Radio Shack 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 45

May 15, 2011. In August 2001, under the terms of an

exchange offering filed with the SEC, we exchanged substan-

tially all of these notes for a similar amount of publicly

registered notes. Because no additional debt was issued in

the exchange offering, the net effect of this exchange was

that no additional debt was issued on August 3,2001, and

substantially all of the notes are now registered with the SEC.

We have a $300.0 million debt shelf registration statement

which became effective in August 1997. In August 1997,

we issued $150.0 million of 10-year unsecured long-term

notes under this shelf registration.The interest rate on the

notes is 6.95% per annum with interest payable on

September 1 and March 1 of each year, commencing March

1, 1998. These notes are due September 1, 2007.

We also issued, in various amounts and on various dates

from December 1997 through September 1999, medium-

term notes totaling $150.0 million under the shelf registration.

At December 31, 2003, $44.5 million of these notes

remained outstanding.The interest rates at December 31,

2003, for the outstanding $44.5 million medium-term notes

ranged from 6.42% to 7.35% and had a weighted average

coupon rate of 7.19%.These notes have maturities ranging

from 2004 to 2008. As of December 31, 2003, there was no

availability under this shelf registration.

In June and August 2003, we entered into interest rate

swap agreements with underlying notional amounts of

debt of $100.0 million and $50.0 million, respectively, with

maturities in May 2011. Additionally, during the third

quarter of 2001, we entered into several interest rate swap

agreements with notional amounts totaling $150.0 million,

with maturities ranging from 2004 to 2007.We entered

into these agreements to effectively convert a portion of our

long-term fixed rate debt to a variable rate. Under these

agreements, we have contracted to pay a variable rate of

LIBOR plus a markup and to receive fixed rates ranging

from 6.950% to 7.375%.We have designated these agree-

ments as fair value hedging instruments.We recorded an

amount in other assets, net, of $4.5 million and $15.4 million

(their fair value) at December 31, 2003 and 2002, respec-

tively, for the swap agreements and adjusted the fair value

of the related debt by the same amount.Fair value was

computed using interest rates which were in effect as of

December 31, 2003 and 2002, respectively, for similar

instruments.

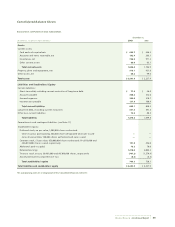

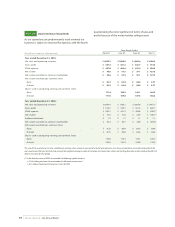

SHORT-TERM BORROWING FACILITIES

Year Ended December 31,

(In millions) 2003 2002 2001

Domestic seasonal bank credit lines

and bank money market lines:

Lines available at year end $700.0 $705.0 $774.0

Loans outstanding at year end ———

Weighted average interest rate

at year end ———

Weighted average loans

outstanding $— $ — $ 22.1

Weighted average interest rate

during year —— 5.7%

Short-term foreign credit lines:

Lines available at year end $ 7.2 $ 15.8 $ 24.5

Loans outstanding at year end ———

Weighted average interest

rate at year end ———

Weighted average loans

outstanding $— $ — $ 1.9

Weighted average interest

rate during year —2.1% 4.9%

Letters of credit and banker’s

acceptance lines of credit:

Lines available at year end $162.7 $167.4 $206.0

Acceptances outstanding

at year end ———

Letters of credit open against

outstanding purchase orders

at year end $ 20.0 $ 26.4 $ 31.2

Commercial paper credit facilities:

Commercial paper outstanding

at year end $— $— $—

Weighted average interest

rate at year end ———

Weighted average commercial

paper outstanding $— $ 0.1 $ 83.2

Weighted average interest

rate during year —2.0% 5.8%

Our short-term credit facilities, including revolving credit lines,

are summarized in the accompanying short-term borrow-

ing facilities table above. The method used to compute

averages in the short-term borrowing facilities table is

based on a daily weighted average computation that takes

into consideration the time period such debt was outstand-

ing, as well as the amount outstanding. Our financing,

primarily short-term debt, consists of short-term seasonal

bank debt and commercial paper. The commercial paper

and the short-term seasonal bank debt have a typical

maturity of 90 days or less.The amount of commercial

paper that can be outstanding is limited to a maximum of

the unused portion of our $600 million bank syndicated

revolving credit facility described in more detail below.