Radio Shack 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report

44

As a result of continued difficulties in the DTH business

and a refocus during the fourth quarter of 2002 on our

satellite installation strategy, together with a revised cash

flow projection for our overall installation business, we

determined that the remaining long-lived assets associated

with RSIS were impaired.We compared the carrying value

of these long-lived assets with their fair value and determined

that the remaining goodwill balance of $8.1 million was

impaired and we, therefore, recorded an impairment charge

of this amount in the accompanying 2002 Consolidated

Statement of Income. As of December 31, 2002, there was

no remaining goodwill balance on our balance sheet relat-

ing to RSIS. On September 10, 2003, we sold RSIS, resulting

in a loss of $1.8 million which was recorded in other income.

Our test concept with Blockbuster to introduce a RadioShack

“store-within-a-store”at Blockbuster locations in 2001 did

not provide sufficient cash flows to recover our investment

in fixtures and other fixed assets. An impairment loss of

$2.8 million was recorded for those assets in 2001 and is

included as a component of impairment of long-lived

assets in the accompanying 2001 Consolidated Statement

of Income.

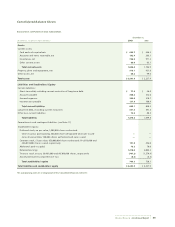

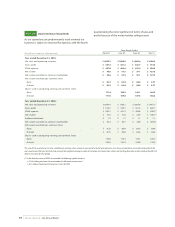

Note 7 Indebtedness and Borrowing Facilities

SHORT-TERM DEBT

December 31,

(In millions) 2003 2002

Short-term debt $ 36.8 $16.0

Current portion of long-term debt 39.5 20.0

Fair value of interest rate swaps 0.9 —

Current portion of capital lease obligations 0.2 —

Total short-term debt $ 77.4 $36.0

LONG-TERM DEBT

December 31,

(In millions) 2003 2002

Ten-year 7 3/8% note payable due in 2011 $350.0 $350.0

Ten-year 6.95% note payable due in 2007 150.0 150.0

Medium-term notes payable with interest rates

at December 31, 2003, ranging from 6.42% to

7.35% due from 2004 to 2007 44.5 64.5

Financing obligation (see Note 4) 32.3 32.3

Notes payable with interest rates at

December 31, 2003, ranging from 2.6% to

2.8% due from 2006 to 2014 6.1 6.1

Capital lease obligations 0.3 —

Unamortized debt issuance costs (5.8) (7.0)

Fair value of interest rate swaps 4.5 15.4

581.9 611.3

Less current portion of:

Notes payable 39.5 20.0

Fair value of interest rate swaps 0.9 —

Capital lease obligations 0.2 —

40.6 20.0

Total long-term debt $541.3 $591.3

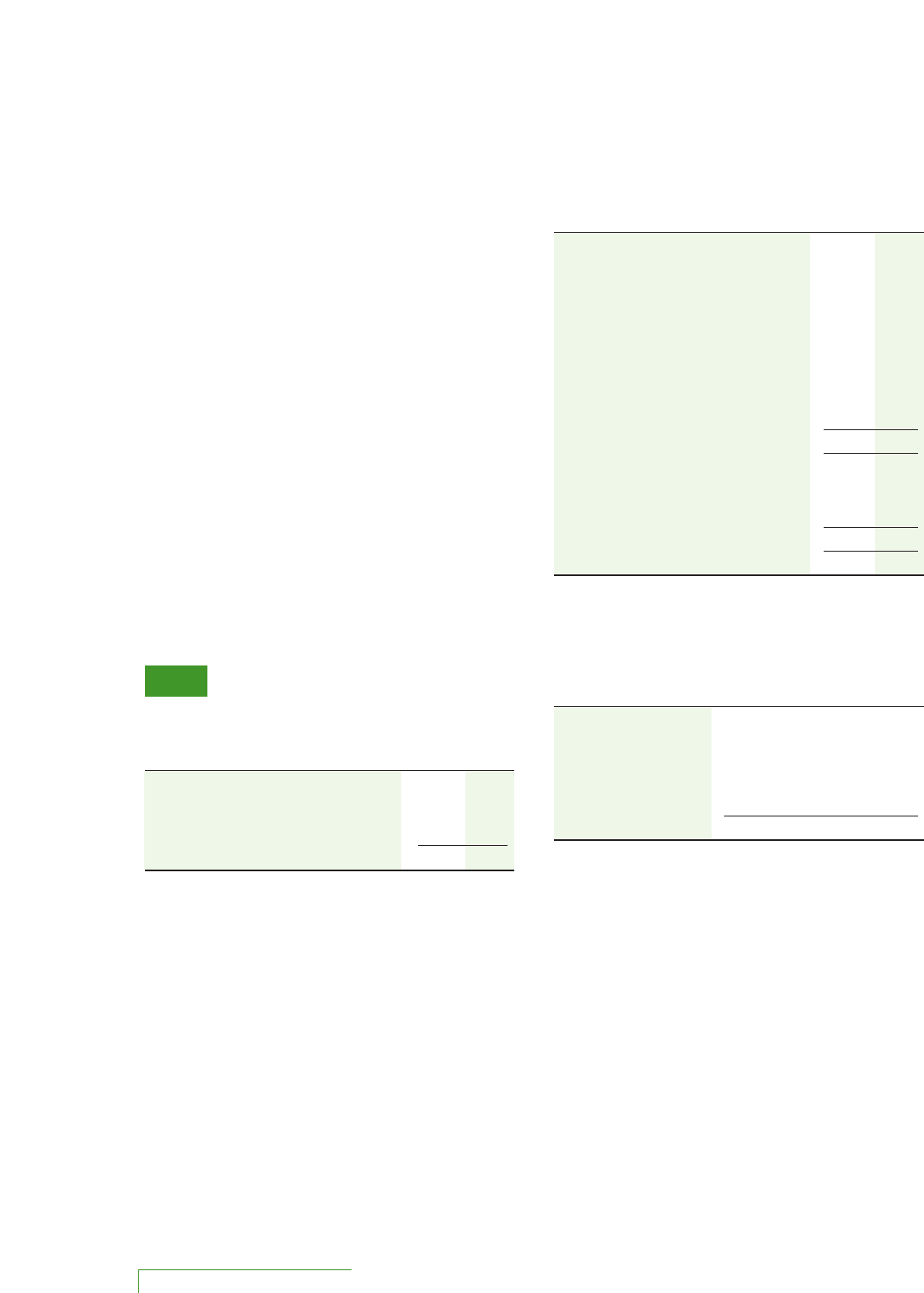

Long-term borrowings and financing obligation outstanding

at December 31, 2003, mature as follows:

Long-Term Capital Financing

(In millions)

Borrowings Lease Obligation(1) Total

2004 $ 39.5 $ 0.2 $ — $ 39.7

2005 — 0.1 32.3 32.4

2006 5.1 — — 5.1

2007 150.0 — — 150.0

2008 5.0 — — 5.0

2009 and thereafter 351.0 — — 351.0

Total $550.6 $ 0.3 $32.3 $583.2

(1) See Note 4 for discussion of financing obligation.

The fair value of our long-term debt of $581.6 million and

$611.3 million at December 31, 2003 and 2002, respectively,

(including current portion, but excluding 2003 capital

leases) was approximately $656.7 million and $675.0 million,

respectively.The fair values were computed using interest

rates which were in effect at the balance sheet dates for

similar debt instruments.

On May 11, 2001, we issued $350.0 million of 10-year 7

3/8% notes in a private offering to initial purchasers who

offered the notes to qualified institutional buyers under

SEC Rule 144A.The annual interest rate on the notes is 7.375%

per annum with interest payable on November 15 and

May 15 of each year. Payment of interest on the notes com-

menced on November 15, 2001, and the notes mature on