Radio Shack 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

while costs of $5.8 million were charged against this reserve

during the corresponding period.In the accompanying 2003

Consolidated Balance Sheet, the balance in the restructuring

reserve is classified in other current liabilities.This reserve

represents the revised expected costs for these real estate

lease obligations. If these facilities’ sublease income

declines in their respective markets or if it takes longer

than expected to sublease or dispose of these facilities, the

actual losses could exceed this reserve estimate. Costs

will continue to be incurred over the remaining terms of

the related leases, the longest of which is 16 years.

In 2001, we initiated an additional restructuring program

related primarily to a general reduction of our corporate

management and administrative labor force, mainly for

early retirement and involuntary and voluntary employee

severance, closure of our national commercial installation

business, and closure of 35 underperforming RadioShack

stores. During the first quarter of 2002, we completed a sig-

nificant portion of the remaining restructuring program,

utilizing the reserves established in 2001. As of December

31, 2002, $3.8 million of the remaining restructuring reserve

was classified in accrued expenses and the remaining

balance of $2.8 million was classified in other non-current

liabilities in the accompanying 2002 Consolidated Balance

Sheet, to be used principally for the remaining cash

commitments associated with the long-term compensation

and lease commitment obligations.

Note 11 Loss on Sale of Assets

On August 31, 1998, we completed the sale of our wholly

owned subsidiary, Computer City, Inc., to CompUSA Inc. for

cash and an unsecured note of $136.0 million. On June 22,

2001, we received $123.6 million for the final determination

of the purchase price and settlement of the $136.0 million

note,resulting in an additional loss of $12.4 million from the

sale of Computer City, Inc. Additionally, in the fourth

quarter of 2001, we sold and leased back most of our corpo-

rate headquarters at a loss of $44.8 million in anticipation

of the building of our new corporate headquarters.These

losses were recorded in 2001 and are included in the

accompanying Consolidated Statements of Income as a

loss on sale of assets.

Note 12 Gain on Contract Termination

RadioShack and Microsoft Corporation mutually agreed

during 2002 to terminate their agreement and settle

the remaining commitments each had to one another.

In the second quarter of 2003, we replaced our existing

$300.0 million 364-day revolving credit facility and

amended our $300.0 million five-year credit facility. These

facilities’maturity dates are June 2004 for the $300.0 mil-

lion 364-day revolving credit facility and June 2007 for the

$300.0 million five-year revolving credit facility.The terms

of these revolving credit facilities are substantially similar to

the previous facilities.These revolving credit facilities will

support any future commercial paper borrowings and are

otherwise available for our general corporate purposes.

As of December 31, 2003, there were no outstanding borrow-

ings under these credit facilities.

We established an employee stock ownership trust in June

1990. Further information on the trust and its related

indebtedness,which we guaranteed, is detailed in the discus-

sion of the RadioShack 401(k) Plan in Note 22.

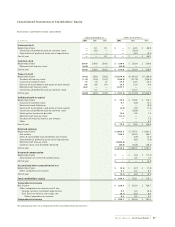

Note 8 Treasury Stock Retirement

On December 11, 2003, our Board of Directors approved

the retirement of 45.0 million shares of our common stock

held as treasury stock.These shares returned to the status

of authorized and unissued. Additional details of the trans-

action may be seen on our 2003 Consolidated Statement

of Stockholders’ Equity.

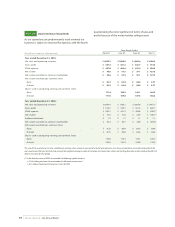

Note 9 Accrued Expenses

December 31,

(In millions) 2003 2002

Payroll and bonuses $ 76.7 $ 56.4

Insurance 70.0 65.6

Sales and payroll taxes 45.5 49.0

Other 150.8 147.7

Total accrued expenses $343.0 $318.7

Note 10 Business Restructurings

In 1996 and 1997, we initiated certain restructuring pro-

grams in which a number of our former McDuff, Computer

City and Incredible Universe retail stores were closed.We

still have certain real estate obligations related to some of

these stores and, at December 31, 2003, the balance in the

restructuring reserve was $17.0 million, consisting of the

remaining estimated real estate obligations to be paid. An

additional provision of $6.5 million was added during 2003,

RADIOSHACK 2003 Annual Report

46