Radio Shack 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report

20

demand and market conditions. If actual market conditions

are less favorable than those projected by management, or

if unexpected changes in technology affect demand for

certain products, we could be exposed to losses on the

recorded amounts in inventory in excess of our established

reserves.

Accrued Expenses: The amount of liability we record for

claims related to self insurance, warranty and pending litiga-

tion requires us to make judgments about the amount of

expenses that will ultimately be incurred.We use our past

history and experience,as well as other specific circumstances

surrounding these claims, in evaluating the amount of

liability that we should record. As additional information

becomes available, we assess the potential liability related

to our various claims and revise our estimates as appropriate.

These revisions could materially impact our results of

operations and financial position.

Income Taxes: We are subject to income taxes in many juris-

dictions, including the U.S., states and localities, and abroad.

We must first determine which revenues and expenses

should be included in each taxing jurisdiction. This process

involves the estimation of our actual current tax exposure,

together with the assessment of temporary differences

resulting from differing treatment of income or expense

items for tax and accounting purposes.We establish tax

reserves in our consolidated financial statements based on

our estimation of current tax exposures. If we prevail in

tax matters for which reserves have been established or we

are required to settle matters in excess of established

reserves, our effective tax rate for a particular period could

be materially affected.Temporary differences arising from

differing treatment of income and expense items for tax

and financial reporting purposes result in deferred tax

assets and liabilities that are recorded on our balance sheet.

If our actual results differ from estimated results or if we

adjust our estimates in the future such that we would not

expect to realize all or part of our net deferred tax assets,

we may need to establish a valuation allowance against our

deferred tax assets, which could also materially affect our

effective tax rate.

Overview of 2003 Financial Performance

Management reviews a number of key indicators to evaluate

our financial performance, including:

>net sales and operating revenues,

>gross margin,

>selling, general and administrative (“SG&A”) expense, and

>operating margin.

For 2003, RadioShack’s net sales and operating revenues

increased 1.6%, and our gross margin improved to 49.8% of

our 2003 net sales. Our SG&A expense decreased to

37.4% of our 2003 net sales, helping to increase our operat-

ing margin to 10.4%.

In managing our business, management uses various metrics

for company operated stores, including average tickets

per store and average sales per ticket. See the table below

for a summary of these statistics for the years indicated.

2003 2002 2001

Average tickets per store per day 72 73 71

Average sales per ticket $30.77 $29.40 $30.41

For a more detailed discussion of our financial perform-

ance, please continue reading our MD&A, Consolidated

Financial Statements and Notes to Consolidated Financial

Statements.

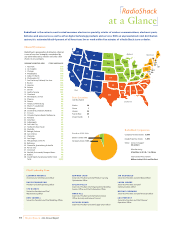

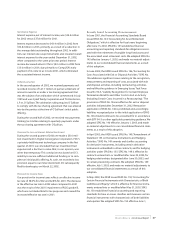

Retail Outlets

The table below shows our retail locations broken down

between company stores and dealer/franchise outlets.

While the dealer/franchise outlets represent approximately

27% of RadioShack’s total retail locations, our sales of

product to dealer/franchisees are less than 10% of our total

net sales and operating revenues (see “Results of

Operations”below).

Average

Store Size At December 31,

(Sq. Ft.) 2003 2002 2001

Company-operated stores 2,439 5,121 5,161 5,127

Cool Things @ Blockbuster (1) N/A —— 127

Dealer/franchise outlets N/A 1,921 2,052 2,119

Total number of retail locations 7,042 7,213 7,373

(1) Test stores closed in early 2002.

In addition to our company operated stores and dealer/

franchise outlets, our existing and emerging sales channels

include our www.radioshack.com Web site and catalog

operations, as well as sophisticated outbound and inbound

telephone call centers.