Memorex 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

sought damages for prior sales and an injunction and/or royalties on future sales. This action had been stayed pending

resolution of the related case described below.

Also on October 24, 2007, SanDisk filed a complaint with the United States International Trade Commission (ITC)

against the same Imation entities listed above, as well as over 20 other companies. This action involved the same patents

and the same products as described above and SanDisk sought an order from the ITC blocking the defendants’

importation of these products into the United States.

The ITC hearing was held October 27, 2008 through November 4, 2008. Prior to the hearing, SanDisk affirmatively

withdrew three of the five patents (US Nos. 6,426,893; 5,719,808 and 6,947,332) from the case. On April 10, 2009, the

Administrative Law Judge issued his Initial Determination that the asserted patent claim of U.S. Patent No. 7,137,011 was

invalid and not infringed and also finding that U.S. Patent No. 6,673,424 was not infringed. SanDisk filed a Petition for Review

on May 4, 2009 to ask the ITC to review the Initial Determination. In August 2009 the ITC declined to review the Administrative

Law Judge’s ruling with respect to the 7,137,011 Patent, but agreed to review the ruling with respect to the 6,763,424 Patent.

On October 23, 2009, the ITC issued its Final Notice affirming the Administrative Law Judge’s ruling that none of the claims of

the 6,763,424 Patent were infringed. SanDisk did not appeal this ruling and the ITC case has been closed.

On November 13, 2009, the judge in the District Court case in Wisconsin lifted the stay of proceedings. Imation filed

its Answer to the Complaint on December 2, 2009. On January 26, 2010, U.S. Patent No. 6,947,332 was withdrawn from

the case without prejudice.

Some of our suppliers are already licensed by SanDisk. We are also generally indemnified by our suppliers against

claims for patent infringement. Additionally, some of our suppliers are now providing us with USB flash drives with new

controllers, which SanDisk has stipulated are not covered by U.S. Patent No. 6,763,424. Therefore, at this time, we do not

believe that the remaining SanDisk action will have a material adverse impact on our financial statements.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

(a) — (b)

As of February 19, 2010, there were 38,151,655 shares of our common stock, $0.01 par value (common stock),

outstanding held by approximately 22,558 shareholders of record. Our common stock is listed on the New York Stock

Exchange and the Chicago Stock Exchange under the symbol “IMN.” No dividends were declared or paid during 2009.

The Board of Directors declared a dividend of $0.16 per share of common stock in February, May and July 2008 and

$0.08 per share of common stock in November 2008. We paid a total of $20.9 million in dividends to shareholders in

2008. The payment of dividends is discretionary and will be subject to determination by our Board of Directors each

quarter following its review of our financial performance and other factors.

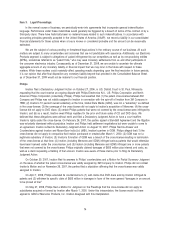

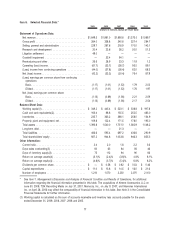

The following table sets forth, for the periods indicated, the high and low sales prices of common stock as reported

on the New York Stock Exchange.

High Low High Low

2009 Sales Prices 2008 Sales Prices

First quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $14.44 $6.94 $27.63 $17.64

Second quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . $11.14 $7.19 $27.41 $22.85

Third quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10.17 $7.34 $25.48 $18.37

Fourth quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10.30 $7.95 $22.78 $10.11

(c) Issuer Purchases of Equity Securities

No shares were repurchased by the Company during the fourth quarter of 2009.

16