Memorex 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

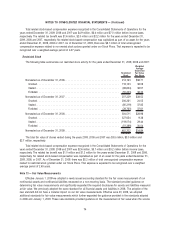

where a net deferred tax asset is recorded. We also considered the forecasts of future profitability, the duration of statutory

carryforward periods and tax planning alternatives.

While we have a history of profits, excluding litigation charges, related expenses and goodwill impairments, our

profitability has declined over the last four years and we recorded a loss in 2008 and 2009 in the United States where

$63.7 million of our deferred tax assets are recorded. While we currently anticipate profitability in the United States during

2010, achievement of overall profitability will be a significant factor in determining our continuing ability to carry these

deferred tax assets. If we do not achieve at least moderate levels of pretax results in 2010, it is reasonably possible that

we may need to establish a valuation allowance for some or all of the deferred tax assets in the United States, which

could materially impact our income tax provision, financial position and results of operations.

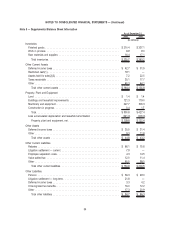

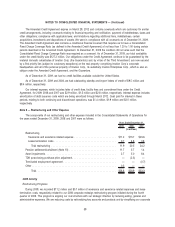

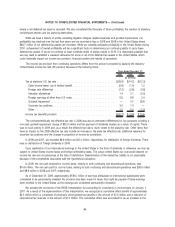

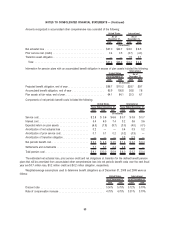

The income tax provision from continuing operations differs from the amount computed by applying the statutory

United States income tax rate (35 percent) because of the following items:

2009 2008 2007

Years Ended December 31,

(In millions)

Tax at statutory U.S. tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(26.9) $(14.2) $(12.3)

State income taxes, net of federal benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . (5.6) (1.0) 1.2

Foreign rate differential . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7.2) (2.6) (0.6)

Valuation allowances. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.4 2.1 (2.5)

Foreign earnings at other than U.S. rates . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.6 6.9 2.4

Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 3.7 28.9

Uncertain tax positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.5 1.0 —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.5 0.2 (1.5)

Income tax (benefit) provision . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(32.7) $ (3.9) $ 15.6

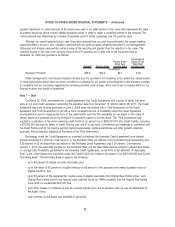

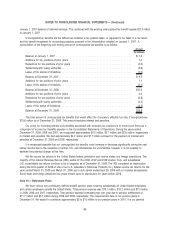

The uncharacteristically low effective tax rate in 2008 was due to permanent differences for tax purposes including a

non-cash goodwill impairment charge of $32.4 million and the payment of dividends treated as a return of capital. There

was no such activity in 2009 and, as a result, the effective tax rate is much closer to the statutory rate. Other items that

have an impact on the 2009 effective tax rate include an increase in the state tax effective rate, additional reserves for

uncertain tax positions and the change in proportion of income by jurisdiction.

In 2008 and 2007, we recorded $6.9 million and $2.4 million, respectively, for distribution of foreign dividends. There

was no distribution of foreign dividends in 2009.

Upon repatriation of our international earnings to the United States in the form of dividends or otherwise, we may be

subject to United States income taxes and foreign withholding taxes. The actual United States tax cost would depend on

income tax law and circumstances at the time of distribution. Determination of the related tax liability is not practicable

because of the complexities associated with the hypothetical calculation.

In 2009, the net cash received for income taxes, relating to both continuing and discontinued operations, was

$14.8 million. The net cash paid for income taxes, relating to both continuing and discontinued operations was $26.5 million

and $9.6 million in 2008 and 2007, respectively.

As of December 31, 2009, approximately $138.5 million of earnings attributable to international subsidiaries were

considered to be permanently invested. No provision has been made for taxes that might be payable if these earnings

were remitted to the United States as the earnings are considered permanently reinvested.

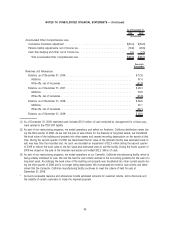

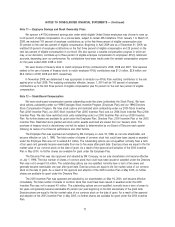

We adopted the provisions of the FASB interpretation for accounting for uncertainty in income taxes on January 1,

2007. As a result of the implementation of this interpretation, we recognized a cumulative effect benefit of approximately

$2.5 million which is comprised of previously unrecognized tax benefits in the amount of $1.5 million and a reduction of

international tax reserves in the amount of $1.0 million. This cumulative effect was accounted for as an increase to the

64

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)