Radio Shack 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 51

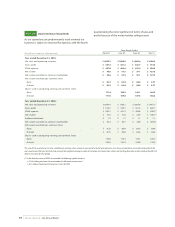

Restricted Stock: We may also use restricted stock grants to

compensate certain of our employees. As of December 31,

2003, no shares of restricted stock were outstanding.

Compensation expense related to restricted shares is

recognized ratably over the related service period.This

expense totaled $0.7 million for the year ended December 31,

2001. There was no expense for the years ended

December 31, 2003 and 2002.

In 1998, the Committee granted a total of 172,000 shares of

restricted stock awards to three executive officers. Of

these awards, 100,000 shares vested ratably over three years

and were fully vested in 2001.The remaining 72,000 shares

vested in 1999. In 1999, the Committee granted 10,000

shares of restricted stock awards to two executive officers.

These awards were to vest ratably over three years; 4,000 of

these awards were canceled in 2000. At December 31, 2001,

all of the 1999 shares granted had either vested or been

canceled.In 2000, the Committee granted a total of 66,712

shares of restricted stock awards to 38 executive officers

and these awards vested ratably over three years, subject to

the achievement of certain performance targets each year.

At December 31, 2003, none of these shares granted in 2000

remained outstanding.No restricted awards were granted in

2001, 2002 or 2003.

Note 19 Deferred Compensation Plans

The Executive Deferred Compensation Plan and the Executive

Deferred Stock Plan (“Compensation Plans”) became

effective on April 1, 1998.These plans permit employees

who are corporate or division officers to defer up to 80% of

their base salary and/or bonuses. Certain executive officers

may defer up to 100% of their base salary and/or bonuses.

In addition, officers are permitted to defer delivery of any

restricted stock or stock acquired under an NQ exercise that

would otherwise vest. Cash deferrals may be made in our

common stock or mutual funds; however, restricted stock

deferrals and deferrals of stock acquired under an NQ exer-

cise may only be made in our common stock.We match

12% of salary and bonus deferrals in the form of our

common stock.We will match an additional 25% of salary

and bonus deferrals if the deferral period exceeds five years

and the deferrals are invested in our common stock.

Payment of deferrals will be made in cash or our common

stock in accordance with the employee’s specifications

at the time of the deferral; payments to the employee will

be in a lump sum or in annual installments not to exceed

20 years.

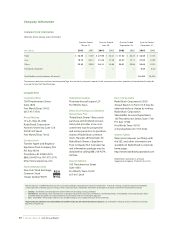

We contributed $0.4 million, $0.5 million and $1.4 million to

the Compensation Plans for the years ended December 31,

2003, 2002 and 2001, respectively.

Note 20 Termination Protection Plans

In August 1990 and in May 1995, our Board of Directors

approved termination protection plans and amendments

to the termination protection plans, respectively.These

plans provide for defined termination benefits to be paid to

our eligible employees who have been terminated, with-

out cause, following a change in control of our company. In

addition, for a certain period of time following an

employee’s termination, we, at our expense, must continue

to provide on behalf of the terminated employee certain

employment benefits. In general, during the twelve months

following a change in control, we may not terminate or

change existing employee benefit plans in any way which

would affect accrued benefits or decrease the rate of our

contribution to the plans.There have been no payments

under these protection plans for the years shown.

Note 21 Company Stock Purchase Plan

Eligible employees may contribute 1% to 7% of their

annual compensation to purchase our common stock at

the monthly average daily closing price.We match 40%,

60% or 80% of the employee’s contribution, depending on

the employee’s length of continuous participation in the

Stock Purchase Plan. This match is also in the form of our

common stock. Company contributions to the Stock Plan

amounted to $15.4 million, $15.1 million and $15.4 million

for the years ended December 31, 2003, 2002 and 2001,

respectively.

Note 22 RadioShack 401(k) Plan

The RadioShack 401(k) Plan (“Plan”) is a defined contri-

bution plan. Eligible employees may direct their contributions

into various investment options, including investing

in our common stock. Participants may defer, via payroll

deductions, 1% to 8% of their annual compensation.

Contributions per participant are limited to certain annual

maximums permitted by the Internal Revenue Code. Any

contributions made by us are discretionary and, if made, go