TCF Bank 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

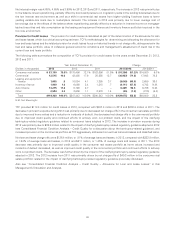

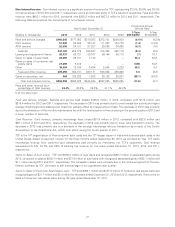

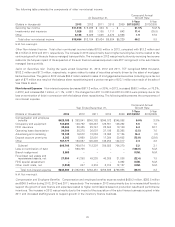

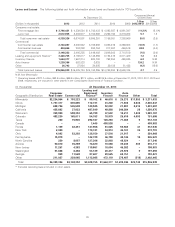

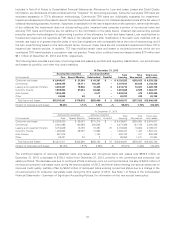

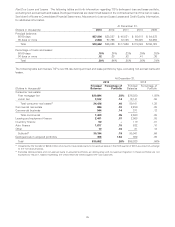

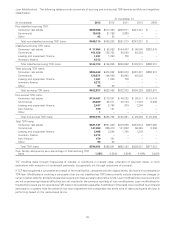

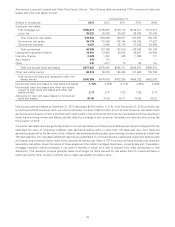

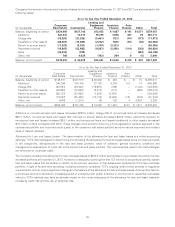

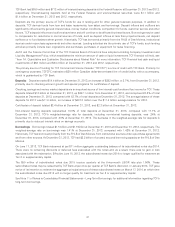

Loan Modifications The following tables provide a summary of accruing and non-accrual TDR loans by portfolio and regulatory

classification.

At December 31,

(In thousands) 2013 2012 2011 2010 2009

Non-classified accruing TDR:

Consumer real estate $469,586 $417,409 $288,671 $247,321 $ –

Commercial 19,435 21,755 2,639 – –

Other 93 38–––

Total non-classified accruing TDR loans $489,114 $439,202 $291,310 $247,321 $ –

Classified accruing TDR loans:

Consumer real estate $ 37,054 $ 60,853 $144,407 $ 90,080 $252,510

Commercial 101,436 122,753 95,809 48,838 –

Leasing and equipment finance 1,021 1,050 776 – –

Inventory finance 4,212 ––––

Total classified accruing TDR loans $143,723 $184,656 $240,992 $138,918 $252,510

Total accruing TDR loans:

Consumer real estate $506,640 $478,262 $433,078 $337,401 $252,510

Commercial 120,871 144,508 98,448 48,838 –

Leasing and equipment finance 1,021 1,050 776 – –

Inventory finance 4,212 ––––

Other 93 38–––

Total accruing TDR loans $632,837 $623,858 $532,302 $386,239 $252,510

Non-accrual TDR loans:

Consumer real estate $134,487 $173,587 $ 46,728 $ 30,511 $ 15,416

Commercial 26,209 92,311 83,154 17,487 9,586

Leasing and equipment finance 2,447 2,794 979 1,284 –

Auto finance 470 101 – – –

Other 1––––

Total non-accrual TDR loans $163,614 $268,793 $130,861 $ 49,282 $ 25,002

Total TDR loans:

Consumer real estate $641,127 $651,849 $479,806 $367,912 $267,926

Commercial 147,080 236,819 181,602 66,325 9,586

Leasing and equipment finance 3,468 3,844 1,755 1,284 –

Inventory finance 4,212 ––––

Auto finance 470 101 – – –

Other 94 38–––

Total TDR loans $796,451 $892,651 $663,163 $435,521 $277,512

Over 60-day delinquency as a percentage of total accruing TDR

loans 1.28% 4.34% 5.69% 4.64% 2.48%

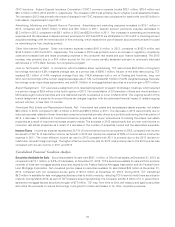

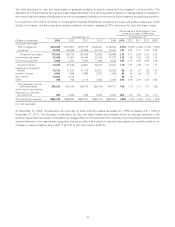

TCF modifies loans through forgiveness of interest or reductions in interest rates, extension of payment dates, or term

extensions with reduction of contractual payments, but generally not through reductions of principal.

If TCF has not granted a concession as a result of the modification, compared with the original terms, the loan is not considered a

TDR loan. Modifications involving a concession that are not classified as TDR loans primarily include interest rate changes to

current market rates for similarly situated borrowers who have access to alternative funds. Loan modifications to borrowers who

are not experiencing financial difficulties are not included in the previous reporting of loan modifications. Loan modifications to

troubled borrowers are not reported as TDR loans in the calendar years after modification if the loans were modified to an interest

rate equal to or greater than the yields of new loan originations with comparable risk at the time of restructuring and the loan is

performing based on the restructured terms.

36