Radio Shack 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report

52

to Plan participants, compensation expense was recorded

and unearned compensation was reduced. Interest expense

on the Refinanced Notes was also recognized as a cost of

the Plan.The compensation component of the Plan

expense was reduced by the amount of dividends accrued

on the TESOP Preferred Stock, with any dividends in excess

of the compensation expense reflected as a reduction of

interest expense.

Contributions made by us to the Plan for the years ended

December 31, 2002 and 2001, totaled $4.0 million and

$8.6 million, respectively, including dividends paid on the

TESOP Preferred Stock of $4.5 million and $4.9 million,

respectively.

As of December 31, 2002, all of the original 100,000 shares

of TESOP Preferred Stock were converted into 5.1 million

shares of our common stock and allocated to participants’

accounts in the Plan.

Note 23 Treasury Stock Repurchase Program

On February 20, 2003, our Board of Directors authorized a

new repurchase program for 15.0 million shares, which was

in addition to our 25.0 million share repurchase program

that was completed during the second quarter of 2003.The

15.0 million share repurchase program has no expiration

date and allows shares to be repurchased in the open

market.We repurchased 9.9 million shares of our common

stock for $251.0 million for the year ended December 31,

2003, under our combined 40.0 million share repurchase

programs.The funding required for these share repurchase

programs will come from cash generated from net sales

and operating revenues and cash and cash equivalents.

Under our programs described above, we will also repur-

chase shares in the open market to offset the sales of

shares to our employee benefit plans. At February 20, 2004,

there were 8.9 million shares available to be repurchased

under the 15.0 million share repurchase program.

The purchases under the share repurchase program

described above are in addition to the shares required for

employee benefit plans, which are repurchased from our

treasury stock throughout the year.

directly to the Plan for investment in our common stock.

Effective April 1, 2002, a participant becomes fully vested in

the Plan contributions we made on his on her behalf on the

third anniversary of the participant’s employment date.

At January 1, 2004, the Plan year was changed to a calendar

year basis.

TESOP Portion of the Plan: On July 31, 1990, the trustee of the

Plan borrowed $100.0 million at an interest rate of 9.34%;

this amount was paid off on June 30, 2000 (“TESOP Notes”).

The Plan trustee used the proceeds from the 1990 issuance

of the TESOP Notes to purchase from us 100,000 shares

of TESOP Preferred Stock at a price of $1,000 per share. In

December 1994, the Plan entered into an agreement

with an unrelated third-party to refinance up to $16.7 mil-

lion of the TESOP Notes in a series of six annual notes

(the “Refinanced Notes”), beginning December 30, 1994. As

of December 31, 1999, the Plan had borrowed all of the

$16.7 million for the refinancing of the TESOP Notes. As of

December 31, 2002, the Plan had repaid all of the

Refinanced Notes. Dividend payments and contributions

received by the Plan from us were used to repay the

indebtedness.

Each share of TESOP Preferred Stock was convertible into

87.072 shares of our common stock.The annual cumulative

dividend on TESOP Preferred Stock was $75.00 per share,

payable semiannually. Because we had guaranteed the

repayment of the Refinanced Notes, the indebtedness of

the Plan was recognized as a liability in the accompanying

Consolidated Balance Sheets. An offsetting charge was

made in the stockholders’ equity section of the 2001

Consolidated Balance Sheet to reflect unearned compensa-

tion related to the Plan.On December 31, 2002, all shares of

TESOP Preferred Stock were converted into our common

stock and all unearned compensation related to the Plan

was recognized as of that date.

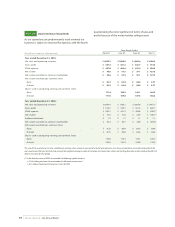

Compensation and interest expense related to the Plan

before the reduction for the allocation of dividends are pre-

sented below for each year ended December 31:

(In millions) 2003 2002 2001

Compensation expense $— $ 4.3 $ 6.4

Accrued additional contribution —4.1 —

Interest expense —0.2 0.8

The last allocation of TESOP Preferred Stock to participants

was made as of the Plan year ended March 31, 2003, and

was based on the total debt service made on the indebted-

ness. As shares of the TESOP Preferred Stock were allocated