Radio Shack 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Staying On Strategy

I am convinced that the main, over-arching reason why we delivered on our financial promises in 2003 (and what we believe

will make us successful in the future) is that we stayed true to our strategy “to dominate cost-effective solutions to meet

everyone’s routine electronics needs and families’ distinct electronics wants.”

In 2003, we did make significant moves to fulfill

the “cost-effective solutions” element of our strategy.

This is the long-term direction of our organization, and we know we have a long way to go until we literally fulfill our strategy.

While we didn’t expect to dominate any consumer electronics categories by year’s end, our merchandising, marketing and

store operations decisions were all reasonably well-aligned with this strategy statement.

We put more time and financial resources into driving the categories for which customers give us credit… which are most

profitable… which we want to be famous for… and in which we are highly competent.

We clearly met customers’ routine needs for wireless communications, for example, and posted 14% annual sales growth

in this department. Our most successful results tend to come from categories that are small cube, can be accessorized,

require answers, and are convenience-driven.The wireless business certainly plays to those characteristics. Our wireless business

succeeded because customers embraced our formidable product offerings and store associates executed well. Our merchants

have also become highly skilled at securing, pricing and distributing these products. In 2004, we think wireless will have

another good year due in part to a new product cycle and more accessory bundles.

We also drove good sales and gross profit results from categories such as digital imaging, power, wellness, and the connected

home. Like wireless, these categories play to RadioShack’s strengths in that they are all small cube and accessory-ready, driven

by convenience and require answers. Ongoing commitment to these categories will further our strategy and give RadioShack

its best opportunities for long-term financial success.

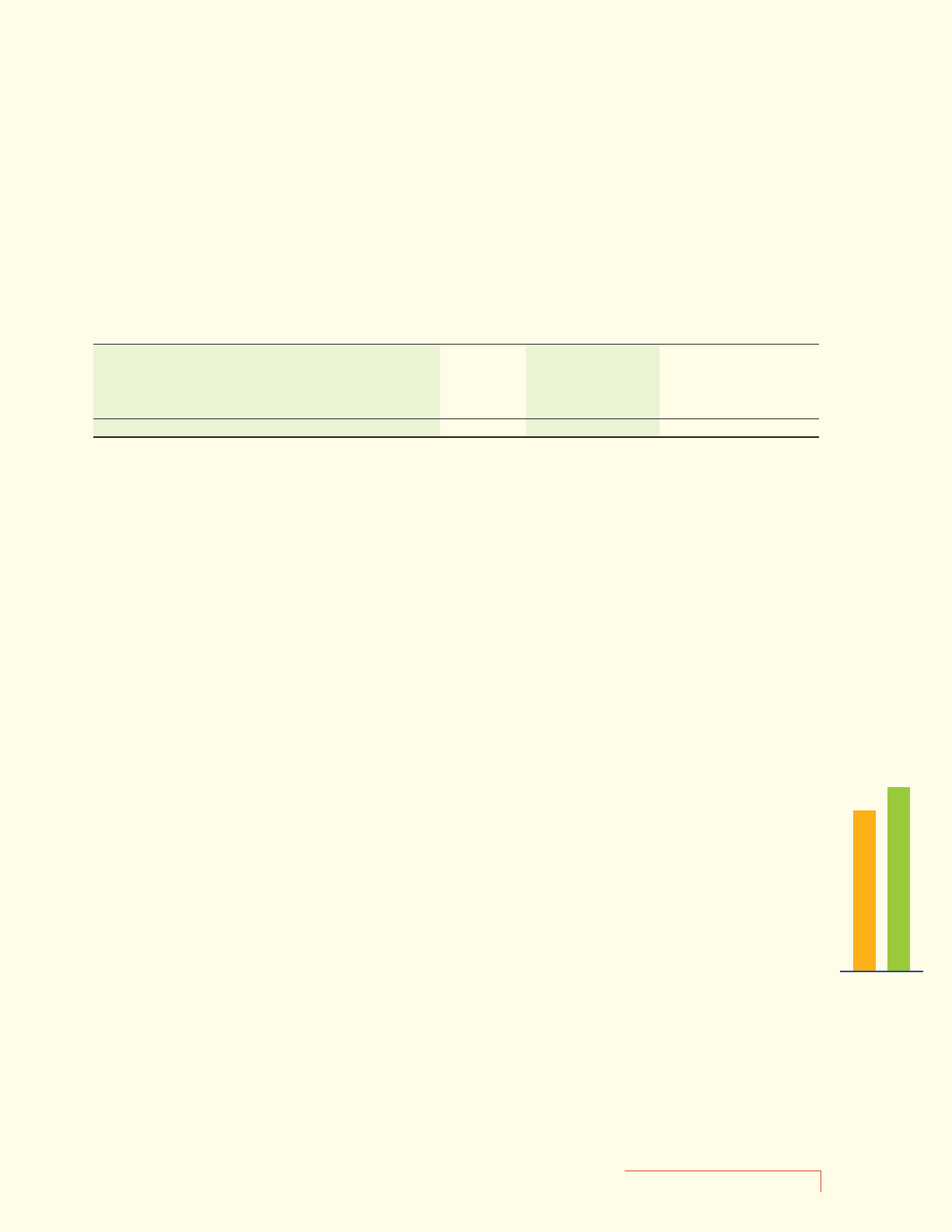

*Reconciliation of Net Cash

Provided by Operating Activities (a GAAP Financial Measure) to Free Cash Flow

(a Non-GAAP Financial Measure)

Year Ended

December 31, Increase

2003 2002 2003 vs 2002

Net cash provided by operating activities $651.9 $521.6 $130.3

Less:

Additions to property, plant and equipment 189.6 106.8 82.8

Dividends paid 40.8 39.8 1.0

Free cash flow $421.5 $375.0 $46.5

RADIOSHACK 2003 Annual Report 3

In addition to our outstanding stock performance in 2003, we delivered $422 million of free cash flow*, well ahead

of the $375 million of free cash flow in 2002, which was also an excellent year. As a result of our strong operating and

free cash flow performance, our cash position at year end was up 42% to $635 million.

RadioShack

Wireless

Department

Sales

(in billions)

2002 2003

$1.4

$1.6