Radio Shack 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADIOSHACK 2003 Annual Report 23

improved the impact of markdowns, priced our products

more appropriately, and utilized other techniques and

incentives to optimize gross profit.

We also improved our merchandise mix within departments

by increasing the sales mix for many of our higher margin

products, while managing the mix down for many lower

margin products.

We anticipate that gross profit as a percentage of net sales

and operating revenues will continue to improve for

2004, when compared to 2003, due primarily to the planned

enhancement of our current sales mix towards higher

margin products such as computer accessories, batteries,

wellness and digital products. Also, the impact of addi-

tional supply chain management initiatives, particularly in

vendor relations and end-of-life inventory management,

should provide a positive impact.

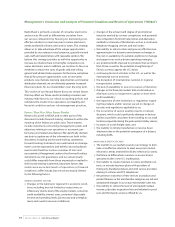

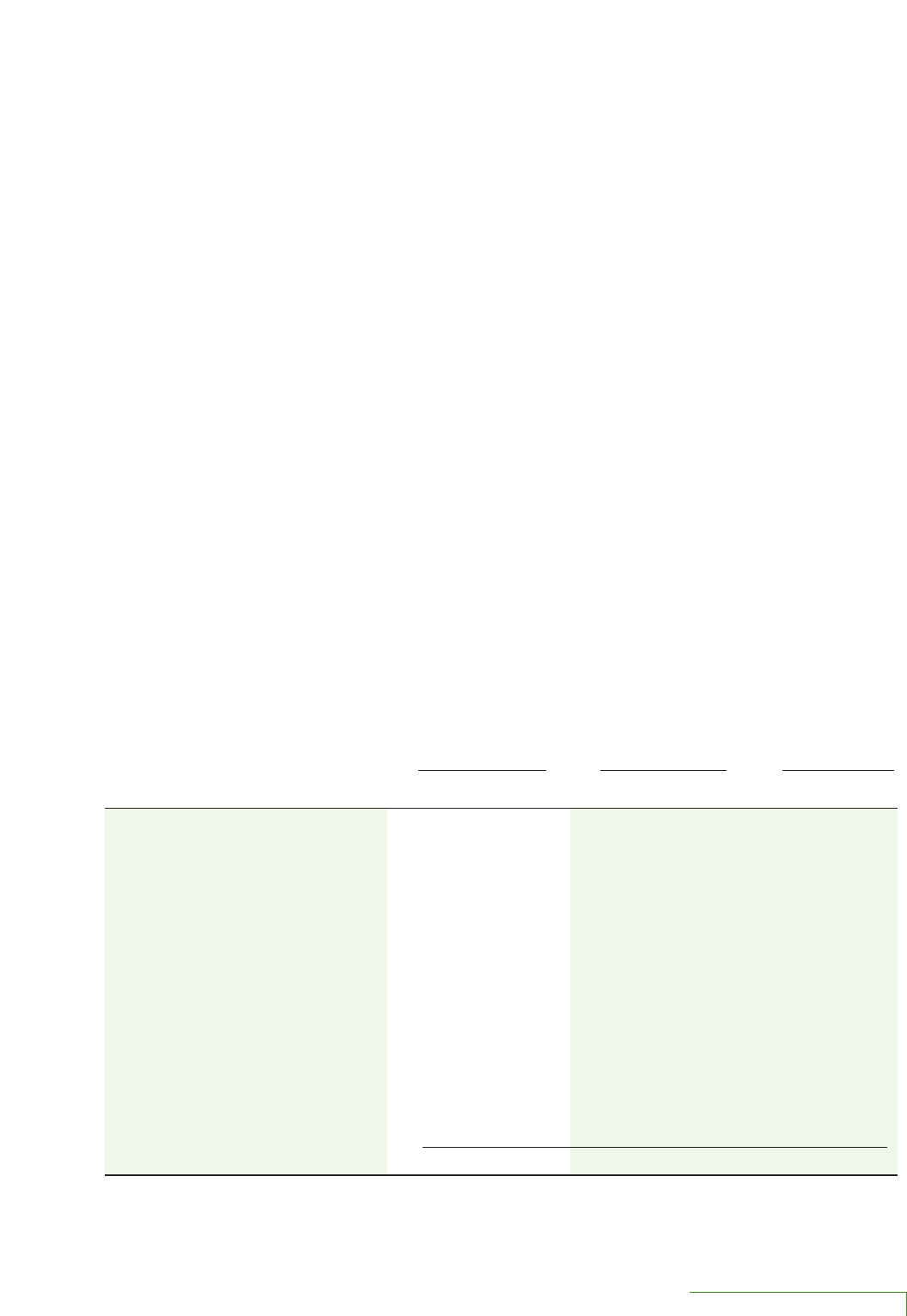

Selling, General and Administrative Expense

The table below summarizes the breakdown of various

components of our consolidated SG&A expense and its related

percentage of total net sales and operating revenues.

Our SG&A expense increased 0.7% in dollars, but decreased

as a percent of net sales and operating revenues to 37.4%

for the year ended December 31, 2003, from 37.8% for the

year ended December 31, 2002. The dollar increase for

2003 was primarily due to a $23.9 million increase in payroll

and commissions and a $13.4 million increase in advertis-

ing, partially offset by the $29.0 million litigation charge in

2002 related to the settlement of a class action lawsuit

in California.

Payroll expense increased by $23.9 million to $751.9 million

in 2003 and increased 0.3 percentage points to 16.2%

of net sales and operating revenues in 2003, compared to

15.9% in 2002.The increase in both dollars and as a per-

centage of total sales was due primarily to an increase in

incentive pay based on increased earnings, as well as

the 2.4% increase in company retail sales.We expect payroll

expense to increase in 2004.

Advertising expense increased $13.4 million in 2003 to

$254.4 million from $241.0 million in 2002 and increased

0.2 percentage points to 5.5% of net sales and operating

revenues in 2003, compared to 5.3% in 2002.

Rent expense increased by $5.2 million to $250.1 million in

2003, but remained the same as a percent of net sales

and operating revenues of 5.4% in both 2003 and 2002.The

dollar increase was due primarily to lease renewals and

relocations at higher rates, as well as a slight increase in the

average store size.The percent of net sales remained the

Year Ended December 31,

2003

2002 2001

% of Sales % of Sales % of Sales

(In millions)

Dollars & Revenues Dollars & Revenues Dollars & Revenues

Payroll and commissions $ 751.9 16.2% $ 728.0 15.9% $ 740.3 15.5%

Advertising 254.4 5.5 241.0 5.3 253.9 5.3

Rent 250.1 5.4 244.9 5.4 230.3 4.8

Other taxes 106.9 2.3 105.9 2.3 111.8 2.4

Insurance 81.5 1.8 71.0 1.6 60.6 1.3

Utilities and telephone 75.8 1.6 74.9 1.6 73.2 1.5

Credit card fees 36.1 0.8 35.8 0.8 34.9 0.7

Lawsuit settlement —— 29.0 0.6 — —

Stock purchase and savings plans 21.5 0.4 20.8 0.5 20.3 0.4

Repairs and maintenance 11.6 0.2 12.0 0.3 11.4 0.2

Printing, postage and office supplies 10.0 0.2 10.5 0.2 12.2 0.3

Travel 8.6 0.2 9.6 0.2 10.4 0.2

Loss on real estate sub-lease 5.6 0.1 6.0 0.1 — —

Bad debt 0.4 — 4.7 0.1 14.5 0.3

Store closing costs —— — — 7.6 0.2

Other 125.6 2.7 134.5 2.9 132.5 2.8

$1,740.0 37.4% $1,728.6 37.8% $1,713.9 35.9%