Radio Shack 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 39

services pursuant to the contracts exceeds the related

unearned revenue.

Vendor Allowances: We receive allowances from third-party

service providers and product vendors through a variety

of promotional programs and arrangements as a result of

purchasing and promoting their products and services in the

normal course of business.We consider vendor allowances

received to be a reduction in the price of a vendor’s products

or services and record them as a component of cost of

products sold when the related product or service is sold,

unless the allowances represent reimbursement of specific,

incremental and identifiable costs incurred to promote a

vendor’s products and services, in which case we record them

when earned as an offset to the associated expense

incurred to promote the applicable products and/or services.

Advertising Costs: Our advertising costs are expensed the

first time the advertising takes place.We receive allowances

from certain third-party service providers and product ven-

dors which we record when earned as an offset to

advertising expense incurred to promote the applicable

products and/or services only if the allowances represent

reimbursement of specific, incremental and identifiable

costs (see “Vendor Allowances”above). Advertising expense

was $254.4 million, $241.0 million and $253.9 million for

the years ended December 31, 2003, 2002 and 2001 respec-

tively, net of vendor allowances of $40.9 million, $59.6

million and $53.1 million, respectively.

Stock-Based Compensation: At December 31, 2003, we had

stock-based employee compensation plans.We measure

stock-based compensation costs under Accounting

Principles Board (“APB”) Opinion No. 25,“Accounting for

Stock Issued to Employees”and its related interpretations.

Accordingly, no compensation expense has been recog-

nized for our fixed price stock option plans, as the exercise

price of options must be equal to or greater than the stock

price on the date of grant under our incentive stock plans.

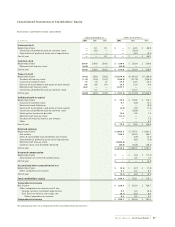

The table below illustrates the effect on net income and

net income available per common share as if we had

accounted for our employee stock options under the fair

value recognition provisions of SFAS No. 123,“Accounting

for Stock-Based Compensation.” For purposes of the pro

forma disclosures below, the estimated fair value of the

options is amortized to expense over the vesting period.

Year Ended December 31,

(In millions, except per share amounts) 2003 2002 2001

Net income, as reported $298.5 $263.4 $166.7

Stock-based employee compensation

expense included in reported net

income, net of related tax effects 14.2 14.0 15.2

Total stock-based compensation

expense determined under fair

value method for all awards, net

of related tax effects (51.1) (60.5) (60.0)

Pro forma net income $261.6 $216.9 $121.9

Net income available per common share:

Basic – as reported $ 1.78 $ 1.50 $ 0.88

Basic – pro forma $ 1.56 $ 1.23 $ 0.64

Diluted – as reported $ 1.77 $ 1.45 $ 0.85

Diluted – pro forma $ 1.55 $ 1.19 $ 0.62

The pro forma amounts in the preceding table were esti-

mated using the Black-Scholes option-pricing model with

the following weighted average assumptions:

Year Ended December 31,

2003 2002 2001

Expected life in years 666

Expected volatility 48.3% 46.1% 42.3%

Annual dividend paid per share $ 0.25 $ 0.22 $ 0.22

Risk free interest rate 3.1% 4.5% 4.9%

Fair value of options granted during year $ 9.63 $13.53 $15.64

Impairment of Long-Lived Assets: Long-lived assets (primarily

property, plant and equipment and goodwill) held and

used by us or to be disposed of are reviewed for impairment

whenever events or changes in circumstances indicate

that the net book value of the asset may not be recoverable.

An impairment loss is recognized if the sum of the

expected future cash flows (undiscounted and before inter-

est) from the use of the asset is less than the net book

value of the asset.The amount of the impairment loss is

measured as the difference between the net book value of

the assets and the estimated fair value of the related assets.

Income Taxes: Income taxes are accounted for using the

asset and liability method. Deferred taxes are recognized

for the tax consequences of “temporary differences”by

applying enacted statutory tax rates applicable to future

years to differences between the financial statement carry-

ing amounts and the tax basis of existing assets and

liabilities.The effect on deferred taxes of a change in tax

rates is recognized in income in the period that includes

the enactment date. In addition, we recognize future tax

benefits to the extent that such benefits are more likely

than not to be realized.