Radio Shack 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 43

In the second quarter of 2002, we sold and leased back our

corporate technology center building, recording this

transaction as a financing obligation, because we retained

certain responsibilities during the lease term. Under a

financing obligation, the associated assets remain on our

balance sheet.This obligation has a three-year term expiring

in 2005 with renewal options.The lessors are unrelated

third-parties. We entered into this transaction in contem-

plation of and to facilitate the relocation of our corporate

headquarters to a new custom-built corporate campus,

which is currently being constructed and is scheduled for

occupation beginning in the fourth quarter of 2004

through early 2005.

In the fourth quarter of 2001, we sold and leased back most

of our corporate headquarters and recognized a loss of

$44.8 million. The operating lease has a three-year term

expiring in 2004 with renewal options.

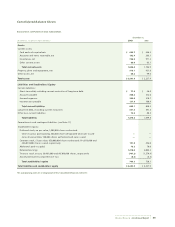

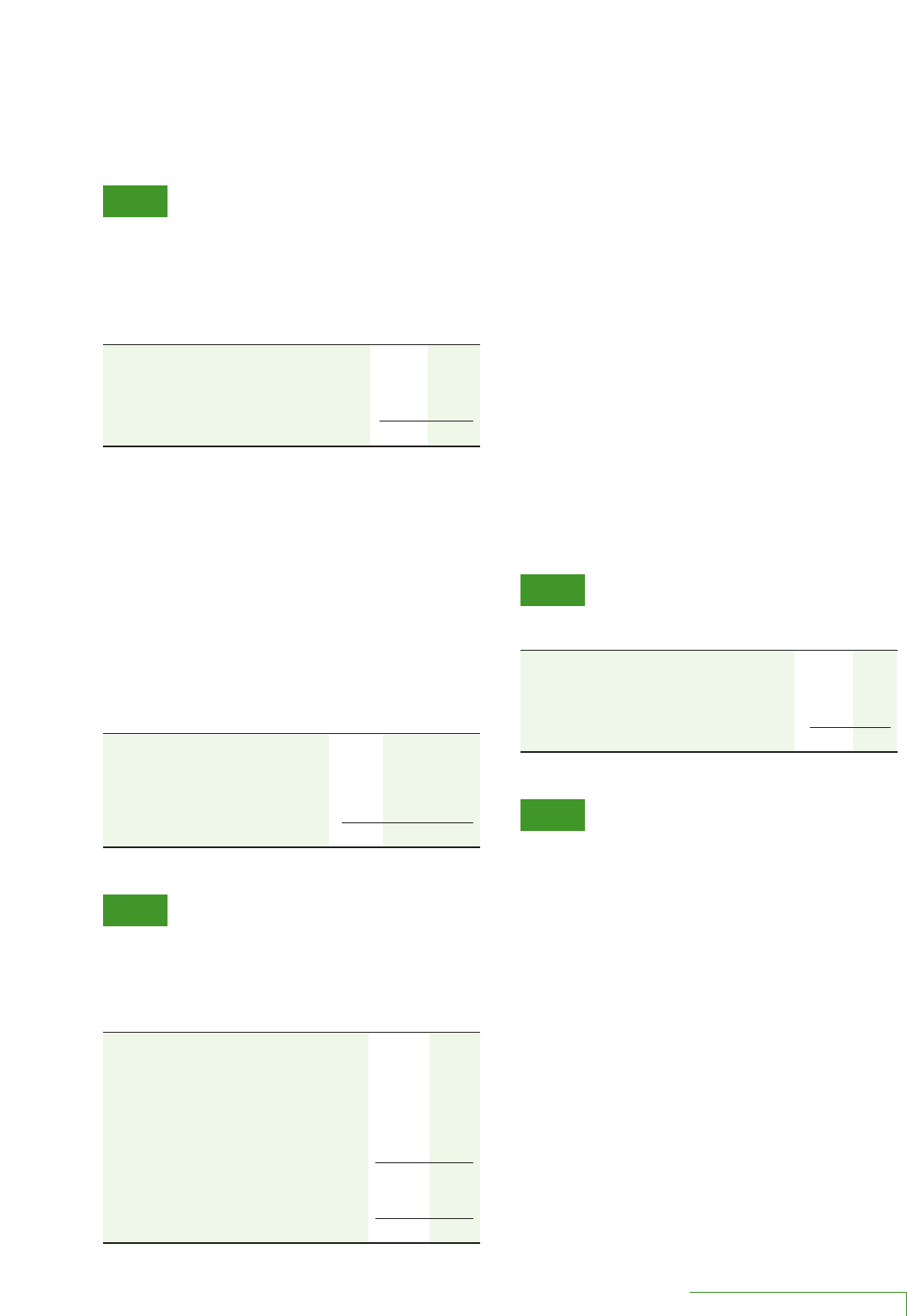

Note 5 Other Assets, Net

December 31,

(In millions) 2003 2002

Notes receivable $ 9.8 $ 4.0

Goodwill 2.9 2.9

Deferred income taxes 22.2 52.2

Other 29.3 40.3

Total other assets,net $64.2 $99.4

Note 6 Impairment of Long-Lived Assets

RSIS was acquired in 1999 to provide us with residential

installation capabilities for the technologies and services

offered in our retail stores. From the time of its acquisition,

RSIS has incurred operating losses and negative cash

flows. In 2000 and in 2001, we attempted to restructure and

reorganize RSIS, but due to the overall slowdown in the

economy and the market decline for professionally

installed home Internet connectivity services, RSIS contin-

ued to report losses. During the fourth quarter of 2001,

we prepared a revised analysis of estimated future cash

flows for RSIS, which indicated that its long-lived assets

were impaired.The carrying value of RSIS’s long-lived assets

(principally goodwill and fixed assets) exceeded the dis-

counted present value of the estimated future cash flows

by approximately $37.0 million. An impairment of goodwill

for that amount was recorded and included in the

accompanying Consolidated Statement of Income for 2001.

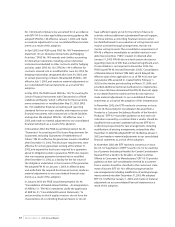

Note 3 Accounts and Notes Receivable, Net

As of December 31, 2003 and 2002, we had the following

accounts and notes receivable outstanding in the accom-

panying Consolidated Balance Sheets:

December 31,

(In millions) 2003 2002

Receivables from vendors and service providers $ 92.3 $120.0

Trade accounts receivable 75.6 70.6

Other receivables 18.6 22.9

Allowance for doubtful accounts (4.1) (7.4)

Accounts and notes receivable, net $182.4 $206.1

Receivables from vendors and service providers relate to

marketing development funds, residual income, customer

acquisition fees, and rebates and other promotions from

our third-party service providers and product vendors, after

taking into account estimates for service providers’ cus-

tomer deactivations and non-activations, which are factors

in determining the amount of customer acquisition fees

and residual income earned.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

December 31,

(In millions) 2003 2002 2001

Balance at the beginning of the year $ 7.4 $ 6.8 $ 6.3

Provision for bad debts included in selling,

general and administrative expense 0.4 4.7 14.5

Uncollected receivables written off, net of

recoveries (3.7) (4.1) (14.0)

Balance at the end of the year $ 4.1 $ 7.4 $ 6.8

Note 4 Property, Plant and Equipment (“PP&E”), Net

The following table outlines the ranges of estimated useful

lives and balances of each major fixed asset category:

Range of December 31,

(In millions) Estimated Useful Life 2003 2002

Land — $ 35.0 $ 35.0

Buildings 10-40 years 169.1 98.1

Furniture, fixtures and

equipment 2-15 years 631.8 586.9

Leasehold improvements

Primarily, the shorter of the

life of the improvements or the

term of the related lease and

certain renewal periods

345.8 337.4

Total PP&E 1,181.7 1,057.4

Less accumulated depreciation

and amortization of capital leases (668.6) (635.8)

PP&E, net $ 513.1 $ 421.6