Radio Shack 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report

32

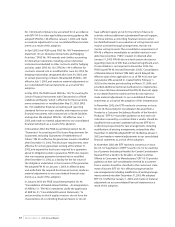

However, we have no reason to believe that CompUSA or

the other assignees will not fulfill their obligations under

these leases; consequently, we do not believe there will

be a material impact on our financial statements from

any fulfillment of these commitments.

Off-Balance Sheet Arrangements

Other than the operating leases described above, we do

not have any off-balance sheet financing arrangements,

transactions, or special purpose entities.

Inflation

Inflation has not significantly impacted us over the past

three years.We do not expect inflation to have a

significant impact on our operations in the foreseeable

future, unless international events substantially affect

the global economy.

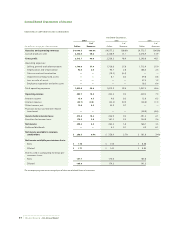

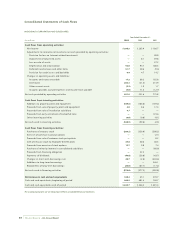

The first table below contains the contractual commit-

ments associated with our financing obligations, lease

obligations, and marketing agreements. Purchase obliga-

tions include our product commitments, marketing

agreements, utility and freight commitments.

We have contingent liabilities related to retail leases of

locations which were assigned to other businesses. The

majority of these contingent liabilities relate to various

lease obligations arising from leases that were assigned to

CompUSA, Inc. as part of the sale of our Computer City, Inc.

subsidiary to CompUSA, Inc. in August 1998. In the event

CompUSA or the other assignees, as applicable, are unable

to fulfill their obligations, we would be responsible for

rent due under the leases. Our rent exposure from the

remaining undiscounted lease commitments with no pro-

jected sublease income is approximately $183 million.

Payments Due by Period

(In millions)

Total Amounts

Less than Over

Contractual Obligations Committed 1 year 1-3 years 3-5 years 5 years

Long-term debt obligations $ 582.9 $ 39.5 $ 37.4 $155.0 $351.0

Capitalized lease obligations 0.3 0.2 0.1 — —

Operating lease obligations 695.4 183.7 279.7 137.0 95.0

Purchase obligations 467.7 436.8 24.2 6.7 —

Other long-term liabilities reflected on the balance sheet 75.2 7.4 22.9 8.4 36.5

$1,821.5 $667.6 $364.3 $307.1 $482.5

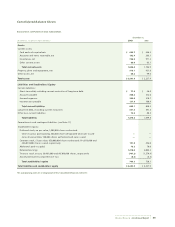

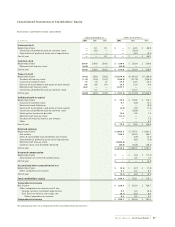

The table below contains our credit commitments from various financial institutions.

Commitment Expiration per Period

(In millions)

Total Amounts

Less than Over

Credit Commitments Committed 1 year 1-3 years 3-5 years 5 years

Lines of credit $600.0 $300.0 $300.0 — —

Stand-by letters of credit 12.7 2.4 10.3 — —

Total credit commitments $612.7 $302.4 $310.3 — —