Radio Shack 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 41

$43.8 million and $46.6 million, net of accumulated

amortization of $53.3 million, $39.0 million and $26.3 mil-

lion, respectively.

Goodwill: Goodwill represents the excess of the purchase

price over the fair value of net assets acquired. At

December 31, 2003, the net goodwill balance totaled $2.9

million, composed primarily of goodwill resulting from the

conversion of various dealer/franchise outlets to company

retail stores.During 2002, we recorded an impairment

of the AmeriLink Corporation, also known as RadioShack

Installation Services (“RSIS”), goodwill aggregating $8.1

million, resulting in a net goodwill balance at December 31,

2002, of $2.9 million (see Note 6 for further details).

Derivatives: We have entered into interest rate swap agree-

ments to effectively convert a portion of our long-term

fixed rate debt to a variable rate. Under these agreements,

we have contracted to pay a variable rate of LIBOR plus a

markup and to receive fixed rates ranging from 6.950% to

7.375%.We have designated these agreements as fair value

hedging instruments.The accounting for changes in the

fair value of an interest rate swap depends on the use of

the swap.To the extent that a derivative is effective as a

hedge of an exposure to future changes in fair value, the

change in the derivative’s fair value is recorded in earnings,

as is the change in fair value of the item being hedged.To

the extent that a swap is effective as a cash flow hedge of

an exposure to future changes in cash flows, the change in

fair value of the swap is deferred in accumulated other

comprehensive income. Any portion considered to be inef-

fective will be immediately reported in earnings.The

differentials to be received or paid under interest rate swap

contracts designated as hedges are recognized in income

over the life of the contracts as adjustments to interest

expense. Gains and losses on terminations of interest rate

contracts designated as hedges are deferred and amortized

into interest expense over the remaining life of the original

contracts or until repayment of the hedged indebtedness.

We maintain strict internal controls over our hedging

activities, which include policies and procedures for risk

assessment and the approval, reporting and monitoring

of all derivative financial instrument activities.We monitor

our hedging positions and credit worthiness of our

counter-parties and do not anticipate losses due to our

counter-parties’nonperformance.We do not hold or issue

derivative financial instruments for trading or speculative

purposes.To qualify for hedge accounting, derivatives must

meet defined correlation and effectiveness criteria, be

designated as a hedge and result in cash flows and finan-

cial statement effects that substantially offset those of the

position being hedged.

Fair Value of Financial Instruments: The fair value of financial

instruments is determined by reference to various market

data and other valuation techniques as appropriate. Unless

otherwise disclosed, the fair values of financial instruments

approximate their recorded values, due primarily to

the short-term nature of their maturities or their varying

interest rates.

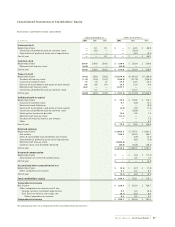

Comprehensive Income: Comprehensive income is defined

as the change in equity (net assets) of a business enterprise

during a period, except for those changes resulting from

investments by owners and distributions to owners.

Comprehensive income is comprised of the gain (loss) on

an interest rate swap used as a cash flow hedge and foreign

currency translation adjustments, which are shown net

of tax in the accompanying Consolidated Statements of

Stockholders’ Equity.

Reclassifications: Certain amounts in the December 31, 2002

and 2001, financial statements have been reclassified to

conform with the December 31, 2003, presentation. These

reclassifications had no effect on net income or stockhold-

ers’equity as previously reported.

Recently Issued Accounting Pronouncements: In June 2001, the

Financial Accounting Standards Board (“FASB”) issued SFAS

No.143,“Accounting for Asset Retirement Obligations,”

which is effective for fiscal years beginning after June 15,

2002. SFAS No. 143 establishes financial accounting and

reporting standards for obligations associated with the

retirement of tangible long-lived assets and the associated

asset retirement costs. We adopted SFAS No. 143 effec-

tive January 1, 2003, and made no material adjustments

to our consolidated financial statements as a result of

this adoption.

In June 2002, the FASB issued SFAS No. 146,“Accounting for

Costs Associated with Exit or Disposal Activities.” SFAS No.

146 addresses significant issues relating to the recognition,

measurement, and reporting of costs associated with

exit and disposal activities, including restructuring activities,

and nullifies the guidance in Emerging Issues Task Force

Issue No. 94-3,“Liability Recognition for Certain Employee

Termination Benefits and Other Costs to Exit an Activity

(Including Certain Costs Incurred in a Restructuring).”The

provisions of SFAS No. 146 are effective for exit or disposal

activities initiated after December 31, 2002. Retroactive

application of SFAS No. 146 is prohibited and, accordingly,

liabilities recognized prior to the initial application of SFAS