Radio Shack 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 53

Note 24 Preferred Share Purchase Rights

In July 1999, we amended and restated a stockholder rights

plan which declared a dividend of one right for each

outstanding share of our common stock.The rights plan, as

amended and restated, will expire on July 26, 2009.The

rights are currently represented by our common stock cer-

tificates.When the rights become exercisable, they will

entitle each holder to purchase 1/10,000th of a share of our

Series A Junior Participating Preferred Stock for an exercise

price of $250 (subject to adjustment).The rights will

become exercisable and will trade separately from the

common stock only upon the date of public announce-

ment that a person, entity or group (“Person”) has acquired

15% or more of our outstanding common stock without

the consent or approval of the disinterested directors

(“Acquiring Person”) or ten days after the commencement

or public announcement of a tender or exchange offer

which would result in any Person becoming an Acquiring

Person.In the event that any Person becomes an Acquiring

Person,the rights will be exercisable for 60 days thereafter

for our common stock with a market value (as determined

under the rights plan) equal to twice the exercise price.

In the event that, after any Person becomes an Acquiring

Person, we engage in certain mergers, consolidations, or

sales of assets representing 50% or more of our assets or

earning power with an Acquiring Person (or Persons acting

on behalf of or in concert with an Acquiring Person) or in

which all holders of common stock are not treated alike,

the rights will be exercisable for common stock of the

acquiring or surviving company with a market value (as

determined under the rights plan) equal to twice the exercise

price.The rights will not be exercisable by any Acquiring

Person.The rights are redeemable at a price of $0.01 per

right prior to any Person becoming an Acquiring Person or,

under certain circumstances, after a Person becomes an

Acquiring Person.

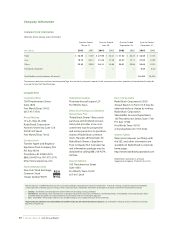

Note 25 Dividends Declared

We declared dividends of $0.25, $0.22 and $0.165 for the

years 2003, 2002 and 2001, respectively. On July 25, 2001,

we announced that we would pay cash dividends on an

annual, instead of quarterly, basis beginning in 2002.

Dividends declared in 2002 and thereafter have been paid

annually in December.

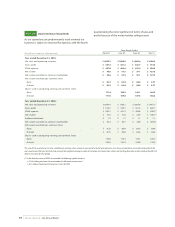

Note 26 Product Sales Information

Our net sales and operating revenues are summarized by

groups of similar products and services as follows:

Year Ended December 31,

(In millions) 2003 2002 2001

Wireless products and services $1,623.2 $1,419.9 $1,297.5

Home entertainment products

and services 737.9 855.2 1,121.4

Computer products 455.9 456.8 461.1

Power and technical products 634.1 623.9 618.9

Personal electronics,toys and

personal audio products 588.1 576.2 562.0

Wired and radio products and

other(1) 610.1 645.2 714.8

$4,649.3 $4,577.2 $4,775.7

(1) Other includes outside sales of our retail support operations,service plan

income and store repair income.

Note 27 Supplemental Cash Flow Information

Cash flows from operating activities included cash payments

as follows:

Year Ended December 31,

(In millions) 2003 2002 2001

Interest paid $ 35.0 $ 43.9 $ 48.4

Income taxes paid 153.5 160.2 171.2

Note 28 Related Party Transactions

In April 2002, we entered into a supply chain management

consulting agreement with a company affiliated with a

corporation whose chairman and chief executive officer is a

member of our Board of Directors and who currently

serves on the Corporate Governance and Management

Development and Compensation Committees of our

Board of Directors. Under this agreement, we incurred

approximately $1.8 million and $8.2 million in consulting

fees during the years ended December 31, 2003 and

2002, respectively.