Radio Shack 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The termination of this agreement took effect at the start

of the fourth quarter of 2002, upon satisfaction of several

contractual obligations.The net financial result was an

$18.5 million gain (principally cash received), driven prima-

rily by the settlement of a multi-year obligation Microsoft

had to connect our stores with broadband capabilities.

Note 13 Internet-Related Investment

During the second quarter of 2000, we made a $30.0 million

cash investment in Digital:Convergence Corporation

(“DC”), a privately-held Internet technology company. In the

first quarter of 2001, we believed that our investment had

experienced a decline in value that, in our opinion, was

other than temporary. This belief was due to DC’s inability

to secure financing at that time, as well as its commence-

ment of restructuring activities involving the termination of

much of its workforce and the curtailing of its business

activities. As such, we recorded a loss provision equal to our

initial investment. DC subsequently filed for bankruptcy on

March 22, 2002.

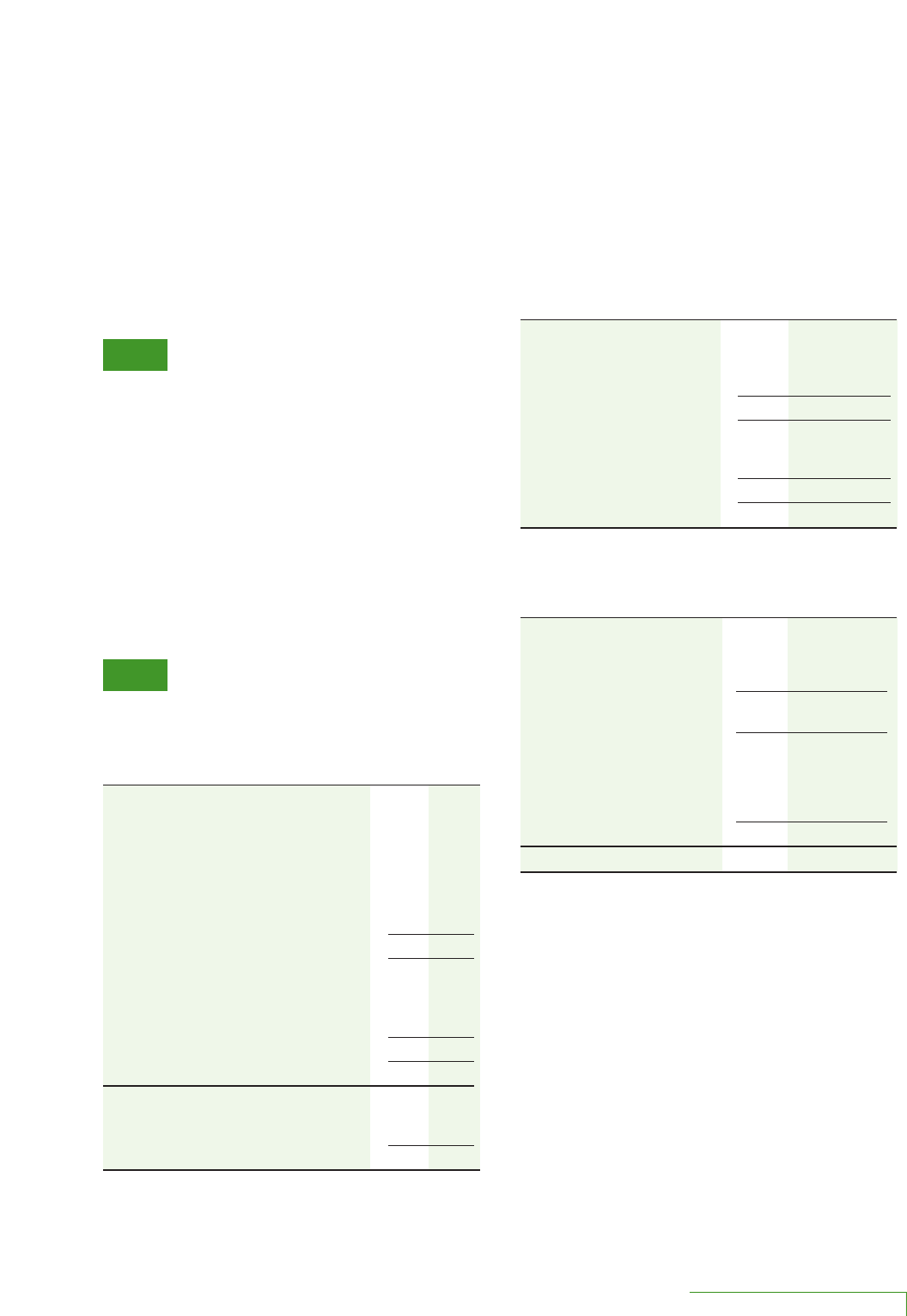

Note 14 Income Taxes

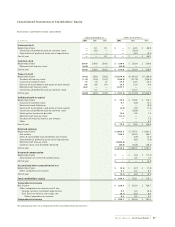

Deferred tax assets and liabilities as of December 31, 2003

and 2002, were comprised of the following:

December 31,

(In millions) 2003 2002

Deferred tax assets

Insurance reserves $22.4 $ 22.8

Depreciation and amortization —12.5

Deferred compensation 23.8 18.7

Inventory adjustments, net 6.5 0.3

Restructuring reserves 6.5 6.2

Bad debt reserve 1.6 2.8

Other 29.0 44.9

Total deferred tax assets 89.8 108.2

Deferred tax liabilities

Deferred taxes on foreign operations 14.5 11.0

Depreciation and amortization 10.3 —

Other 3.1 3.7

Total deferred tax liabilities 27.9 14.7

Net deferred tax asset $61.9 $ 93.5

The net deferred tax asset is classified as follows:

Other current assets $39.7 $ 41.3

Non-current assets 22.2 52.2

Net deferred tax asset $61.9 $ 93.5

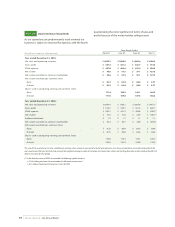

The components of the provision for income taxes and a

reconciliation of the U.S. statutory tax rate to our effective

income tax rate are given in the two accompanying tables.

INCOME TAX EXPENSE

Year Ended December 31,

(In millions) 2003 2002 2001

Current

Federal $117.5 $127.3 $137.3

State 21.9 13.3 18.2

Foreign 3.3 3.3 2.9

142.7 143.9 158.4

Deferred

Federal 33.5 17.5 (26.0)

State (1.9) 0.1 (7.6)

31.6 17.6 (33.6)

Provision for income taxes $174.3 $161.5 $124.8

STATUTORY VS. EFFECTIVE TAX RATE

Year Ended December 31,

(In millions) 2003 2002 2001

Components of income from

continuing operations:

United States $456.5 $408.8 $272.1

Foreign 16.3 16.1 19.4

Income before income taxes 472.8 424.9 291.5

Statutory tax rate x35.0% x35.0% x35.0%

Federal income tax expense at

statutory rate 165.5 148.7 102.0

State income taxes, net of federal benefit 13.0 8.7 6.9

Non-deductible goodwill —2.8 13.8

Other, net (4.2) 1.3 2.1

Total income tax expense $174.3 $161.5 $124.8

Effective tax rate 36.9% 38.0% 42.8%

We anticipate that we will generate sufficient pre-tax income

in the future to realize the full benefit of U.S.deferred tax

assets related to future deductible amounts.Accordingly, a

valuation allowance was not required at December 31, 2003

or 2002. Our tax returns are subject to examination by taxing

authorities in various jurisdictions.The Internal Revenue

Service is currently in the process of concluding its examina-

tion of our federal income tax returns for the taxable years

from 1993 through 2001. Several states are also currently in

the process of examining our state income tax returns.We

record tax reserves based on our best estimate of current tax

exposures in the relevant jurisdictions. While we believe

that the reserves recorded in the consolidated financial

statements accurately reflect our tax exposures, our actual

RADIOSHACK 2003 Annual Report 47

Provision for Loss on