Radio Shack 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report

24

same due to fewer company stores and our continued rent

reduction efforts. We expect a similar increase in 2004 rent

for the same reasons described for 2003.

Insurance expense increased $10.5 million to $81.5 million

in 2003 from $71.0 million in 2002 and increased as a per-

cent of net sales and operating revenues to 1.8% in 2003,

compared to 1.6% in 2002. Substantially all of our insurance

expense relates to our self-insurance programs.We main-

tain reserves for self-insurance liabilities related to our

group medical and casualty losses, which include general

and product liability and workers’ compensation. In some

cases, risks are insured through outside carriers for losses in

excess of self-insured amounts.These reserves are adjusted

to reflect estimates based on historical experience, estimated

claims incurred but not yet reported, the impact of risk

management programs, and the estimated effect of external

factors. As of December 31, 2003, actual losses had not

exceeded our expectations.

In 2004, we expect SG&A expense to increase slightly in

dollars, but decrease slightly as a percentage of net sales

and operating revenues, due to increased sales volume and

a continued focus on leveraging our fixed expense base.

Depreciation and Amortization

Depreciation and amortization expense decreased $2.7 mil-

lion dollars to $92.0 million and remained at 2.0% of net

sales and operating revenues for both 2003 and 2002. We

expect depreciation and amortization expense to increase

slightly in 2004, due to depreciation increases associated

with new store fixtures, capitalized software related to

inventory management, and information systems projects.

Gain on Contract Termination

There was no gain on contract termination in 2003. For

information on the prior year gain on contract termination,

see the discussion below under the section titled “2002

Compared with 2001.”

Impairment of Long-Lived Assets

There was no impairment of long-lived assets in 2003.For

information on the prior year impairment of long-lived

assets, see the discussion below under the section titled

“2002 Compared with 2001.”

Net Interest Expense

Interest expense, net of interest income, was $22.9 million

for 2003 versus $34.4 million for 2002, a decrease of $11.5

million or 33.4%.

Interest expense decreased to $35.7 million in 2003 from

$43.4 million in 2002.This decrease was primarily the result

of a reduction in the average debt outstanding throughout

2003. In addition, our interest rate swap instruments and

the capitalization of $2.6 million of interest expense related

to the construction of our new corporate campus also low-

ered overall interest expense for the year ended December

31, 2003, when compared to the same prior year period.

Interest income increased over 42% to $12.8 million in

2003 from $9.0 million in 2002, primarily as a result of a

$5.6 million increase in interest received from tax settlements

in 2003, as compared to 2002. Interest income, including

accretion of discount as applicable, earned on the amounts

outstanding during the three years ended December 31,

2003, 2002 and 2001, was as follows:

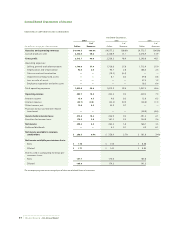

Year Ended December 31,

(In millions) 2003 2002 2001

CompUSA note receivable $— $ — $ 6.1

Other (includes short-term

investment interest) 12.8 9.0 6.9

Total interest income $12.8 $9.0 $13.0

Interest expense, net of interest income, is expected to

decrease in 2004, when compared to 2003.

Other Income, Net

On July 28, 2003, we received payment of $15.7 million

resulting from the favorable settlement of a lawsuit we had

previously filed.We recorded this settlement in the third

quarter of 2003 as other income of $10.7 million, net of

legal expenses of $5.0 million paid as a result of the lawsuit.

On September 10, 2003, we sold our wholly-owned sub-

sidiary, AmeriLink Corp. (“AmeriLink”), also referred to as

RSIS, to INSTALLS inc, LLC in a cash-for-stock sale, resulting

in a loss of $1.8 million, based on AmeriLink’s book value,

which was recorded in other income.

For the year ended December 31, 2003, we received and

recorded income of $3.1 million owed to us under a tax

sharing agreement with O’Sullivan Industries Holdings, Inc.

(“O’Sullivan”), compared to $33.9 million received and

recorded in the corresponding prior year period. In the

second quarter of 2002, we received and recorded income

of $27.7 million in partial settlement of amounts owed to

us under this tax sharing agreement that was the subject of

an arbitration dispute with O’Sullivan.This partial settle-

ment followed a ruling in our favor by the arbitration panel.