Memorex 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

goodwill impairment. A control premium of 25 percent was used in our determination of fair value which represents the value

an investor would pay above minority interest transaction prices in order to obtain a controlling interest in the company. The

control premium was determined by a review of premiums paid for similar companies over the past five years.

Although our overall expected future cash flows were reduced from our prior year projections, the excess working

capital identified in the prior year valuation combined with the working capital initiatives described in our Management’s

Discussion and Analysis reduced the carrying value of the reporting unit greater than the reduction in fair value. The

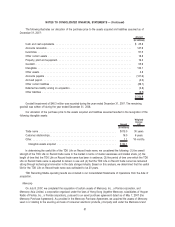

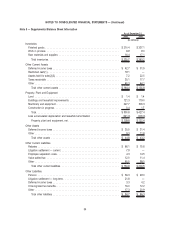

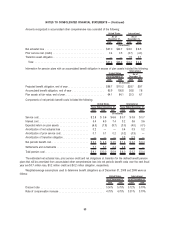

indicated excess in fair value over carrying value of the EP reporting unit in step one of the impairment test at

November 30, 2009 and goodwill is as follows:

Goodwill Carrying Value

Excess of Fair

Value Over

Carrying Value

Percentage of

Excess of Fair

Value Over

Carrying Value

(In millions)

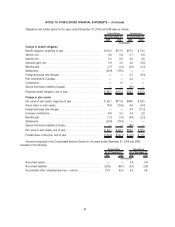

Electronic Products . . . . . . . . . . . . . . . . . . . . . . . $23.5 $74.3 $3.7 5.0%

While management’s most recent analysis indicates that this goodwill is not impaired, to the extent that actual results

or other assumptions about future economic conditions or potential for our growth and profitability in this business changes,

it is possible that our conclusion regarding the remaining goodwill could change, which could have a material effect on our

financial position and results of operations.

Note 7 — Debt

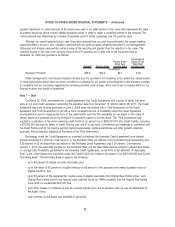

On March 30, 2006, we entered into a credit agreement (the Credit Agreement) with a group of banks that were

party to our prior credit agreement, extending the expiration date from December 15, 2006 to March 29, 2011. The Credit

Agreement was most recently amended on June 3, 2009 when we entered into a Third Amendment to the Credit

Agreement (the Third Amendment) to provide a more consistent amount of availability under the Credit Agreement,

accomplished in part by changing the form of the credit facility such that the availability is now based on the value of

certain assets and generally removing limitations to availability based on income levels. The Third Amendment also

resulted in a reduction of the senior revolving credit facility to an amount up to $200,000,000 (the Credit Facility), including

a $75,000,000 sub-limit for letters of credit, that we may use (i) to pay fees, commissions and expenses in connection with

the Credit Facility and (ii) for ongoing working capital requirements, capital expenditures and other general corporate

purposes. Pricing was also adjusted as the result of the Third Amendment.

Borrowings under the Credit Agreement as amended (collectively the Amended Credit Agreement) bore interest

through December 31, 2009 at a rate equal to (i) the Eurodollar Rate (as defined in the Amended Credit Agreement) plus

3.50 percent or (ii) the Base Rate (as defined in the Amended Credit Agreement) plus 2.50 percent. Commencing

January 1, 2010, the applicable margins for the Eurodollar Rate and the Base Rate became subject to adjustments based

on average daily Availability (as defined in the Amended Credit Agreement), as set forth in the definition of “Applicable

Rate” in the Credit Agreement. Advances under the Credit Facility are limited to the lesser of (a) $200,000,000 and (b) the

“Borrowing Base.” The Borrowing Base is equal to the following:

•up to 85 percent of eligible accounts receivable; plus

•up to the lesser of 65 percent of eligible inventory or 85 percent of the appraised net orderly liquidation value of

eligible inventory; plus

•up to 60 percent of the appraised fair market value of eligible real estate (the Original Real Estate Value), such

Original Real Estate Value to be reduced each calendar month by 1/84th, provided, that the Original Real Estate

Value shall not exceed $40,000,000; plus

•such other classes of collateral as may be mutually agreed upon and at advance rates as may be determined by

the Agent; minus

•such reserves as the Agent may establish in good faith.

58

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)