Memorex 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 11 — Employee Savings and Stock Ownership Plans

We sponsor a 401(k) retirement savings plan under which eligible United States employees may choose to save up

to 20 percent of eligible compensation on a pre-tax basis, subject to certain IRS limitations. From January 1 to March 31,

2009, we matched 100 percent of employee contributions up to the first three percent of eligible compensation plus

50 percent on the next two percent of eligible compensation. Beginning in April 2009 and as of December 31, 2009, we

matched 50 percent of employee contributions on the first three percent of eligible compensation and 25 percent on the

next two percent of eligible compensation in our stock. We also sponsor a variable compensation program in which we

may, at our discretion, contribute up to three percent of eligible employee compensation to employees’ 401(k) retirement

accounts, depending upon our performance. No contributions have been made under the variable compensation program

for the years ended 2009, 2008 or 2007.

We used shares of treasury stock to match employee 401(k) contributions for 2009, 2008 and 2007. Total expense

related to the use of shares of treasury stock to match employee 401(k) contributions was $1.3 million, $2.6 million and

$3.4 million in 2009, 2008 and 2007, respectively.

In November 2009, we determined it was appropriate to reinstate our 401(k) Plan matching contribution to the rate

applied prior to April 2009. The matching contribution effective January 1, 2010 will be 100 percent of employee

contributions up to the first three percent of eligible compensation plus 50 percent on the next two percent of eligible

compensation.

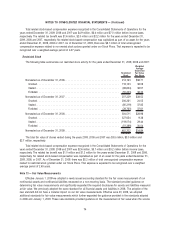

Note 12 — Stock-Based Compensation

We have stock-based compensation awards outstanding under five plans (collectively, the Stock Plans). We have

stock options outstanding under our 1996 Employee Stock Incentive Program (Employee Plan) and our 1996 Directors

Stock Compensation Program. We have stock options and restricted stock outstanding under our 2000 Stock Incentive

Plan (2000 Incentive Plan), our 2005 Stock Incentive Plan (2005 Incentive Plan) and our 2008 Stock Incentive Plan (2008

Incentive Plan). We also have restricted stock units outstanding under our 2005 Incentive Plan and our 2008 Incentive

Plan. No further shares are available for grant under the Employee Plan, Directors Plan, 2000 Incentive Plan or the 2005

Incentive Plan. Restricted stock granted and stock option awards exercised are issued from our treasury stock. The

purchase of treasury stock is discretionary and will be subject to determination by our Board of Directors each quarter

following its review of our financial performance and other factors.

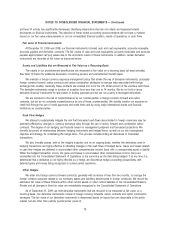

The Employee Plan was approved and adopted by 3M Company on June 18, 1996, as our sole shareholder, and

became effective on July 1, 1996. The total number of shares of common stock that could have been issued or awarded

under the Employee Plan was not to exceed 6.0 million. The outstanding options are non-qualified, normally have a term

of ten years and generally became exercisable from one to five years after grant date. Exercise prices are equal to the fair

market value of our common stock on the date of grant. As a result of the approval and adoption of the 2000 Incentive

Plan in May 2000, no further shares are available for grant under the Employee Plan.

The Directors Plan was also approved and adopted by 3M Company, as our sole shareholder, and became effective

on July 1, 1996. The total number of shares of common stock that could have been issued or awarded under the Directors

Plan was not to exceed 0.8 million. The outstanding options are non-qualified, normally have a term of ten years and

generally became exercisable one year after grant date. Exercise prices are equal to the fair market value of our common

stock on the date of grant. As a result of the approval and adoption of the 2005 Incentive Plan in May 2005, no further

shares are available for grant under the Directors Plan.

The 2000 Incentive Plan was approved and adopted by our shareholders on May 16, 2000, and became effective

immediately. The total number of shares of common stock that could have been issued or awarded under the 2000

Incentive Plan was not to exceed 4.0 million. The outstanding options are non-qualified, normally have a term of seven to

ten years and generally became exercisable 25 percent per year beginning on the first anniversary of the grant date.

Exercise prices are equal to the fair market value of our common stock on the date of grant. As a result of the approval

and adoption of the 2005 Incentive Plan in May 2005, no further shares are available for grant under the 2000 Incentive

Plan.

71

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)