Radio Shack 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 5

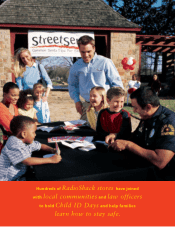

Our new store prototype is another opportunity to drive value in 2004.We

ended 2003 with 232 prototype stores.These stores have superior sight lines

with more contemporary colors and signs.There is also an attractive point of sale

in the middle of the store that brings product out from behind glass counters

and instead displays them within easy reach of our customers. Checkout is

convenient and customers are drawn further into the store. Research suggests

that customers find the new format neater and are more willing to return to

it versus the older format. Customers even perceive a greater selection and

value in the new format, despite the reality that the products and prices are

no different from any other store.

While these soft improvements have yet to translate into a consistently satisfactory financial performance, the financial

results do suggest it is worthwhile to launch more new format stores at a rate consistent with our normal commitment to

store capital expenditures. In 2004, we anticipate the rollout of at least another 300 new format stores. And having consolidated

our fixtures unit, we may see incremental financial improvement by outsourcing production of the new format fixtures.

In 2004, we anticipate a significant opportunity to drive sales productivity. Having terminated our exclusive agreement with

RCA, vast options are now opened up to drive sales from the space formerly dedicated solely to RCA products.This year for

each store, we expect to do nearly equal sales of home entertainment products in about 14 linear feet of space versus the

22 linear feet of space dedicated to home entertainment in 2003. This will be possible by carrying new products with superior

brands in the smaller space.The remaining eight feet will be used to drive one or more of our 2004 priority merchandising

categories which include power, gifts and toys, and wellness, among others.

Our new product development, or technology innovation phase of our growth, will begin to make modest contributions

to sales and earnings growth this year. Our plan is for benefits to become material in late 2005 or beyond.The focus for now

is to be actively engaged with entities worldwide at the cutting edge of technology development to source and sell new

products in our core areas of strength, such as power and communications.

All new stores will now be based on our contemporary,

new format design.

Innovation comes in all shapes and forms, including a cordless

soldering iron with a unique tip that’s cool to the touch in less

than a second after being hot enough to melt metal alloys.

S&P 500 RSH

29%

65%

2003 Total

Shareholder

Return