Memorex 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

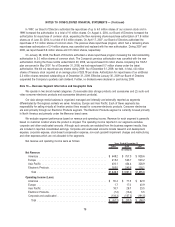

Note 14 — Leases

We incur rent expense under operating leases, which primarily relate to equipment and office space. Most long-term

leases include one or more options to renew at the then fair rental value for a period of approximately one to three years.

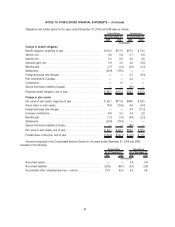

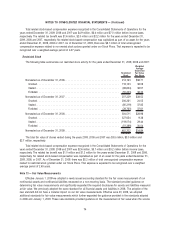

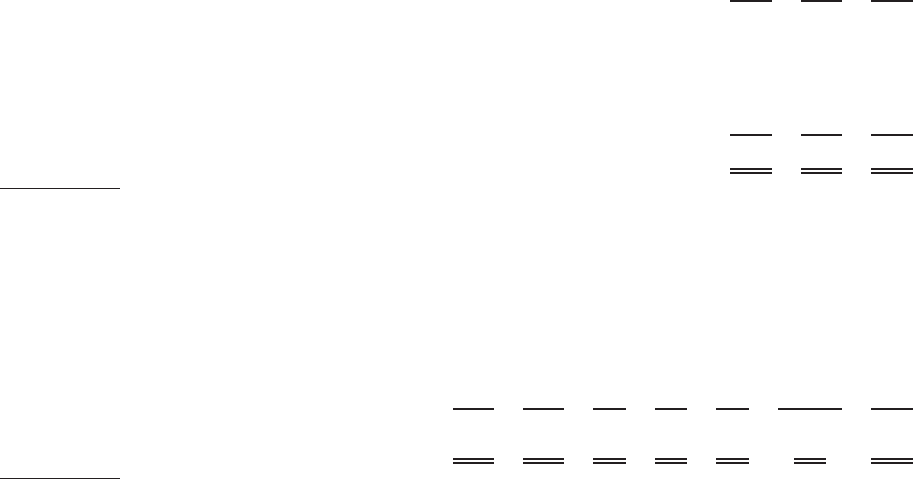

The following table sets forth the components of rent expense during 2009, 2008 and 2007:

2009 2008 2007

(In millions)

Minimum lease payments* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10.3 $16.7 $12.0

Contingent rentals* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.0 13.7 18.9

Rental income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.8) (2.4) (2.9)

Sublease income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.3) (0.5) (0.4)

Total rental expense recognized in income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $25.2 $27.5 $27.6

* Minimum lease payments and contingent rental expenses incurred due to agreements with warehouse providers are

included as a component of cost of goods sold in the Consolidated Statements of Operations. The minimum lease pay-

ments under such arrangements were $2.2 million, $3.9 million and $3.3 million in 2009, 2008 and 2007, respectively.

The contingent rental expenses under such arrangements were $5.8 million, $0.7 million and $1.1 million in 2009, 2008

and 2007, respectively.

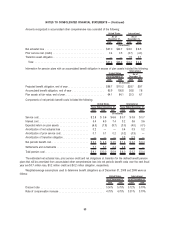

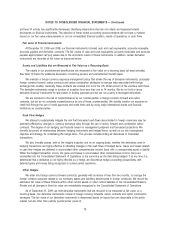

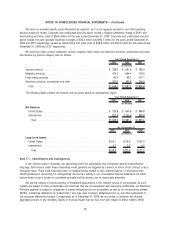

The following table sets forth the minimum rental payments under operating leases with non-cancelable terms in

excess of one year as of December 31, 2009:

2010 2011 2012 2013 2014 Thereafter Total

(In millions)

Minimum lease payments** . . . . . . . . . . . . . . . . . . . . . . $12.7 $11.4 $8.2 $5.3 $4.2 $1.5 $43.3

** Minimum payments have not been reduced by minimum sublease rentals of approximately $2.1 due in the future under

non-cancelable lease agreements.

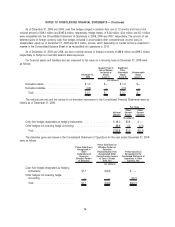

Note 15 — Shareholders’ Equity

In 2006, we adopted a shareholder rights plan under which we have issued one preferred share purchase right (Right)

for each share of our common stock. If it becomes exercisable, each Right will entitle its holder to purchase one one-

hundredth of a share of Series A Junior Participating Preferred Stock at an exercise price of $160, subject to adjustment.

The Rights are exercisable only if a person or group acquires beneficial ownership of 15 percent or more of our outstanding

common stock, or after the first public announcement relating to a tender offer or exchange offer that would result in a

person or group beneficially owning 15 percent or more of our outstanding shares of common stock subject to certain

exceptions. The Rights expire on July 1, 2016 and may be redeemed earlier by the Board of Directors for $0.01 per Right.

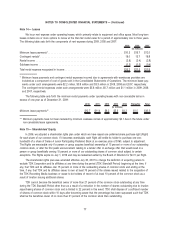

The shareholder rights plan was amended effective July 30, 2007 to change the definition of acquiring person to

exclude TDK Corporation and its affiliates at any time during the period (TDK Standstill Period) beginning at the time, if

any, that TDK and its affiliates own 15 percent or more of the outstanding shares of common stock and ending at the

time, if any, that TDK and its affiliates cease to own at least 75 percent of the shares issued related to the acquisition of

the TDK Recording Media business or cease to be holders of record of at least 10 percent of the common stock as a

result of Imation issuing additional shares.

TDK cannot become the beneficial owner of more than 21 percent of the common stock outstanding at any time

during the TDK Standstill Period other than as a result of a reduction in the number of shares outstanding due to Imation

repurchasing shares of common stock and is limited to 22 percent in this event. TDK shall dispose of a sufficient number

of shares of common stock within 10 days after becoming aware that the percentage has been surpassed such that TDK

shall be the beneficial owner of no more than 21 percent of the common stock then outstanding.

77

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)