TCF Bank 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

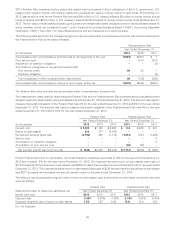

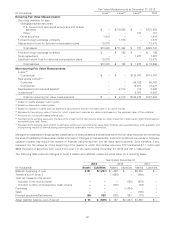

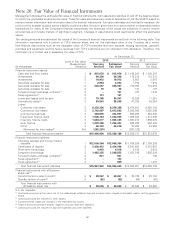

includes valuations that are based on prices obtained from independent pricing sources for the same instruments traded in active

markets; Level 2, which includes valuations that are based on prices obtained from independent pricing sources that are based

on observable transactions of similar instruments, but not quoted markets; and Level 3, for which valuations are generated from

Company model-based techniques that use significant unobservable inputs. Such unobservable inputs reflect estimates of

assumptions that market participants would use in pricing the asset or liability.

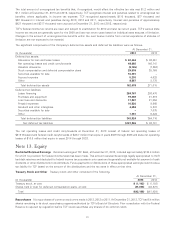

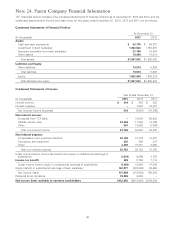

The following tables present the balances of assets and liabilities measured at fair value on a recurring and non-recurring basis.

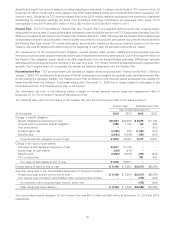

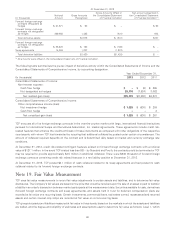

Fair Value Measurements at December 31, 2013

(In thousands) Level(1) Level(2) Level(3) Total

Recurring Fair Value Measurements:

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises and federal

agencies $ – $548,037 $ – $548,037

Other – – 93 93

Other securities 2,934 – – 2,934

Forward foreign exchange contracts – 151 – 151

Swap agreements – 131 – 131

Assets held in trust for deferred compensation plans 16,724 – – 16,724

Total assets $19,658 $548,319 $ 93 $568,070

Forward foreign exchange contracts $ – $ 921 $ – $ 921

Swap agreements – 132 899 1,031

Liabilities held in trust for deferred compensation plans 16,724 – – 16,724

Total liabilities $16,724 $ 1,053 $ 899 $ 18,676

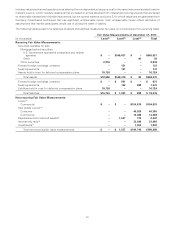

Non-recurring Fair Value Measurements:

Loans:(4)

Commercial $ – $ – $104,576 $104,576

Real estate owned:(5)

Consumer – – 40,355 40,355

Commercial – – 14,088 14,088

Repossessed and returned assets(5) – 1,537 730 2,267

Interest-only strip(6) – – 33,098 33,098

Investments(7) – – 1,902 1,902

Total non-recurring fair value measurements $ – $ 1,537 $194,749 $196,286

91