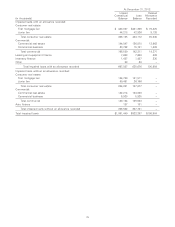

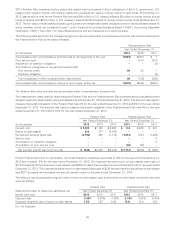

At December 31, 2013, TCF Bank had pledged loans secured by residential real estate and commercial real estate loans with an

aggregate carrying value of $5 billion as collateral for FHLB advances. At December 31, 2013, $350 million of FHLB advances

outstanding were prepayable monthly at TCF’s option.

On August 5, 2013, TCF Bank terminated $50 million long-term variable rate FHLB advances scheduled to mature on January 3,

2014, resulting in a loss on termination of $55 thousand.

On June 17, 2013, TCF Bank redeemed at par $71 million aggregate outstanding balance of its subordinated notes due 2014.

There were no remaining discounts or deferred fees associated with the notes and, as a result, there was no gain or loss

associated with the redemption. Effective June 15, 2013, the subordinated notes due 2014 no longer qualified for treatment as

Tier 2 or supplementary capital.

The $50 million of subordinated notes due 2015 re-price quarterly at the three-month LIBOR rate plus 1.56%. These

subordinated notes may be redeemed by TCF Bank at par once per quarter at TCF Bank’s discretion. In January 2014, TCF gave

notice of its intention to redeem the aggregate principal amount of these subordinated notes on March 17, 2014, at which time

the subordinated notes due 2015 will no longer qualify for treatment as Tier 2 or supplementary capital.

The $74.9 million of subordinated notes due 2016 have a fixed-rate coupon of 5.5% per annum until maturity. The $109.1 million

of subordinated notes due 2022 have a fixed-rate coupon of 6.25% per annum until maturity. At December 31, 2013, all of the

subordinated notes qualify as Tier 2 or supplementary capital for regulatory purposes, subject to certain regulatory limitations.

79