TCF Bank 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

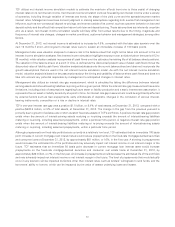

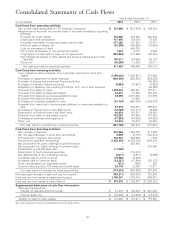

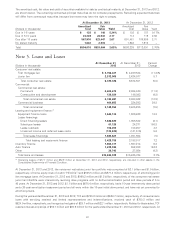

Consolidated Statements of Cash Flows

Year Ended December 31,

(In thousands) 2013 2012 2011

Cash flows from operating activities:

Net income (loss) attributable to TCF Financial Corporation $ 151,668 $ (212,884) $ 109,394

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Provision for credit losses 118,368 247,443 200,843

Depreciation and amortization 117,950 109,192 73,183

Proceeds from sales of loans and leases held for sale 277,180 161,221 40,571

Gains on sales of assets, net (61,265) (140,665) (16,465)

Loss on termination of debt –550,735 –

Net income attributable to non-controlling interest 7,032 6,187 4,993

Originations of loans held for sale, net of repayments (353,982) (171,420) (32,987)

Net increase (decrease) in other assets and accrued expenses and other

liabilities 190,371 (67,985) 92,176

Other, net (36,288) 14,839 28,011

Net cash provided by operating activities 411,034 496,663 499,719

Cash flows from investing activities:

Loan originations and purchases, net of principal collected on loans and

leases (1,196,030) (1,353,981) 812,988

Purchases of equipment for lease financing (904,383) (938,228) (894,593)

Purchase of leasing and equipment finance portfolios –– (68,848)

Purchase of inventory finance portfolios (9,658) (37,527) (5,905)

Acquisition of Gateway One Lending & Finance, LLC, net of cash acquired –– (94,323)

Proceeds from sales of loans 1,378,235 560,421 167,911

Proceeds from sales of lease receivables 43,215 78,805 122,819

Proceeds from sales of securities available for sale 46,096 2,074,494 181,696

Proceeds from sales of other securities –14,550 –

Purchases of securities available for sale (47,734) (645,880) (1,039,379)

Proceeds from maturities of and principal collected on securities available for

sale 91,416 202,431 586,816

Purchases of Federal Home Loan Bank stock (18,789) (157,517) (6,663)

Redemption of Federal Home Loan Bank stock 40,976 197,571 29,093

Proceeds from sales of real estate owned 102,250 132,044 107,428

Purchases of premises and equipment (37,859) (44,082) (34,865)

Other, net 30,476 40,418 34,334

Net cash (used in) provided by investing activities (481,789) 123,519 (101,491)

Cash flows from financing activities:

Net increase in deposits 370,356 1,848,782 617,992

Net increase (decrease) in short-term borrowings 2,299 (3,797) (120,374)

Proceeds from long-term borrowings 744,348 1,283,466 1,898

Payments on long-term borrowings (1,120,402) (4,164,102) (376,087)

Net proceeds from public offerings of preferred stock –263,240 –

Net proceeds from public offering of common stock –– 219,666

Redemption of subordinated debt (71,020) ––

Redemption of trust preferred securities –(115,010) –

Net distributions to non-controlling interest (8,511) (3,411) (2,999)

Dividends paid on preferred stock (19,065) (5,606) –

Dividends paid on common stock (32,227) (31,904) (30,772)

Stock compensation tax (expense) benefit (473) (659) 280

Common shares sold to TCF employee benefit plans 20,179 19,462 17,971

Net cash (used in) provided by financing activities (114,516) (909,539) 327,575

Net (decrease) increase in cash and due from banks (185,271) (289,357) 725,803

Cash and due from banks at beginning of period 1,100,347 1,389,704 663,901

Cash and due from banks at end of period $ 915,076 $ 1,100,347 $ 1,389,704

Supplemental disclosures of cash flow information:

Cash paid (received) for:

Interest on deposits and borrowings $ 61,453 $ 108,524 $ 231,353

Income taxes, net $ (28,456) $ (13,376) $ (12,012)

Transfer of loans to other assets $ 112,463 $ 137,311 $ 175,361

See accompanying notes to consolidated financial statements.

59