TCF Bank 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

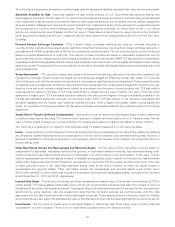

Upon origination of a derivative instrument, the contract is designated either as a hedge of a forecasted transaction or the

variability of cash flows to be paid related to a recognized asset or liability (‘‘cash flow hedge’’), a hedge of the volatility of an

investment in foreign operations driven by changes in foreign currency exchange rates (‘‘net investment hedge’’), or is not

designated as a hedge. To the extent that an instrument is designated as an effective hedge, changes in fair value are recorded

within accumulated other comprehensive income (loss), with any ineffectiveness recorded in non-interest expense. Amounts

recorded within other comprehensive income (loss) are subsequently reclassified to non-interest expense upon completion of

the related transaction. Changes in net investment hedges recorded within other comprehensive income (loss) are subsequently

reclassified to non-interest expense during the period in which the foreign investment is substantially liquidated or when other

elements of the currency translation adjustment are reclassified to income. If a hedged forecasted transaction is no longer

probable, hedge accounting is ceased and any gain or loss included in other comprehensive income (loss) is reported in earnings

immediately.

Cash Flow Hedges TCF uses forward foreign exchange contracts to manage the foreign exchange risk associated with certain

assets, liabilities and forecasted transactions. Forward foreign exchange contracts represent agreements to exchange a foreign

currency for U.S. dollars at an agreed-upon price and settlement date.

Net Investment Hedges Foreign exchange contracts, which include forward contracts, are used to manage the foreign

exchange risk associated with the Company’s net investment in TCF Commercial Finance Canada, Inc., a wholly-owned indirect

Canadian subsidiary of TCF Bank, along with certain assets, liabilities and forecasted transactions of that subsidiary.

Derivatives Not Designated as Hedges Derivatives not designated as hedges are not speculative and result from a service

TCF provides to certain customers. TCF executes interest rate swaps with commercial banking customers to facilitate their

respective risk management strategies. Those interest rate swaps are simultaneously hedged by offsetting interest rate swaps

that TCF executes with a third party, such that TCF minimizes its net risk exposure resulting from such transactions. As the

interest rate swaps associated with this program do not meet the strict hedge accounting requirements, change in the fair value

of both the customer swaps and the offsetting swaps are reflected in non-interest income. These contracts have fixed maturity

dates ranging from five to seven years.

During the second quarter of 2012, TCF sold its Visa Class B stock. In conjunction with the sale, TCF and the purchaser entered

into a derivative transaction whereby TCF may receive or be required to make cash payments whenever the conversion ratio of

the Visa Class B stock into Visa Class A stock is adjusted. The fair value of this derivative has been determined using estimated

future cash flows using probability weighted scenarios for multiple estimates of Visa’s aggregate exposure to covered litigation

matters, which include consideration of amounts funded by Visa into its escrow account for the covered litigation matters.

Changes in the valuation of this swap agreement, which has no determinable maturity date, are reflected in non-interest income.

Additionally, certain forward foreign exchange contracts used to manage foreign exchange risk are not designated as hedges.

Changes in the fair value of these foreign exchange contracts are reflected in non-interest expense.

The following tables summarize TCF’s outstanding derivative instruments as of December 31, 2013 and 2012. See Note 19, Fair

Value Measurement for additional information.

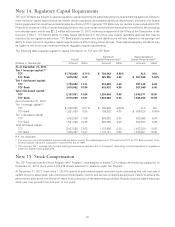

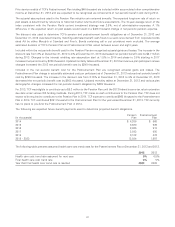

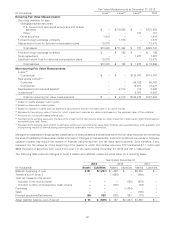

At December 31, 2013

Gross Amounts Offset in Net amount presented in

Notional Gross Amounts the Consolidated Statement the Consolidated Statement

(In thousands) Amount Recognized of Financial Condition of Financial Condition(1)

Forward foreign exchange

contracts not designated

as hedges $ 98,847 $ 151 $ (151) $ –

Swap agreements 13,500 131 – 131

Total derivative assets $ 282 $ (151) $131

Forward foreign exchange

contracts designated as

hedges $ 32,761 $ 87 $ – $ 87

Forward foreign exchange

contracts not designated

as hedges 363,475 834 – 834

Swap agreements 41,358 1,031 (1,031) –

Total derivative liabilities $1,952 $(1,031) $921

89