Radio Shack 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report

26

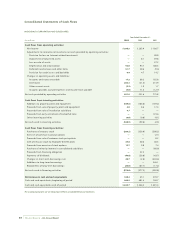

Gain on Contract Termination

RadioShack and Microsoft mutually agreed during 2002 to

terminate their agreement and settle the remaining com-

mitments each had to one another. The termination of this

agreement took effect at the start of the fourth quarter of

2002, upon satisfaction of several contractual obligations.

The net financial result was an $18.5 million gain (princi-

pally cash received), driven primarily by the settlement of a

multi-year obligation Microsoft had to connect our stores

with broadband capabilities.

Impairment of Long-Lived Assets

AmeriLink was acquired in 1999 to provide us with residen-

tial installation capabilities for the technologies and

services offered in our retail stores. As a result of continued

difficulties in the DTH business and a refocus during the

fourth quarter on our satellite installation strategy, together

with a revised cash flow projection for our overall installa-

tion business, we determined that the remaining long-lived

assets associated with RSIS were impaired.We compared

the carrying value of these long-lived assets with their fair

value and determined that the remaining goodwill balance

of $8.1 million was impaired and we, therefore, recorded an

impairment charge of this amount in the accompanying

2002 Consolidated Statement of Income. As of December

31, 2002, there was no remaining goodwill balance on our

balance sheet relating to RSIS.

Loss on Sale of Assets

In the fourth quarter of 2001, we sold and leased back most

of our corporate headquarters at a loss of $44.8 million. In

June 2001, we received $123.6 million for the settlement of

the Computer City, Inc. purchase price and settlement of

the $136.0 million note which was received in connection

with the sale of Computer City, Inc. in 1998. Thus, we

incurred an additional loss from the sale of Computer City,

Inc. of $12.4 million.

Employee Separation and Other Costs

During the third quarter of 2001, as part of our effort to

control operating costs, we incurred approximately $13.5

million in charges related to a reduction of our labor force,

primarily for early retirements and involuntary and volun-

tary employee severance. In addition, during the fourth

quarter of 2001, $4.8 million in charges were incurred relat-

ing to the closure of RSIS’s national commercial installation

business.These costs were primarily comprised of sever-

ance costs, write-offs of certain fixed assets and future lease

commitments.

for the power and technical department. Additionally,

the gross profit percentage improved for our retail support

operations in 2002.

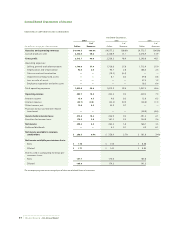

Selling, General and Administrative Expense

Our SG&A expense increased 0.9% in dollars and increased

as a percent of net sales and operating revenues to 37.8%

for the year ended December 31, 2002, from 35.9% for the

year ended December 31, 2001. The dollar increase for 2002

was primarily due to a $29.0 million litigation charge

related to the settlement of a class action lawsuit in

California and a $6.0 million charge to our 1996 restructur-

ing reserve as a result of the bankruptcy of a sub-lessee in a

former Incredible Universe store site. A $14.6 million

increase in our rent expense and lower overall sales in 2002

also contributed to a higher SG&A expense ratio.This was

partially offset by a $7.6 million charge for store closing

costs from 2001, which did not reoccur in 2002. Payroll

expense decreased by $12.3 million to $728.0 million in

2002, but increased slightly as a percent of net sales and

operating revenues to 15.9% in 2002, compared to 15.5% in

2001.The decrease in dollars was due primarily to our

reduction in headcount during the third quarter of 2001.

Rent expense increased by $14.6 million to $244.9 million

in 2002 and increased as a percent of net sales and operat-

ing revenues to 5.4% in 2002 from 4.8% in 2001.These

increases were due primarily to lease renewals and reloca-

tions at higher rates, as well as a slight increase in the

average store size. Advertising expense decreased $12.9

million in 2002 to $241.0 million from $253.9 million in

2001, while remaining at 5.3% of net sales and operating

revenues during both 2002 and 2001.The dollar decrease

was due primarily to an increase in advertising contribu-

tions from our various vendors and third-party service

providers. Insurance expense increased $10.4 million to

$71.0 million in 2002 from $60.6 million in 2001 and

increased as a percent of net sales and operating revenues

to 1.6% in 2002, compared to 1.3% in 2001. As of December

31, 2002, actual losses regarding insurance claims had not

exceeded our expectations.

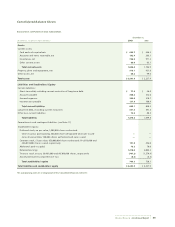

Depreciation and Amortization

Depreciation and amortization expense decreased $13.6

million dollars to $94.7 million and decreased as a percent

of net sales and operating revenues to 2.0% in 2002 from

2.3% in 2001.These decreases were primarily attributable

to the elimination of goodwill amortization related to RSIS,

as well as the sale of our corporate headquarters, during

the fourth quarter of 2001.