Memorex 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

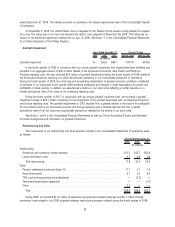

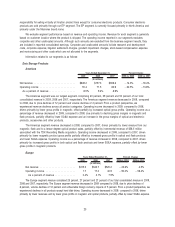

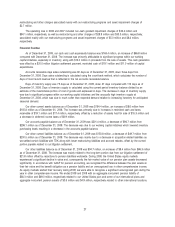

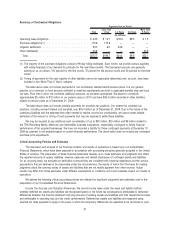

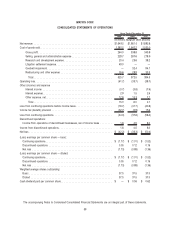

Cash Flows used in Financing Activities:

2009 2008 2007

Years Ended December 31,

(In millions)

Purchase of treasury stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $(26.4) $(108.2)

Exercise of stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.6 7.7

Dividend payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (20.9) (23.2)

Debt repayment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (31.3) (6.3)

Debt issuance costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.2) — —

Net cash used in financing activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(3.2) $(78.0) $(130.0)

Cash used in financing activities of $3.2 million during 2009 was due to cash payments made to amend our line of

credit. These issuance costs were capitalized in our Consolidated Balance Sheet as of June 30, 2009.

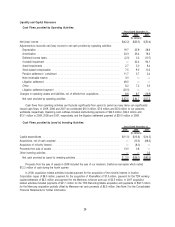

On January 28, 2008, the Board of Directors authorized a share repurchase program increasing the total outstanding

authorization to 3.0 million shares of common stock. The Company’s previous authorization was cancelled with the new

authorization. During the three months ended March 31, 2008, we repurchased 0.8 million shares completing the 10b5-1

plan announced in May 2007. As of December 31, 2008, we had repurchased 0.7 million shares under the latest

authorization. We did not repurchase any shares during 2009. As of December 31, 2009, we held, in total, 5.2 million

shares of treasury stock acquired at an average price of $25.07 per share. Authorization for repurchases of an additional

2.3 million shares remained outstanding as of December 31, 2009.

No dividends were declared or paid during 2009. We paid cash dividends of $0.56 per share or $20.9 million during

2008 and $0.62 per share or $23.2 million during 2007. Any future dividends are at the discretion of and subject to the

approval of our Board of Directors.

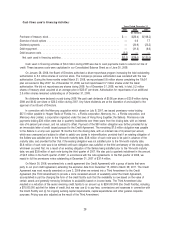

In connection with the Memcorp acquisition which closed on July 9, 2007, we issued promissory notes totaling

$37.5 million payable to Hopper Radio of Florida, Inc., a Florida corporation, Memcorp, Inc., a Florida corporation, and

Memcorp Asia Limited, a corporation organized under the laws of Hong Kong (together, the Sellers). Promissory note

payments totaling $30 million were due in quarterly installments over three years from the closing date, with an interest

rate of 6 percent per annum, and not subject to offset. Payment of the $30 million obligation was further provided for by

an irrevocable letter of credit issued pursuant to the Credit Agreement. The remaining $7.5 million obligation was payable

to the Sellers in a lump sum payment 18 months from the closing date, with an interest rate of 6 percent per annum,

which was unsecured and subject to offset to satisfy any claims to indemnification; provided that if an existing obligation of

the Sellers was satisfied prior to the 18-month maturity date, $3.8 million of such note was to be paid in advance of the

maturity date, and provided further that if the existing obligation was not satisfied prior to the 18-month maturity date,

$3.8 million of such note was to be withheld until such obligation was satisfied or the third anniversary of the closing date,

whichever occurred first. As a result of an existing obligation of the Sellers being satisfied prior to the 18-month maturity

date, we paid $3.8 million of such note during the third quarter of 2007. We also paid a quarterly installment in the amount

of $2.5 million in the fourth quarter of 2007, in accordance with the note agreements. In the first quarter of 2008, we

repaid in full the promissory notes outstanding at December 31, 2007 of $31.4 million.

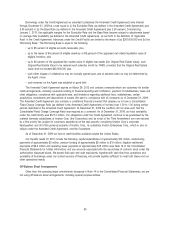

On March 30, 2006, we entered into a credit agreement (the Credit Agreement) with a group of banks that were

party to our prior credit agreement, extending the expiration date from December 15, 2006 to March 29, 2011. The Credit

Agreement was most recently amended on June 3, 2009 when we entered into a Third Amendment to the Credit

Agreement (the Third Amendment) to provide a more consistent amount of availability under the Credit Agreement,

accomplished in part by changing the form of the credit facility such that the availability is now based on the value of

certain assets and generally removing limitations to availability based on income levels. The Third Amendment also

resulted in a reduction of the senior revolving credit facility to an amount up to $200,000,000 (the Credit Facility), including

a $75,000,000 sub-limit for letters of credit, that we may use (i) to pay fees, commissions and expenses in connection with

the Credit Facility and (ii) for ongoing working capital requirements, capital expenditures and other general corporate

purposes. Pricing was also adjusted as the result of the Third Amendment.

29