Radio Shack 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report

30

under this shelf registration. In August 1997, we issued

$150.0 million of 10-year unsecured long-term notes under

this shelf registration.The interest rate on the notes is

6.95% per annum with interest payable on September 1

and March 1 of each year, commencing March 1, 1998.

These notes are due September 1, 2007.

We also issued, in various amounts and on various dates

from December 1997 through September 1999, medium-

term notes totaling $150.0 million under the shelf

registration. At December 31, 2003, $44.5 million of these

notes remained outstanding.The interest rates at

December 31, 2003, for the outstanding $44.5 million

medium-term notes ranged from 6.42% to 7.35% and had a

weighted average coupon rate of 7.19%.These notes have

maturities ranging from 2004 to 2008.

On May 11, 2001, we issued $350.0 million of 10-year 7 3/8%

notes in a private offering to initial purchasers who offered

the notes to qualified institutional buyers under SEC Rule

144A.The annual interest rate on the notes is 7.375% per

annum with interest payable on November 15 and May 15

of each year. Payment of interest on the notes commenced

on November 15, 2001, and the notes mature on May 15,

2011. In August 2001, under the terms of an exchange offer-

ing filed with the SEC, we exchanged substantially all of

these notes for a similar amount of publicly registered

notes. Because no additional debt was issued in the

exchange offering, the net effect of this exchange was that

no additional debt was issued on August 3, 2001, and sub-

stantially all of the notes are now registered with the SEC.

During the third quarter of 2001, we entered into several

interest rate swap agreements with notional amounts total-

ing $150.0 million and maturities ranging from 2004 to

2007. In June and August 2003, we entered into additional

interest rate swap agreements with underlying notional

amounts of debt of $100.0 million and $50.0 million,

respectively, with maturities in May 2011.We entered into

these agreements to effectively convert a portion of our

long-term fixed rate debt to a variable rate. Under these

agreements, we have contracted to pay a variable rate of

LIBOR plus a markup and to receive fixed rates ranging

from 6.950% to 7.375%.We have designated these agree-

ments as fair value hedging instruments. At December 31,

2003, we recorded an amount in other assets, net, of $4.5

million (its fair value) for the swap agreements and

adjusted the fair value of the related debt by the same

amount.The effect of these agreements was a reduction in

our interest expense of $7.8 million during 2003, when

compared to the fixed rates. At current interest rates, we

expect this favorable condition to reoccur in 2004.

presentation of free cash flow, a non-GAAP financial measure,

to be considered in isolation or as a substitute for measures

prepared in accordance with GAAP.

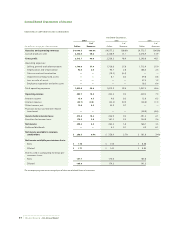

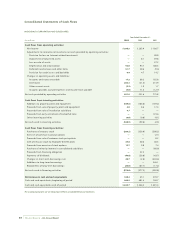

The following table is a reconciliation of cash flows from

operating activities to free cash flow.

Year Ended December 31,

(In millions) 2003 2002 2001

Net cash provided by operating

activities $651.9 $ 521.6 $775.8

Less:

Additions to property, plant

and equipment 189.6 106.8 139.2

Dividends paid 40.8 39.8 43.7

Free cash flow $421.5 $375.0 $592.9

Capital Structure and Financial Condition

Management considers our financial structure and condition

solid. At December 31, 2003, total capitalization was

$1,388.0 million, consisting of $618.7 million of debt and

$769.3 million of equity, which resulted in a debt-to-total

capitalization ratio of 44.6%, compared to 46.3% for the

corresponding prior year period.The ratio decreased from

the prior year due to a smaller increase in debt of $8.6 mil-

lion, compared to a larger increase in equity of $41.2 million

from 2002.

Long-term debt as a percentage of total capitalization was

39.0% at December 31, 2003, compared to 43.6% at

December 31, 2002, and 39.0% at December 31, 2001.The

decrease in 2003 was due to the decrease in long-term

debt, as some of the notes moved to the short-term debt

classification as current maturities.

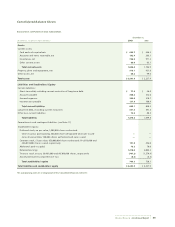

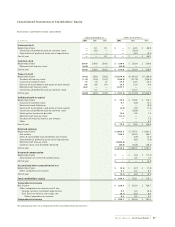

Our debt is considered investment grade by the rating

agencies. On May 20, 2003, Fitch changed our senior unse-

cured debt from “A-“ to “BBB+.” Below are the agencies’

latest ratings by category.

Standard

Category Moody’s and Poor’s Fitch

Senior unsecured debt Baa1 A- BBB+

Commercial paper P-2 A-2 F2

Our senior unsecured debt primarily consists of two

issuances of 10-year long-term notes and an issuance of

medium-term notes.

We have a $300.0 million debt shelf registration statement

which became effective in August 1997. As of December

31, 2003, there was no availability for further debt issuances