Radio Shack 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 25

Future payments under the tax sharing agreement will vary

based on the level of O’Sullivan’s future earnings and are

also dependent on O’Sullivan’s overall financial condition

and ability to pay.There can be no assurances that future

payments will be received under the tax sharing agreement

each quarter, nor can we give any assurances as to the

amount of payment that may be received each quarter.

Provision for Income Taxes

Our provision for income taxes reflects an effective income

tax rate of 36.9% for 2003 and 38.0% for 2002.The decrease

in the effective tax rate for 2003, when compared to 2002,

was the result of a favorable tax settlement related to prior

year tax matters.We anticipate that the effective tax rate for

2004 will be approximately 38.0%.

2002 COMPARED WITH 2001

Net Sales and Operating Revenues

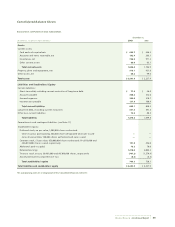

Sales decreased approximately 4.2% to $4,577.2 million in

2002 from $4,775.7 million in 2001.This decrease was pri-

marily the result of a 38.7% decline in sales to our

dealer/franchise outlets in 2002, mainly due to the decline

in DTH unit sales. In addition, we also had a 1% decrease in

comparable company store sales due primarily to the

decline of DTH unit sales and desktop computers, but offset

by sales increases in wireless handsets and related acces-

sories. Retail support operations, service plans and other

sales decreased 26.2% from 2001 to 2002 primarily as a

result of a $19.1 million decrease in 2002 domestic manu-

facturing sales due to large Verizon fixture sales in 2001

and a $15.2 million decrease in RSIS sales as a result of our

exit from the national commercial installation business at

the end of 2001. Sales in the wireless communication

department increased 9.4% in dollars and increased to

31.1% of our total sales in 2002 from 27.2% in 2001.This

sales increase was due to an increase in sales of wireless

handsets and accessories which resulted from our empha-

sis on national carrier offerings with desirable product

features and content, such as color screens, photo capabil-

ity and Internet access. Sales in the wired communication

department decreased 1.0% in dollars and increased

slightly as a percentage of our total sales to 8.3% in 2002

from 8.0% in 2001. Increased sales of cordless telephones

were more than offset by decreased sales of corded tele-

phones. Sales in the radio communication department

decreased 8.7% in dollars and decreased slightly as a per-

centage of our total sales to 2.6% in 2002 from 2.8% in

2001.The decrease in this department was primarily the

result of a decrease in Family Radio Service (“FRS”) and CB

radio sales, scanner sales and communication accessories,

partially offset by a sales increase in GPS devices. Sales in

the home entertainment department decreased 23.7% in

dollars and decreased as a percentage of our total sales to

18.7% in 2002 from 23.5% in 2001. Substantially all of the

dollar decrease was attributable to a decrease in sales of

satellite dishes and related installations.This decrease was

partially offset by increased sales of DVD players. Sales in

the computer department decreased 0.9% in dollars and

increased as a percentage of our total sales to 10.0% in

2002 from 9.6% in 2001.These sales dollars were maintained

primarily due to an increase in laptop computers, computer

accessories and digital camera sales, offset by a decline in

unit sales of desktop CPUs and monitors.Sales in the power

and technical department increased 0.8% in dollars and

also as a percentage of our total sales to 13.6% in 2002

from 13.0% in 2001.These increases were primarily due to

increased sales of general and special purpose batteries,

partially offset by decreased sales of bulk and packaged

wire and technical parts. Sales in the personal electronics,

toys and personal audio department increased 2.6% in

dollars, as well as increasing as a percentage of our total

sales to 12.6% in 2002 from 11.8% in 2001, due primarily to

increased sales of micro radio-controlled cars and related

accessories, in addition to unique giftables.

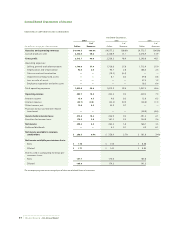

Gross Profit

Gross profit in 2002 was $2,238.3 million or 48.9% of net

sales and operating revenues, compared with $2,296.8 mil-

lion or 48.1% of net sales and operating revenues in 2001.

Gross profit decreased $58.5 million or 2.5% in 2002, prima-

rily as a result of a 4.2% decrease in net sales and operating

revenues.Despite this decrease in gross profit dollars, the

gross profit percentage increased from 48.1% to 48.9% in

2002, due primarily to an increase in the gross profit per-

centage in the home entertainment department and, to a

lesser extent, increases in both the power and technical

and computer departments’ gross profit percentages. Our

gross profit percentage increase was partially offset by

reductions in both the wireless and wired departments’

gross profit percentages, compounded by the increase in

the wireless communication department’s percent of total

retail sales.The reduction in gross profit dollars was par-

tially offset by a decrease in the total sales mix attributable

to the home entertainment department, which has a lower

gross profit percentage than our overall average gross

profit percentage, as well as an increase in gross profit dollars