Radio Shack 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 31

We have short-term debt such as commercial paper

issuances and uncommitted bank loans available to supple-

ment our short-term financing needs.The commercial

paper and short-term seasonal bank debt have a typical

maturity of 90 days or less.The amount of commercial

paper that can be outstanding is limited to a maximum of

the unused portion of our $600 million bank syndicated

revolving credit facility described in more detail below.

In the second quarter of 2003, we replaced our existing

$300.0 million 364-day revolving credit facility and

amended our $300.0 million five-year credit facility. These

facilities’maturity dates are June 2004 for the $300.0 mil-

lion 364-day revolving credit facility and June 2007 for the

$300.0 million five-year revolving credit facility.The terms

of these revolving credit facilities are substantially similar to

the previous facilities.These revolving credit facilities will

support any future commercial paper borrowings and are

otherwise available for our general corporate purposes.We

anticipate replacing our 364-day revolving credit facility in

June 2004 with a new 364-day credit facility with similar

terms. As of December 31, 2003, there were no outstanding

borrowings under these credit facilities. Our outstanding

debt and bank syndicated credit facilities have customary

financial covenants.

We use operating leases, primarily for our retail locations,

distribution centers and corporate headquarters, to lower

our capital requirements.

Management believes that our present ability to borrow is

greater than our established credit lines and long-term

debt in place. However, if market conditions change and

sales were to dramatically decline or we could not control

operating costs, our cash flows and liquidity could be

reduced. Additionally, if a scenario as described above

occurred, it could cause the rating agencies to lower our

credit ratings, thereby increasing our borrowing costs, or

even causing a reduction in or elimination of our access to

debt and/or equity markets.

We repurchased 9.9 million shares of our common stock for

$251.0 million during the year ended December 31, 2003,

under our combined share repurchase programs.

We intend to execute share repurchases from time to time

in order to take advantage of attractive share price levels, as

determined by management.The timing and terms of the

transactions depend on market conditions, our liquidity

and other considerations. On February 20, 2003, our Board

of Directors authorized a new repurchase program for 15.0

million shares, which was in addition to our 25.0 million

share repurchase program that was completed during the

second quarter of 2003. At February 18, 2004, there were

8.9 million shares available to be repurchased under the

15.0 million share repurchase program. We anticipate that

we will repurchase, under our authorized repurchase pro-

grams, between $200.0 million and $250.0 million of our

common stock during 2004.The 15.0 million share repur-

chase program has no expiration date and allows shares

to be repurchased in the open market.The funding required

for these share repurchase programs will come from cash

generated from net sales and operating revenues and cash

and cash equivalents.Under the programs described

above, we will also repurchase shares in the open market to

offset the sales of shares to our employee benefit plans.

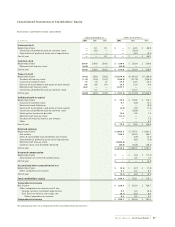

On December 11, 2003, our Board of Directors approved

the retirement of 45.0 million shares of our common stock

held as treasury stock.These shares returned to the status

of authorized and unissued. See our 2003 Consolidated

Statement of Stockholders’Equity for additional details of

this transaction.

On October 10, 2002, our Board of Directors approved the

conversion of our RadioShack Series B convertible preferred

stock, held by the RadioShack 401(k) Plan, to RadioShack

common stock effective December 31, 2002. On December

31, 2002, 0.1 million shares of this preferred stock, repre-

senting all the outstanding Series B convertible preferred

stock, were converted to 5.1 million shares of our common

stock in accordance with their terms.The preferred stock

was held by the RadioShack 401(k) Plan to fund RadioShack

contributions to plan participants.

In the fourth quarter of 2001 and the second quarter of

2002, we sold our corporate headquarters buildings.We are

now constructing a new headquarters in Fort Worth, Texas.

We entered into sale-leaseback agreements in which our

existing corporate headquarters’land and buildings were

sold and leased back to us.These arrangements should

provide us with the necessary time to construct our new

headquarters, which we expect to be completed by the

end of 2004 or early 2005. Currently, we plan to finance our

new corporate headquarters,with total construction costs

estimated to be $200.0 million during 2003 and 2004, with

cash flows from operations and, if needed, existing cash

and cash equivalents.

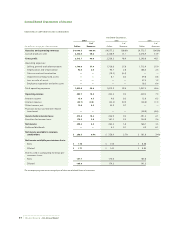

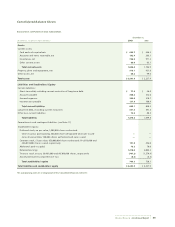

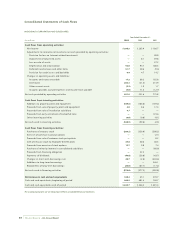

The following tables, as well as the information contained in

Note 7 - “Indebtedness and Borrowing Facilities”to our

“Notes to Consolidated Financial Statements,”provide a

summary of our various contractual commitments, debt and

interest repayment requirements, and available credit lines.